[ad_1]

Each startup’s journey is exclusive, and the street to success is rarely

linear, however value is a story in each enterprise at each time limit,

particularly throughout financial downturns. In a startup, the dialog round

value shifts when shifting from the experimental and gaining traction

phases to excessive development and optimizing phases. Within the first two phases, a

startup must function lean and quick to return to a product-market match, however

within the later levels the significance of operational effectivity ultimately

grows.

Shifting the corporate’s mindset into reaching and sustaining value

effectivity is absolutely tough. For startup engineers that thrive

on constructing one thing new, value optimization is often not an thrilling

matter. For these causes, value effectivity usually turns into a bottleneck for

startups sooner or later of their journey, similar to accumulation of technical

debt.

How did you get into the bottleneck?

Within the early experimental part of startups, when funding is proscribed,

whether or not bootstrapped by founders or supported by seed funding, startups

typically give attention to getting market traction earlier than they run out of their

monetary runway. Groups will decide options that get the product to market

shortly so the corporate can generate income, maintain customers completely happy, and

outperform rivals.

In these phases, value inefficiency is an appropriate trade-off.

Engineers could select to go along with fast customized code as an alternative of coping with

the effort of establishing a contract with a SaaS supplier. They could

deprioritize cleanups of infrastructure elements which can be not

wanted, or not tag assets because the group is 20-people robust and

everybody is aware of all the pieces. Attending to market shortly is paramount – after

all, the startup may not be there tomorrow if product-market match stays

elusive.

After seeing some success with the product and reaching a fast development

part, these earlier selections can come again to harm the corporate. With

site visitors spiking, cloud prices surge past anticipated ranges. Managers

know the corporate’s cloud prices are excessive, however they might have hassle

pinpointing the trigger and guiding their groups to get out of the

state of affairs.

At this level, prices are beginning to be a bottleneck for the enterprise.

The CFO is noticing, and the engineering group is getting a number of

scrutiny. On the identical time, in preparation for one more funding spherical, the

firm would want to indicate affordable COGS (Value of Items Offered).

Not one of the early selections had been flawed. Creating a wonderfully scalable

and value environment friendly product isn’t the fitting precedence when market traction

for the product is unknown. The query at this level, when value begins

turning into an issue, is how you can begin to scale back prices and change the

firm tradition to maintain the improved operational value effectivity. These

adjustments will make sure the continued development of the startup.

Indicators you might be approaching a scaling bottleneck

Lack of value visibility and attribution

When an organization makes use of a number of service suppliers (cloud, SaaS,

growth instruments, and so forth.), the utilization and value information of those companies

lives in disparate methods. Making sense of the full expertise value

for a service, product, or group requires pulling this information from varied

sources and linking the fee to their product or function set.

These value stories (resembling cloud billing stories) could be

overwhelming. Consolidating and making them simply comprehensible is

fairly an effort. With out correct cloud infrastructure tagging

conventions, it’s inconceivable to correctly attribute prices to particular

aggregates on the service or group stage. Nonetheless, until this stage of

accounting readability is enabled, groups will likely be compelled to function with out

totally understanding the fee implications of their selections.

Value not a consideration in engineering options

Engineers contemplate varied elements when making engineering selections

– practical and non-functional necessities (efficiency, scalability

and safety and so forth). Value, nevertheless, isn’t at all times thought-about. A part of the

purpose, as coated above, is that growth groups usually lack

visibility on value. In some instances, whereas they’ve an affordable stage of

visibility on the price of their a part of the tech panorama, value could not

be perceived as a key consideration, or could also be seen as one other group’s

concern.

Indicators of this downside is perhaps the shortage of value concerns

talked about in design paperwork / RFCs / ADRs, or whether or not an engineering

supervisor can present how the price of their merchandise will change with scale.

Homegrown non-differentiating capabilities

Firms typically preserve customized instruments which have main overlaps in

capabilities with third-party instruments, whether or not open-source or industrial.

This will likely have occurred as a result of the customized instruments predate these

third-party options – for instance, customized container orchestration

instruments earlier than Kubernetes got here alongside. It might even have grown from an

early preliminary shortcut to implement a subset of functionality offered by

mature exterior instruments. Over time, particular person selections to incrementally

construct on that early shortcut lead the group previous the tipping level that

might need led to using an exterior software.

Over the long run, the full value of possession of such homegrown

methods can turn into prohibitive. Homegrown methods are usually very

straightforward to begin and fairly tough to grasp.

Overlapping capabilities in a number of instruments / software explosion

Having a number of instruments with the identical function – or not less than overlapping

functions, e.g. a number of CI/CD pipeline instruments or API observability instruments,

can naturally create value inefficiencies. This usually comes about when

there isn’t a paved

street,

and every group is autonomously selecting their technical stack, somewhat than

selecting instruments which can be already licensed or most popular by the corporate.

Inefficient contract construction for managed companies

Selecting managed companies for non-differentiating capabilities, such

as SMS/electronic mail, observability, funds, or authorization can enormously

help a startup’s pursuit to get their product to market shortly and

maintain operational complexity in test.

Managed service suppliers usually present compelling – low-cost or free –

starter plans for his or her companies. These pricing fashions, nevertheless, can get

costly extra shortly than anticipated. Low-cost starter plans apart, the

pricing mannequin negotiated initially could not swimsuit the startup’s present or

projected utilization. One thing that labored for a small group with few

clients and engineers may turn into too costly when it grows to 5x

or 10x these numbers. An escalating pattern in the price of a managed

service per person (be it staff or clients) as the corporate achieves

scaling milestones is an indication of a rising inefficiency.

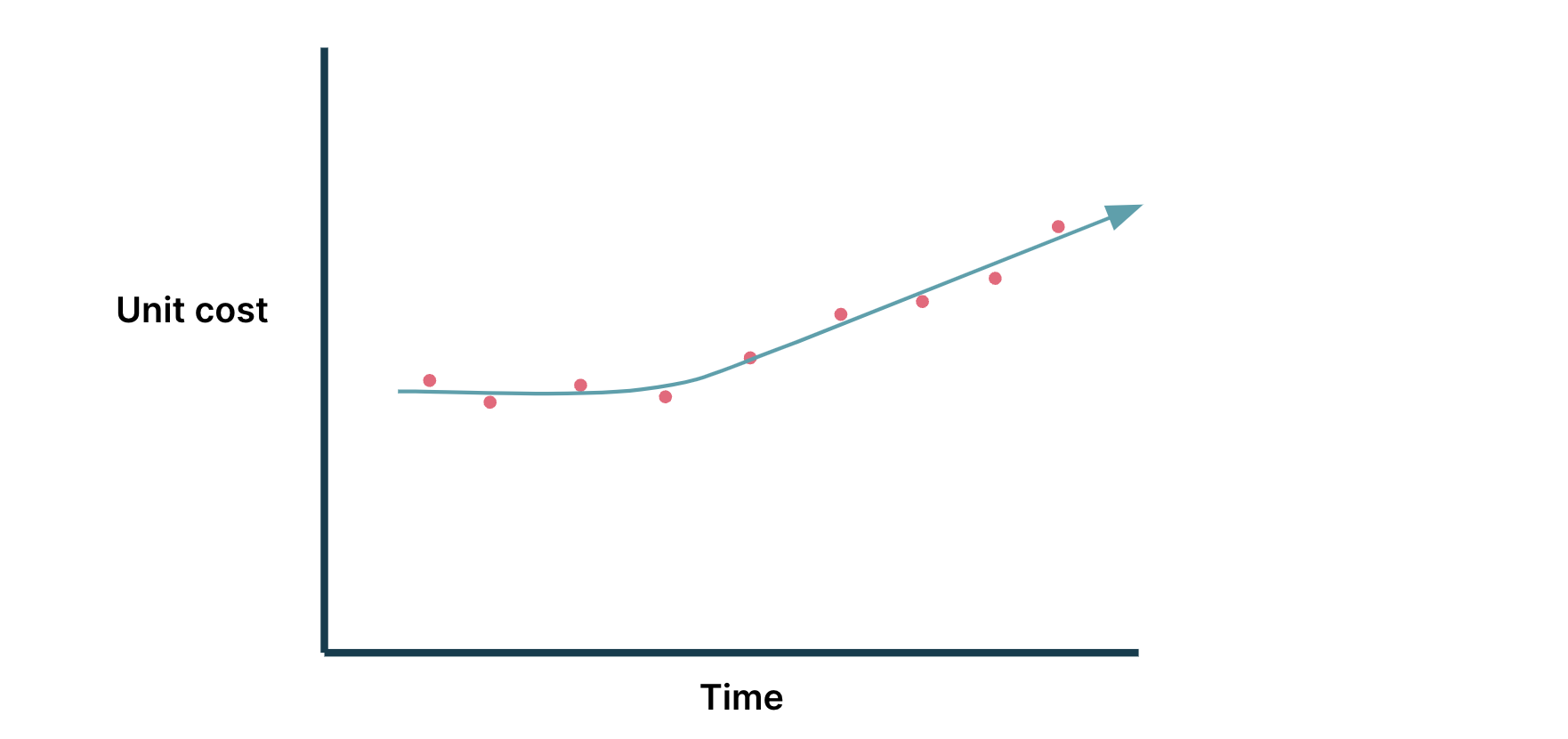

Unable to succeed in economies of scale

In any structure, the fee is correlated to the variety of

requests, transactions, customers utilizing the product, or a mixture of

them. Because the product positive factors market traction and matures, firms hope

to achieve economies of scale, lowering the typical value to serve every person

or request (unit

value)

as its person base and site visitors grows. If an organization is having hassle

reaching economies of scale, its unit value would as an alternative improve.

Determine 1: Not reaching economies of scale: growing unit value

Word: on this instance diagram, it’s implied that there are extra

models (requests, transactions, customers as time progresses)

How do you get out of the bottleneck?

A traditional state of affairs for our group after we optimize a scaleup, is that

the corporate has seen the bottleneck both by monitoring the indicators

talked about above, or it’s simply plain apparent (the deliberate finances was

utterly blown). This triggers an initiative to enhance value

effectivity. Our group likes to arrange the initiative round two phases,

a scale back and a maintain part.

The scale back part is concentrated on brief time period wins – “stopping the

bleeding”. To do that, we have to create a multi-disciplined value

optimization group. There could also be some concept of what’s potential to

optimize, however it’s essential to dig deeper to actually perceive. After

the preliminary alternative evaluation, the group defines the method,

prioritizes based mostly on the affect and energy, after which optimizes.

After the short-term positive factors within the scale back part, a correctly executed

maintain part is important to keep up optimized value ranges in order that

the startup doesn’t have this downside once more sooner or later. To help

this, the corporate’s working mannequin and practices are tailored to enhance

accountability and possession round value, in order that product and platform

groups have the required instruments and data to proceed

optimizing.

As an example the scale back and maintain phased method, we are going to

describe a current value optimization enterprise.

Case examine: Databricks value optimization

A consumer of ours reached out as their prices had been growing

greater than they anticipated. They’d already recognized Databricks prices as

a prime value driver for them and requested that we assist optimize the fee

of their information infrastructure. Urgency was excessive – the growing value was

beginning to eat into their different finances classes and rising

nonetheless.

After preliminary evaluation, we shortly shaped our value optimization group

and charged them with a purpose of lowering value by ~25% relative to the

chosen baseline.

The “Scale back” part

With Databricks as the main target space, we enumerated all of the methods we

might affect and handle prices. At a excessive stage, Databricks value

consists of digital machine value paid to the cloud supplier for the

underlying compute functionality and value paid to Databricks (Databricks

Unit value / DBU).

Every of those value classes has its personal levers – for instance, DBU

value can change relying on cluster kind (ephemeral job clusters are

cheaper), buy commitments (Databricks Commit Models / DBCUs), or

optimizing the runtime of the workload that runs on it.

As we had been tasked to “save value yesterday”, we went in quest of

fast wins. We prioritized these levers towards their potential affect

on value and their effort stage. Because the transformation logic within the

information pipelines are owned by respective product groups and our working

group didn’t have deal with on them, infrastructure-level adjustments

resembling cluster rightsizing, utilizing ephemeral clusters the place

acceptable, and experimenting with Photon

runtime

had decrease effort estimates in comparison with optimization of the

transformation logic.

We began executing on the low-hanging fruits, collaborating with

the respective product groups. As we progressed, we monitored the fee

affect of our actions each 2 weeks to see if our value affect

projections had been holding up, or if we would have liked to regulate our priorities.

The financial savings added up. Just a few months in, we exceeded our purpose of ~25%

value financial savings month-to-month towards the chosen baseline.

The “Maintain” part

Nonetheless, we didn’t need value financial savings in areas we had optimized to

creep again up after we turned our consideration to different areas nonetheless to be

optimized. The tactical steps we took had diminished value, however sustaining

the decrease spending required continued consideration because of an actual danger –

each engineer was a Databricks workspace administrator able to

creating clusters with any configuration they select, and groups had been

not monitoring how a lot their workspaces value. They weren’t held

accountable for these prices both.

To deal with this, we got down to do two issues: tighten entry

management and enhance value consciousness and accountability.

To tighten entry management, we restricted administrative entry to simply

the individuals who wanted it. We additionally used Databricks cluster insurance policies to

restrict the cluster configuration choices engineers can decide – we wished

to realize a stability between permitting engineers to make adjustments to

their clusters and limiting their selections to a smart set of

choices. This allowed us to attenuate overprovisioning and management

prices.

To enhance value consciousness and accountability, we configured finances

alerts to be despatched out to the house owners of respective workspaces if a

explicit month’s value exceeds the predetermined threshold for that

workspace.

Each phases had been key to reaching and sustaining our goals. The

financial savings we achieved within the diminished part stayed secure for a variety of

months, save for utterly new workloads.

[ad_2]