[ad_1]

In relation to eCommerce, the heartbeat of what you are promoting is a seamless on-line fee system. However amidst the digital buzz, false beliefs about on-line funds can maintain retailers again from totally harnessing its energy. For the savvy service provider, dispelling these misconceptions is essential to staying forward within the aggressive sport of on-line commerce. We’re right here to set the report straight and arm you with the data to information your on-line fee technique in the direction of progress.

Why do you have to be cautious about these myths? As a result of what you are promoting selections ought to all the time be primarily based on right information, sourced by respected retailers. In any other case, you run dangers corresponding to limiting your organization’s attain, stalling its progress path, or worse but, dropping buyer belief.

Let’s dive into probably the most extensively unfold false data on on-line funds and see what’s reality and what’s fiction.

Fantasy 1: On-line Funds Are Not Safe

The Actuality:

On-line safety is a sound concern for retailers and prospects alike, nevertheless it’s not a barrier. Prevalence of reports of potential digital funds fraud has been rising 12 months on 12 months, as malevolent actors diversify their choices to commit fraud, however this doesn’t make on-line transactions inherently unsafe. The fact is that strong fee gateways make use of state-of-the-art encryption, tokenization, and fraud monitoring that make on-line transactions as safe or much more safe than conventional strategies.

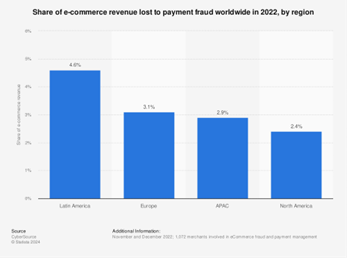

Cost suppliers and retailers in areas internationally are taking vital strides in combating losses attributed to safety points. And the numbers again these developments. Lately, on-line retailers from 4 world areas reported dropping simply above a median 3% of income to fee fraud.

Supply: Statista

The Resolution:

For peace of thoughts, go for a fee supplier that’s PCI DSS compliant, just like the 2Checkout platform. Look out for people who supply encryption protocols and tokenization, which replaces delicate information with non-decipherable values, drastically decreasing the chance of an information breach.

Fantasy 2: On-line Funds Are Difficult to Set Up

The Actuality:

Gone are the times of advanced integrations. Not way back on-line sellers with a restricted portfolio of merchandise used to choose the route of creating their very own digital commerce options in-house. BYOS (Constructed-Your-Personal-Resolution) stacks, nevertheless, have come to develop into much less interesting, as the associated fee and energy of integrating proprietary software program with exterior options reached new ranges of complexity.

These days, superior APIs, cellular SDKs and turnkey options have simplified the setup course of, making certain that on-line funds might be able to go in a fraction of the time you may anticipate. On the identical time, retailers leveraging digital commerce platforms and widespread procuring carts like Shopify, Magento or WooCommerce now have ready-made plugin options accessible which simplify the method of accepting funds to a 2-3 step integration stream.

The Resolution:

Leverage the experience of established fee suppliers that provide out-of-the-box options which may combine seamlessly along with your eCommerce platform, saving you invaluable time and assets. Go for suppliers with off-the-shelf capabilities which might be available and require no additional integration or added price. The 2Checkout platform, for instance, might be simply built-in with over 120 procuring carts accessible available on the market, enabling sellers to seamlessly settle for funds. As well as, the answer capabilities are available within the service provider dashboard, requiring no additional setup or dev work.

Fantasy 3: On-line Funds Are Costly

The Actuality:

There’s a notion that with the comfort and strong safety of on-line funds comes a hefty price ticket. Whereas it’s true that fee processing includes prices, the panorama of on-line fee charges has diversified to supply cheaper choices for retailers.

In at present’s world many fee suppliers supply aggressive pricing plans, together with pricing primarily based on gross sales volumes, and no hidden prices. With most suppliers, on-line sellers pay merely for profitable transactions, in percentages of the sum processed.

Supply: Freepik

Whereas it’s true that card schemes themselves are sometimes below scrutiny to rethink their pricing strategy, retailers have been efficiently lobbying for optimized price constructions. So, whereas you will have heard that on-line processing prices are steep, this isn’t the case.

Any such false assertions haven been aired by those that examine on-line transaction prices to these for in-store funds. Within the case of the previous, nevertheless, you get much more on your price: enhanced security measures like AVS (Handle Verification Companies) or CVV checks, or CX options like storing fee particulars for future comfort, for instance.

The Resolution:

Take a calculated strategy to fee prices and do your homework. Examine price constructions and, most significantly, take into account the returns on funding. A superb fee supplier will supply a transparent pricing mannequin that aligns with what you are promoting objectives, with clear price breakdowns and no hidden charges.

Nonetheless unsure the place to start out? Overview our listing of 12 questions you need to consider potential eCommerce suppliers on and weigh your choices.

Fantasy 4: Prospects Desire Money Funds

The Actuality:

The fashionable buyer craves comfort. It’s simple to consider that the chiming of cash or crinkling of notes is the common sound of gross sales satisfaction, nevertheless, present developments in shopper habits counsel that digital wallets are quick changing into the brand new pockets of desire. With the rise of Various Cost Strategies, subscription companies, and new avenues for supply and success, the pattern is irreversibly tipping towards digital fee strategies.

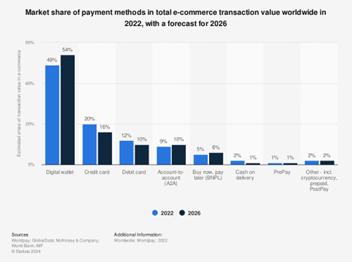

To place issues in perspective, greater than half of the world’s eCommerce transactions had been concluded with digital wallets in 2022. The place is money within the equation? At simply 2% of shopper desire for on-line spending and forecast to proceed lowering, this fantasy holds no validity regardless of how we have a look at the difficulty.

Supply: Statista

The Resolution:

Keep forward of buyer developments by providing a various vary of fee choices that cater to totally different preferences, together with widespread digital wallets, cellular fee options and a domestically favored collection of playing cards.

Promoting in a couple of nation? Select a fee supplier that has an intensive portfolio of accepted fee strategies. With the 2Checkout platform, retailers can settle for transactions in 50+ totally different fee strategies and APMs, for a really localized shopper expertise.

Fantasy 5: It Takes a Lengthy Time and it’s Costly to Swap to a New Cost Supplier

The Actuality:

Transitioning to a brand new fee supplier is commonly perceived as a frightening process, however in actuality, it may be a fast, seamless course of that brings vital advantages to companies. With the suitable preparation and assist, and when following a pre-defined migration stream, the change might be made easily, minimizing disruptions to operations.

What prompts retailers to modify fee suppliers? Typically, it’s about overcoming present limitations. They might not have all capabilities wanted to scale or they might have outgrown the preliminary fee supplier. Different instances, switching suppliers is a strategic resolution that may end up in long-term price financial savings by providing extra aggressive transaction charges and higher service phrases.

Deciding on a brand new supplier can cone with a variety of options designed to reinforce the shopper expertise, corresponding to sooner processing instances, extra fee choices, and improved safety measures. With market-leading suppliers, the transition is often a fast, rigorously calculated and seamless course of, which is commonly concluded in a matter of days or perhaps weeks.

The Resolution:

Go for a fee supplier that provides devoted assist in the course of the transition part, making certain minimal disruption and a swift change that’s each financially viable and operationally environment friendly. 2Checkout has a thorough course of in place for migrating delicate information – devoted groups assist onboard new retailers whereas a number of enterprise metrics are monitored all through the migration course of.

Fantasy 6: You Can’t Change Your Cost Monetization Mannequin

The Actuality:

Trendy fee suppliers are designed with versatility at their core, catering to the evolving wants of companies in a dynamic market. This flexibility is especially evident within the vary of partnership fashions they provide, which may simply adapt to totally different gross sales methods. So, if you happen to’ve heard data like “When you’ve signed up with a fee supplier, you’re locked in to a selected gross sales mannequin”, know that that is now not the case.

Firstly, with trendy fee suppliers retailers can promote one-time, recurring, or any mixture between the 2, in adaptable flows. For companies centered on promoting one-time gadgets, these suppliers allow easy, safe transactions that reassure each the vendor and the customer. However, firms aiming to determine a gentle earnings by way of subscription-based companies profit from fee options that assist recurring billing, computerized renewals, and simple administration of buyer subscriptions. All-in-one platforms can assist both of those flows, making certain that whether or not a enterprise is trying to promote handcrafted items, digital content material, or entry to an ongoing service, there’s a fee mannequin that matches below the identical roof.

High quality fee suppliers these days additionally allow retailers to replace their monetization fashions as enterprise wants evolve. When partnered with such a platform, a service provider beforehand promoting lifetime licenses, for instance, can effortlessly change to promoting month-to-month or quarterly subscription plans for its product and companies. One other side of resolution flexibility in relation to monetization additionally extends to promoting past a enterprise’ personal web site. The best fee companion will allow sellers to seamlessly additionally deploy funds for his or her cellular apps, with out the necessity for buying a further resolution.

By accommodating numerous enterprise wants, trendy fee suppliers not solely facilitate smoother operations but in addition empower companies to discover new income streams and progress methods with out being constrained by their fee processing system.

The Resolution:

Associate with a fee supplier that understands your business and presents versatile, future-prof monetization fashions that assist your particular enterprise targets, regardless of how they evolve.

Conclusion

In conclusion, on-line funds usually are not the advanced, inflexible, pricey, and insecure processes some myths make them out to be. By staying knowledgeable and selecting the best fee companions, retailers can unlock the complete potential of their eCommerce operations and guarantee they’re not held again by outdated beliefs. It’s time to take management, and the suitable fee supplier might be the game-changer what you are promoting wants. Uncover how the 2Checkout platform might be your progress companion, with its wide selection ecosystem to caters to all of your targets – learn this materials to get a primer on our resolution and its income scaling capabilities.

[ad_2]