[ad_1]

Accrued revenue refers to these incomes which have been earned by the agency within the present accounting interval however haven’t been obtained but. Such forms of revenue may be Curiosity on mortgage, lease obtained, fee, and many others. So, following the accrual idea of accounting, these incomes are recorded within the yr wherein they’re rendered by the agency and handled as an revenue for the agency.

Adjustment:

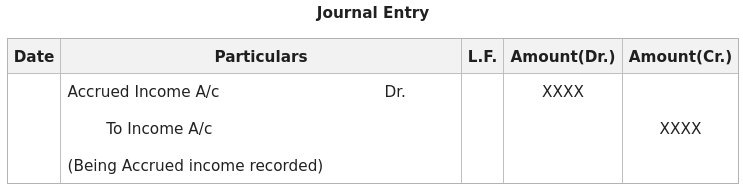

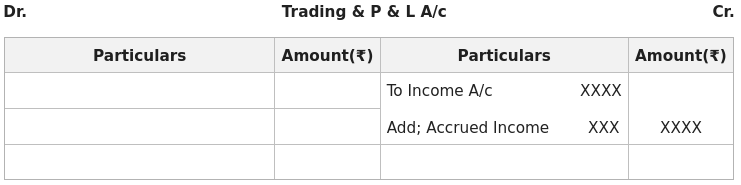

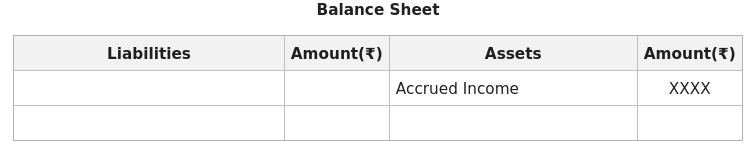

A. If Accrued Earnings is given exterior the trial stability: In such case, two entries will likely be handed:

- Can be added to the associated Earnings A/c within the Cr. aspect of Revenue & Loss A/c.

- Can be proven within the Property aspect of the Stability Sheet or added to the involved supply within the Property aspect of the Stability Sheet.

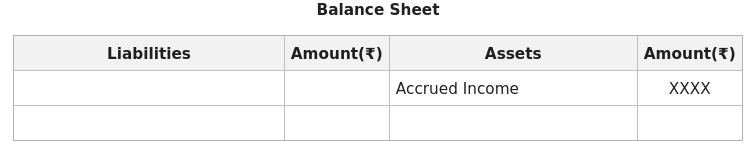

B. If Accrued Earnings is given contained in the trial stability: It would solely be proven on the Property aspect of the Stability Sheet.

Illustration:

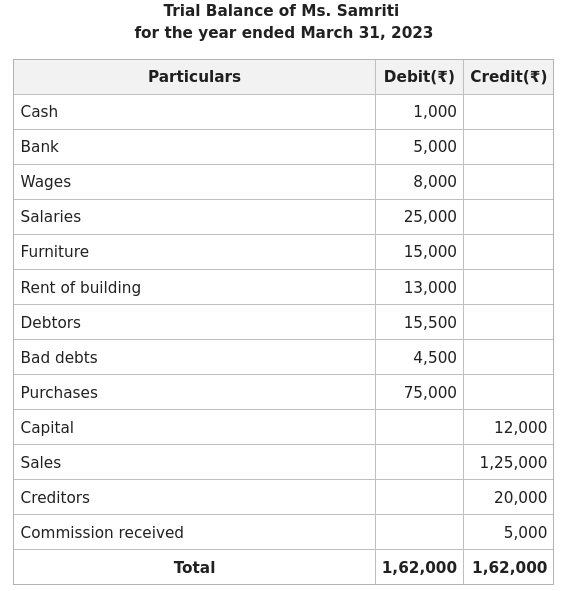

The Trial Stability of Ms. Samriti for the yr ended March 31 2023, seems as follows:

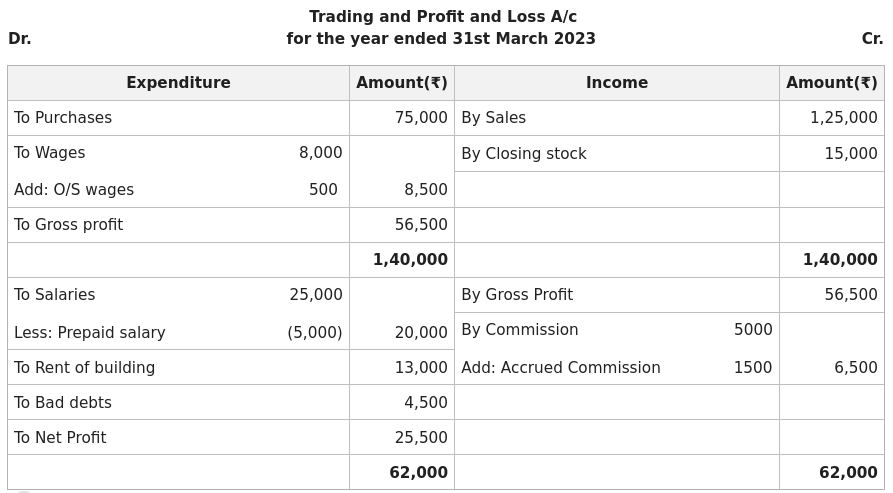

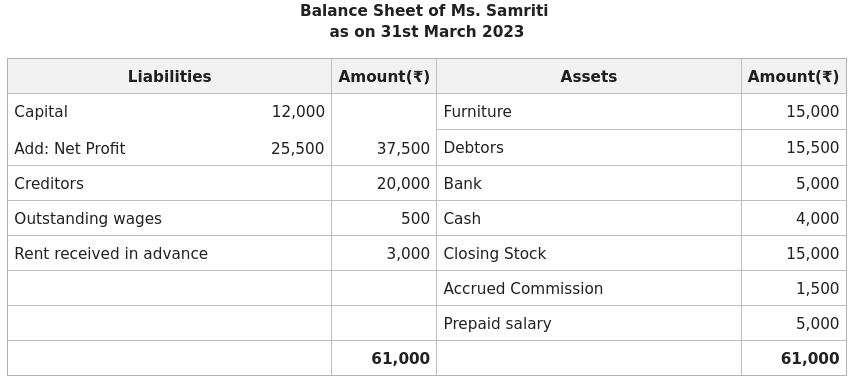

The next changes have been famous on that date:

1. Fee amounting to ₹1,500 remains to be to be obtained.

2. Quantity of Closing inventory on thirty first March 2022 was ₹15,000.

3. Excellent wages amounting to ₹500.

4. Wage paid prematurely amounting to ₹5,000.

5. Lease obtained prematurely quantities to ₹3,000.

Put together Buying and selling and Revenue and Loss A/c and stability sheet after taking the next changes into consideration.

Resolution:

[ad_2]