[ad_1]

The expansion of on-line gross sales has been on an upward development in recent times, particularly influenced by the pandemic, which has include fee fraud.

The amount of stories articles and posts by specialists within the discipline associated to fee fraud makes an attempt, tendencies and scams are proof of the fixed battle confronted by builders engaged on fee fraud detection know-how. Actually, figuring out how you can forestall fraud has arguably grow to be some of the vital features of managing an on-line enterprise.

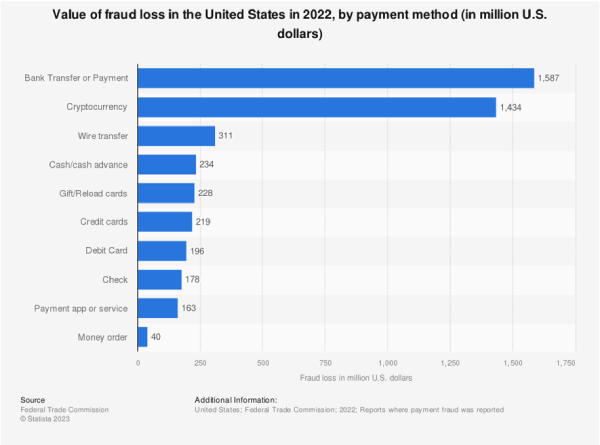

This 12 months is predicted to see report losses throughout a number of fee strategies, following on from 2022, which additionally noticed report highs. In accordance with Statista, financial institution switch funds have been the first supply of fraudulent funds final 12 months, with the full quantity of losses on this class in the USA reaching nearly $1.6 billion {dollars}. Cryptocurrency was additionally affected by large losses, totaling over $1.4 billion.

Supply: Statista

Losses linked to wire switch fraud have been significantly decrease at $311 million, with bank cards, present or reload playing cards and money or money advance fraud losses all totaling properly over $200 million every. Debit card fraud was additionally shut, at a complete of $196 million whole losses, whereas verify fraud losses totaled $178 million, and fee app fraud totaled $163 million.

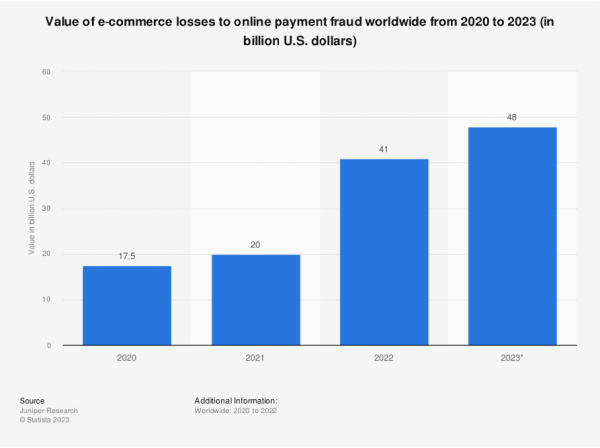

These large numbers level to an upward development in world losses linked to fee fraud during the last three years. In 2020, the full worldwide losses the eCommerce sector incurred from fee fraud amounted to $17.5 billion, which rose to $20 billion in 2021. We then noticed an enormous leap to $40 billion whole losses in 2022, with the worldwide whole of on-line fee fraud losses for 2023 projected to achieve a staggering $48 billion.

Supply: Statista

So, what’s the explanation for this large enhance in on-line fee fraud? Let’s discover out.

Socio-economic-tech context is fueling the rise in fraud

There are a number of components contributing to the rise of on-line fee fraud. –

Entry to AI (Synthetic Intelligence) know-how

First amongst the net fraud drivers are the improvements in AI know-how which have supplied fraudsters with automated instruments to assist them run extra scams with much less effort. The instruments for these actions have additionally grow to be considerably cheaper and extra accessible, encouraging much less subtle criminals to strive their luck.

Recession and inflation

These are difficult instances for lots of people, and such financial circumstances often create or encourage opportunistic actors who’re extra keen to make faux funds as a result of their present struggles – determined instances name for determined measures. This ties in with the know-how to commit fraud being less expensive and much more accessible than ever earlier than.

Pleasant fraud

Pleasant fraud is the attention-grabbing identify given to the act of a buyer buying an merchandise on-line utilizing their very own bank card and knowledge, after which disputing the cost with their financial institution. When that is carried out with out a official motive, it’s higher described as cyber-shoplifting as a result of the shopper has obtained the merchandise in passable situation, however opens a chargeback anyway, to get their a refund, in addition to retains the merchandise.

Apart from the intentional chargeback fraud , there are different causes for a cardholder to dispute a cost, therefore why the time period ‘pleasant fraud’ has grow to be standard as a catch-all time period.

Such real causes for pleasant fraud embrace confusion, the place a buyer legitimately doesn’t acknowledge the cost and thus disputes it. One other can be when a toddler steals their dad or mum’s bank card and makes a purchase order, after which the dad or mum subsequently disputes the cost. There may be situations the place clients are genuinely dissatisfied with their buy and instantly open a chargeback, though the correct plan of action can be to contact the service provider and hash it out with them by a refund or change course of.

Even in instances of real confusion, it’s tough for a lot of retailers to problem all of the chargebacks they obtain because of the sophisticated course of concerned. Many companies merely write them off as an anticipated loss.

Varieties of fee fraud retailers and buyers are uncovered to

Each on-line sellers and their clients are in danger from fraud, so let’s shortly run by the kinds of fee fraud which are commonest in 2023.

Account takeover (ATO) fraud

ATO fraud is when a fraudster logs into somebody’s account to steal delicate private info or acquire entry to funds and/or fee playing cards registered within the respective account. The perpetrators can additional impersonate the account proprietor, to acquire extra entry or monetary advantages, or defraud the folks within the account holder’s contacts. Widespread methods scammers attempt to get entry to your accounts with delicate fee info -is achieved by getting access to your credentials, sometimes by social engineering, information breaches and phishing assaults. Account takeover is a long-term rip-off, because the curiosity of the malevolent occasion is to hide the truth that credentials and account info was accessed by them.

Within the eCommerce house, ATO fraud is more and more frequent on buy-now-pay-later (BNPL) platforms. Scammers search for information breaches and make use of bots to strive the leaked credentials-on customers’ BNPL accounts, or brute-force their approach into accounts.

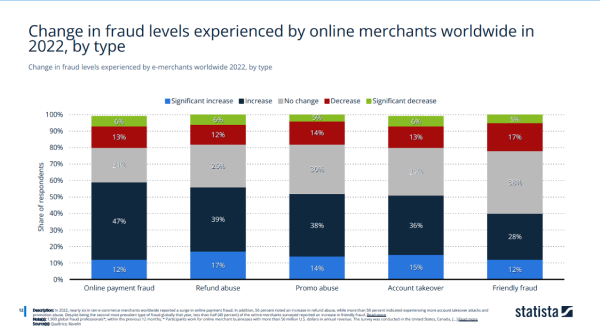

Enhance in pleasant fraud

We lined the growing quantities of pleasant fraud in larger element above. It comes all the way down to the recession and rising inflation inflicting extra buyers to request chargebacks. Pleasant fraud has been on the rise since final 12 months, with 40% of e-merchants reporting they’re seeing such a fraud having elevated in incidence.

Supply: Statista

Id theft

Fraudsters stealing somebody’s identification to make fraudulent funds is among the oldest on-line crimes round, and it continues to be a major difficulty in 2023. The true change is how the criminals acquire the data they need.

Social engineering assaults contain a fraudster impersonating an authority determine or trusted entity to trick folks into willingly providing up their private info. Such assaults are on the rise particularly thanks to simply accessible software program for constructing deep faux profiles.

Various fee strategies (APM) fraud

This 12 months can be experiencing a rise in fraudsters utilizing social engineering to contact people to get them to make immediate, irrevocable funds through APM know-how and peer-to-peer (P2P) scams. That is partially because of the growing safety on bank cards – extra on these beneath – and the rising demand for such different fee techniques amongst customers. Digital wallets, for instance, have been reported because the fee methodology for 49% of eCommerce transactions in 2021, and their elevated adoption, resulting in an uptick in fraudulent makes an attempt. Digital pockets fraud could even be extra “environment friendly” for fraudsters than bank card fraud given that each one the hackers want is the digital copy of card info, without having the bodily card itself, or to easily acquire entry to the account credentials.

Counterfeit card fraud and card ID theft

Additionally a type of identification theft, counterfeit bank card fraud includes the unauthorized use of one other particular person’s bank card info to both cost purchases to the account or straight-up take away funds from it.

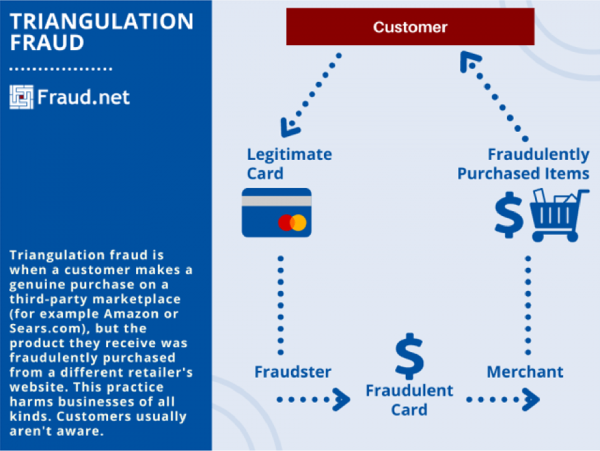

Triangular fraud

Triangular fraud includes an harmless buyer making a real buy through what they imagine to be a official third-party market. However then the third-party fraudulently buys the product from a special retailer’s web site and sends it to the shopper. Triangular, often known as triangulation fraud, includes a number of events and is the kind of course of the place the service provider suffers whereas the shopper putting a good-faith order is oblivious to the rip-off occurring within the backend.

Supply: Fraud.internet

Enterprise e mail compromise (BEC) scams

A BEC rip-off is when fraudsters impersonate a official service provider and request wire transfers from their enterprise clients. It’s a type of phishing assault concentrating on B2Bs, the place the scammers trick a senior worker or government with funds management into revealing delicate info or instantly transferring funds.

Enhance in false positives from anti-fraud instruments

Whereas not an act of fraud in itself, false positives are a significant problem that retailers have to beat. When anti-fraud instruments wrongly flag a official fee as potential fraud, this results in losses by stopping the fee and even freezing the account of the shopper.

Instruments to strengthen your safety within the face of fraud

The answer for companies to fight fee fraud is multi-pronged. You’ll be able to implement identification habits evaluation, which can, generally, contain automation and machine studying – though it could actually, no less than in principle, be carried out manually. An optimum strategy can be to make use of each advanced algorithms and a human layer, to cowl all situations. Algorithms are able to recognizing patterns that people would miss, and behavioral evaluation can spot anomalies each on a person stage and throughout a corporation. Apart from getting used to detect fraudulent exercise from cybercriminals, behavioral evaluation can be used to detect fraud and weird habits by employees groups.

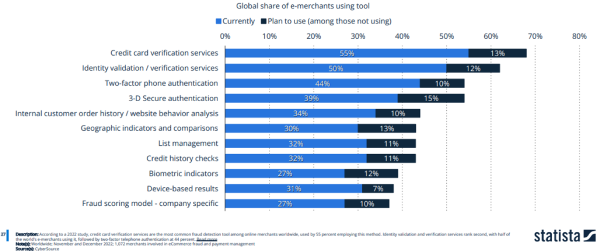

Among the many presently most generally employed fraud detection instruments, these revolving round card verification providers and identification validation providers have been probably the most widespread in 2022.

Supply: Statista

To supply a bit extra perception into the prime 3 mostly used options, below Credi card verification providers, the 2 choices most popular by retailers to each deter and detect fraud are CVV (Card Verification Worth – a 3 or 4 digit code printed on every branded credit score/debit card) and AVS (Deal with Verification Service – the cardboard firm/issuing financial institution checks the billing handle supplied through the procuring course of towards the billing handle supplied in its data and studies again to the service provider/processor, who will get to determine whether or not or to not course of the transaction).

The second most utilized fraud detection methodology includes KYC (Know Your Buyer) and revolves round figuring out (collect and log consumer information), verifying (confirming the validity of the information) and authenticating the shopper towards the logged information (make sure the verified information is constant each time the consumer reappears).

Two-Issue authentication, 3D safe authentication, Biometric authentication can all be bundled below having an additional layer of safety to confirm your identification, by having entry to a passcode, a tool or perhaps a fingerprint, to realize entry to providers or fee instruments. Having such a authentication in place can considerably decrease your fraud ratio and might help keep away from pleasant fraud fully.

Whereas speedy transactions are handy for purchasers, it’s all the time smart to have some smart friction inside your fee flows. You’ll be able to then make sure the journey is easy sufficient for buyers whereas authenticating the identification of the payer earlier than the transaction is totally licensed.

Lastly, you’ll be able to considerably cut back the danger of fraud by implementing CAPTCHAs , together with buyer authentication processes. It can be worthwhile to make efforts to teach clients concerning the danger posed to them by the related scams described above.

Conclusion

The numbers concerned within the current rise of fraud could also be considerably alarming, however retailers and enterprise house owners needn’t panic. A good schooling on the present dangers posed will inform you as to what risks your personal enterprise faces, plus there are many protections for each you and your clients.

There may even be assist from knowledgeable fee suppliers who ought to have anti-fraud instruments included as a part of their providers, and retailers can leverage these instruments for their very own companies.

[ad_2]