[ad_1]

When the worldwide financial forecast is unsure, fundraising is simply the primary half of the battle for brand spanking new startups. The VCs that proceed to put money into new firms typically demand extra aggressive phrases to cut back their danger. Time period sheets from respected VCs in all probability received’t be outright predatory, however throughout a recession, worst-case eventualities usually tend to happen, and founders shall be extra more likely to pay the worth. Cautious cap desk modeling and monetary modeling will help you keep away from surrendering extra fairness than you in any other case have to.

Because the co-founder of a world VC agency that has funded greater than 50 startups, I’ve sat throughout the desk from founders such as you many occasions. I can let you know that VCs need you to succeed as a result of that’s how they succeed. However a dark financial system makes everybody a bit of extra tight-fisted and danger averse, which suggests you’ll be able to count on your funding to return with additional situations you wouldn’t essentially see in increase occasions.

Valuation will get lots of headlines, however most popular phrases—the popular fairness that traders obtain—are the a part of the negotiation that may actually lure you right into a worse deal than you supposed to make. Pricing these phrases could be difficult as a result of a lot of them will solely change into related solely below sure circumstances. Dilution safety, for instance, kicks in solely throughout a down spherical, so it may seem to be a comparatively low-risk concession in financial system. In a unstable one, nonetheless, it may imply the distinction between life or dying to your firm.

Probably the most correct method to worth conditional phrases is to run a simulation of potential outcomes in your monetary mannequin and calculate the impact of the proposed phrases in your cap desk, then common these outcomes over many iterations. Nevertheless, that may require costly specialised software program and important statistical experience that you could be not have.

A far simpler—but nonetheless very dependable—choice is to undertake state of affairs evaluation along with your cap desk and monetary modeling. In state of affairs evaluation, you analyze distinct levels of monetary outcomes (sometimes low, medium, and excessive) somewhat than operating a dynamic simulation that iterates on a whole lot of doable outcomes.

A whole overview of how finest to cost most popular phrases is past the scope of this text, however I supply a roadmap for learn how to strategy a number of of the commonest and consequential phrases. I additionally present you learn how to worth them precisely sufficient to keep away from unintentionally gifting away an excessive amount of of your organization.

Place Your self for Negotiation

Earlier than you sit down on the desk, do some homework: Ensure your startup’s funds are so as, make certain that you perceive dilution, be certain that your fairness is apportioned appropriately, and have your monetary mannequin in place.

These steps will put together you to estimate your organization’s valuation and construct your cap desk so you’ll be able to mannequin the phrases your traders are proposing.

Nail Down Your Valuation

For those who’re on the seed stage, valuation is usually a much less essential a part of the negotiation, however it’s essential to make a persuasive case for the numbers you set forth.

This requires some inventive considering. Whereas there are quantitative instruments that talk to the monetary well being of a startup, at this early stage you almost certainly won’t have adequate money circulate information to reach at a sturdy fair-value estimate. As a substitute, strategy this matter as a triangulation train, utilizing the next components:

Monetary Mannequin

Even with out lots of historic information, you want a place to begin, so carry out a standard discounted money circulate in your monetary mannequin with no matter data you have got. Then use the usual enterprise goal price of return—20% to 25%—as the price of capital to see what present-day valuation it implies. Lastly, work backward to find out how a lot money circulate progress could be required to hit your goal valuation. This may reveal the milestones it’s essential to hit in an effort to develop a transparent plan to attain your goal valuation, in addition to reveal, ideally, a beneficiant return on funding to your traders.

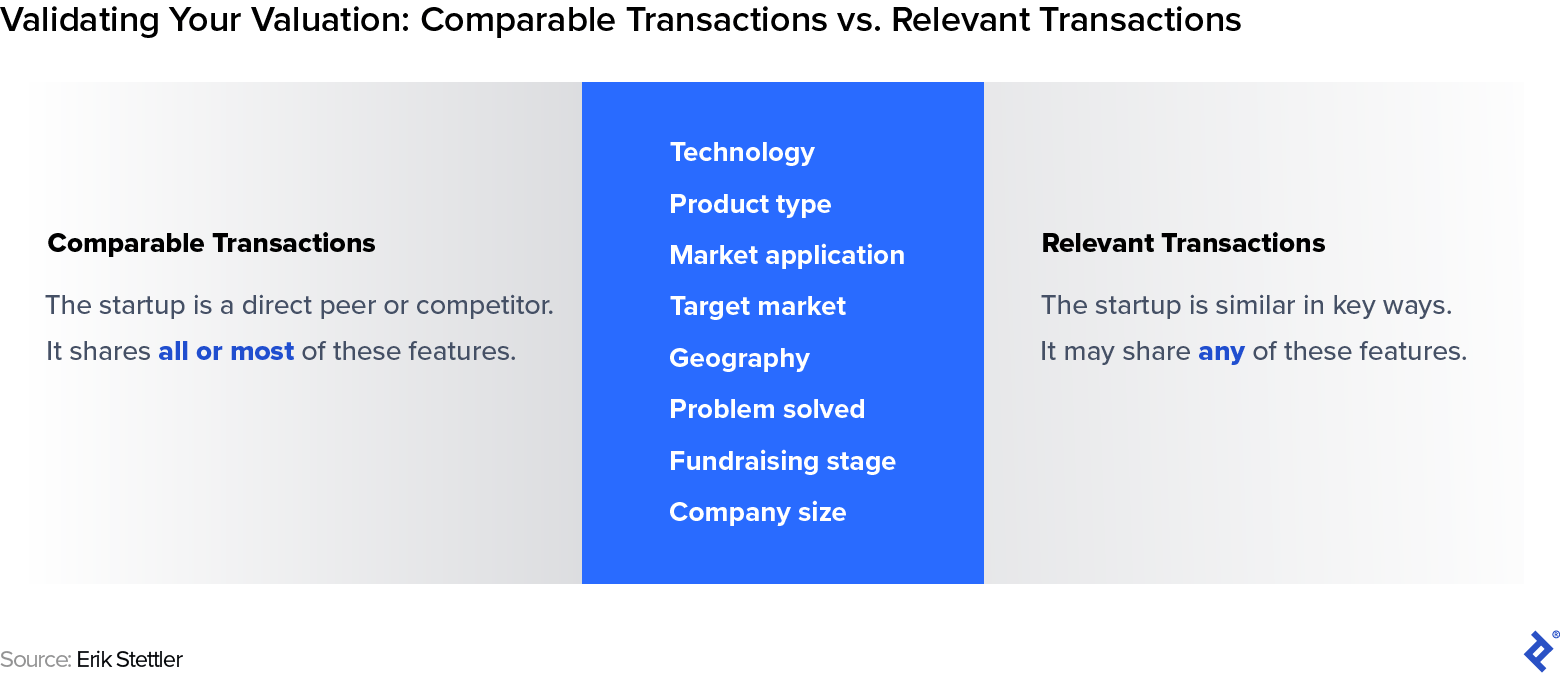

Latest Related Transactions and/or Exits

The standard knowledge is to take a look at latest comparable transactions to validate your figures, however discovering latest comparable offers amongst direct friends or opponents is troublesome, even below regular market situations. Each startup and enterprise deal is completely different, and the publicly accessible data on transactions excludes essential components of the general deal phrases or construction.

Nevertheless, by increasing your search to latest related transactions—these in your normal business or expertise space—you’ll be able to nonetheless present traders with persuasive context to help the a number of in your income and different relevant metrics.

Combination Market Tendencies

Pitchbook affords a substantial quantity of free information on non-public market developments in valuation and deal dimension throughout funding levels. That information could be skewed by a small variety of “mega rounds” at unusually excessive valuations and might conceal a substantial vary of outcomes. Even so, typically, exhibiting that the implied valuation out of your monetary mannequin is consistent with different offers will assist validate your asking worth.

If an investor aggressively pushes for a decrease valuation, take into account {that a} purple flag. The first concern of traders must be their return. Framing the worth dialogue inside the bigger context of the expansion that you simply’ll obtain with this funding spherical—and the long run valuation it’ll allow you to succeed in—will help take among the strain off your present valuation. I as soon as had a startup consumer that was capable of reveal so convincingly that it might count on ongoing 70% month-to-month progress that the query of reducing its valuation by no means got here up.

Use a Dynamic Cap Desk

Your monetary mannequin is central to the valuation dialogue. However the true battlefield for the negotiations is your cap desk, which is the place you monitor the fairness breakdown of your organization. Listed here are three options you need to embody in your cap desk format to mannequin your traders’ proposed phrases:

- Each Spherical of Fundraising: Embody any prior seed or pre-seed investments that may convert upon Collection A. Embody your future rounds as properly—one thing I see founders fail to do on a regular basis. Usually, I assume at the least a Collection B previous to exit or adequate profitability, nevertheless it’s a good suggestion to imagine a Collection C too.

- Investor Payout: Add a line that tallies your investor payout throughout rounds. That is essential as a result of when you supply a sure most popular time period to your Collection A lead investor, then you’ll be able to sometimes count on your Collection B result in demand the identical. For those who’re not modeling the affect of your phrases via the tip of fundraising, these concessions can snowball.

- Future Fundraising Wants: As your corporation grows, so will your bills—workers wage and choices, bodily overhead, manufacturing prices, and extra. Simply as you funds for these in your monetary mannequin, you’ll have to funds for them in your cap desk.

Cap desk modeling may even assist with the widespread query of how a lot cash you must try to boost in a given spherical. Fundraising in smaller increments can reduce dilution, since your valuation will presumably enhance over time. Nevertheless, you need to weigh this potential profit in opposition to the danger of getting much less cash within the financial institution at any given second, in addition to the probability that you simply’ll have much less time to deal with fundraising as your corporation grows.

This query typically intertwines with negotiations, because the attractiveness of the phrases will have an effect on how a lot capital you select to just accept. Your modeling can also enable you to resolve that it is likely to be higher to stroll away completely and undertake an extension of your prior seed or pre-seed spherical as an alternative, to purchase you extra time to develop.

Put together to Mannequin Most well-liked Phrases

Valuation is only one piece of the puzzle. In occasions of capital shortage, traders are more likely to take into account extra aggressive most popular phrases within the hopes of lowering their danger (draw back safety) or growing their potential reward (upside optionality).

Listed here are three of the commonest and impactful most popular phrases that founders ought to, in some instances, keep away from and, on the very least, mannequin rigorously earlier than accepting.

Liquidation Desire

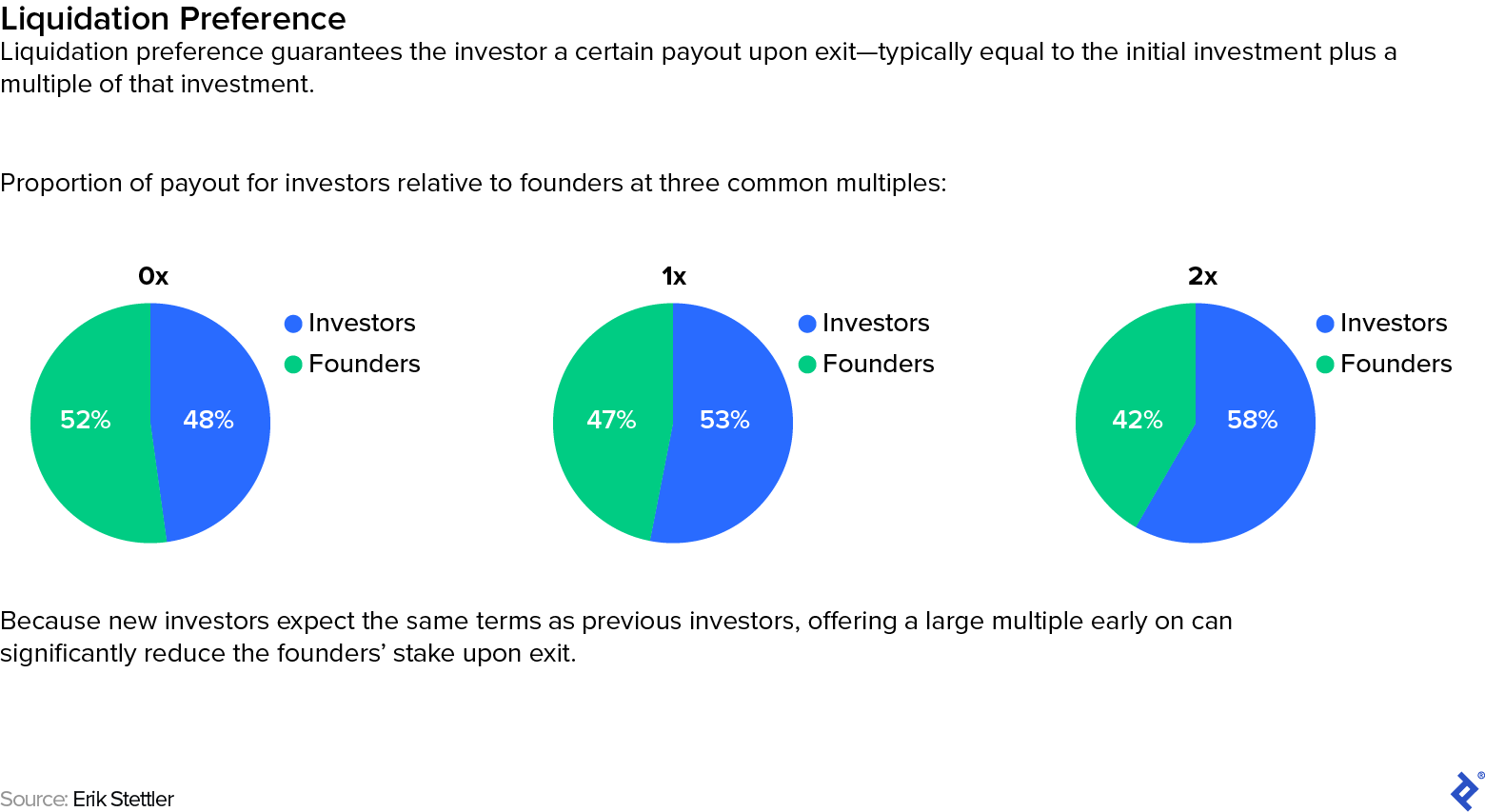

Within the occasion of liquidity or dissolution, liquidation desire grants the investor an agreed-upon quantity—normally the return of their capital (1x), plus a possible assured a number of (>1x)—earlier than you obtain something. The remainder of the pie is allotted proportionally based mostly on % possession.

To see the affect of your traders’ proposed liquidation desire, add a line to the cap desk that exhibits the quantity that shall be due upfront to your traders (and people from anticipated future rounds) earlier than you obtain your share. The outcomes might reveal a considerable discount within the payout that you simply and your crew members can count on.

You should utilize this data within the negotiation to make the case that if the traders count on to derisk their return on this approach, they need to settle for a better valuation. It’s a matter of precept: Danger and reward go hand in hand in investing, and contractually lowering the previous ought to then elevate the scale of the latter.

Dilution Safety

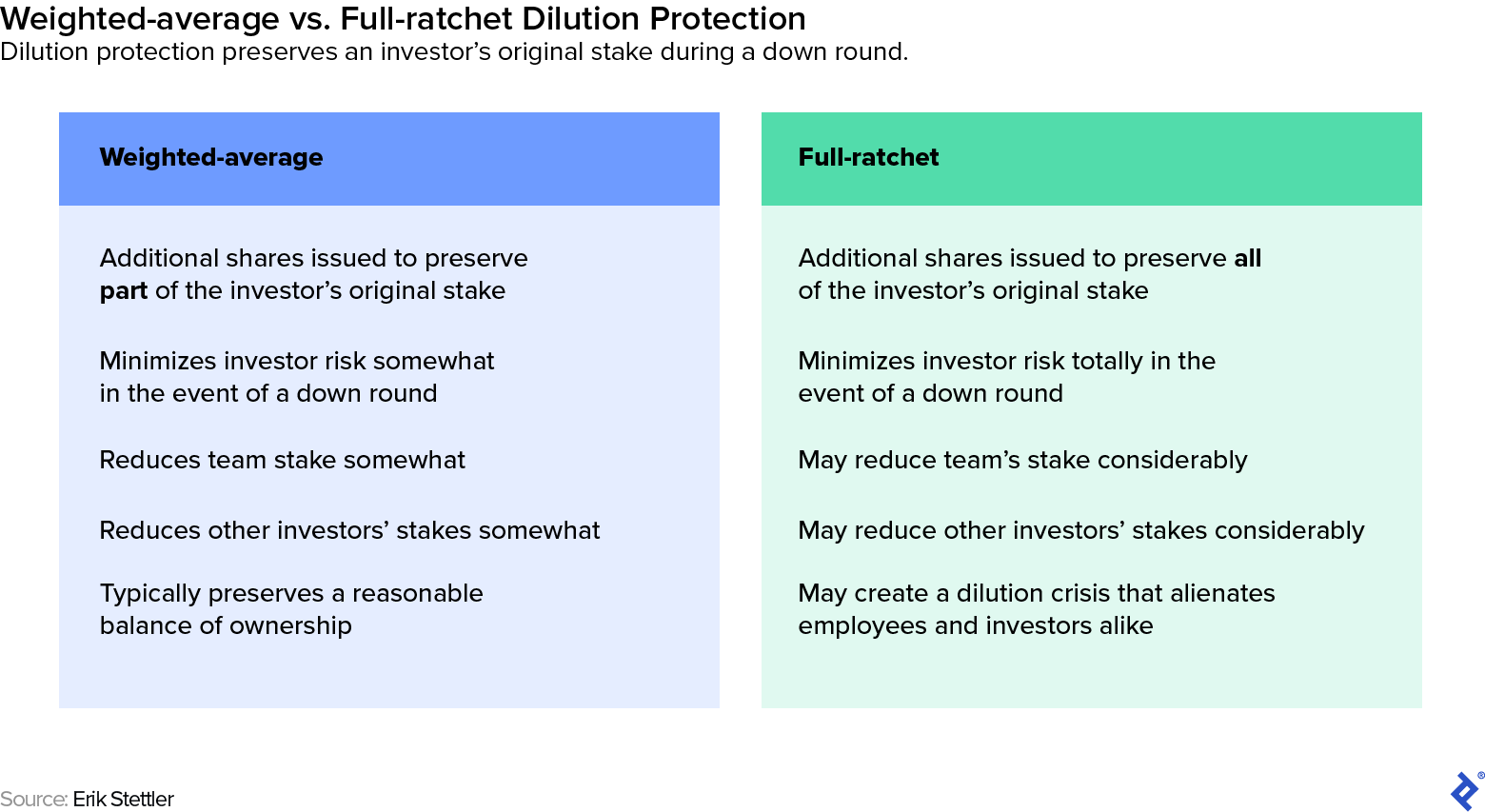

Within the occasion of a down spherical, dilution safety clauses require a startup to generate extra shares for the investor in an effort to preserve the investor’s relative stake. Weighted-average dilution safety, which solely ensures a sure proportion of the unique stake, is a tolerable ask. Full-ratchet dilution safety, which preserves the investor’s whole stake, is a extremely aggressive request, because it primarily calls for all of the potential reward with out exposing the investor to the corresponding danger.

Aggressive dilution safety raises your danger as properly, as it may set off a dilution dying spiral that may in the end kill your possibilities of surviving a down spherical. When your organization turns into too diluted, that may eat up so most of the shares reserved to your crew and future traders that it turns into troublesome to retain and rent the most effective expertise, in addition to proceed fundraising.

Pushing again in opposition to full-ratchet dilution safety requires a fragile contact. I discover one of the simplest ways to do it’s to take a Socratic strategy and ask your traders sufficient questions in regards to the potential downsides of their proposal that they finally come round to your place of their very own accord.

First, present your traders your cap desk modeling and clarify the affect that that stage of dilution can have on worker morale and investor attraction. Ask them how they suppose it’s doable so that you can develop the corporate below such situations with out the extra capital a better valuation would supply. On this approach, you’ll be able to present them how the anticipated greenback worth of their closing holdings can enhance if they provide a bit of on the share at this time.

Full-ratchet dilution safety could be so damaging to a startup that I usually advise doing every part doable to keep away from it—together with strolling away from the deal—until your corporation won’t survive with out that investor. Even then, it’s value attempting to push again.

Tremendous Professional-rata Rights

Commonplace pro-rata rights permit the investor to take part in subsequent rounds, as much as the purpose of sustaining their preliminary possession stake. This time period can most frequently come up throughout the seed spherical, as many seed traders look to comply with on with extra capital as the celebrities start rising. I sometimes advocate that founders preemptively supply pro-rata rights to traders, as the chance to comply with on is a part of what makes early-stage investing viable.

Throughout tight markets, nonetheless, traders generally request tremendous pro-rata rights, which give them the precise to take a position sufficient to enhance their % stake in subsequent rounds.

Whereas pro-rata rights are truthful, tremendous pro-rata rights are usually not, as they lock in a share of the potential upside disproportionate to the scale of the investor’s dedication within the present spherical. They’re primarily the other aspect of the coin from full-ratchet dilution safety. In case you are accustomed to choices pricing, you’ll be able to mannequin this as a name choice the place the strike worth is your anticipated Collection A valuation and the volatility inputs come from the state of affairs evaluation you carried out along with your monetary mannequin and their respective possibilities.

I don’t advocate granting tremendous pro-rata rights below any circumstances, as that may hinder your capability to deliver on extra traders in future rounds. Buyers in later-stage firms sometimes have a minimal proportion that they’re prepared to just accept, and if tremendous pro-rata rights allocate an excessive amount of to your earlier traders, you could find your self in a state of affairs the place you have got too little area left within the spherical to shut your funding hole. If an investor desires extra publicity to your organization, they need to enhance their present funding quantity as an alternative.

If, nonetheless, you actually can’t afford to stroll away from a deal that calls for tremendous pro-rata rights, then it’s essential to persuade the investor to present a bit extra on present valuation in return for this capability to seize extra upside.

Learn the Contract and Get a Lawyer

I can not emphasize sufficient how crucial it’s to rent a lawyer who makes a speciality of enterprise agreements whenever you’re reviewing an investor contract. That is one space the place you don’t wish to skimp.

Most well-liked phrases are always evolving, and irrespective of how exactly we try and mannequin or summarize them, the one supply of fact is the authorized contract. Whilst you can negotiate the enterprise and monetary essence of the phrases, don’t signal something with out first exhibiting the documentation to a lawyer to make sure that it precisely displays what you’ve agreed upon.

Sloppy and ambiguous language could be simply as harmful as a deliberate “gotcha” clause. For instance, any metrics-based payout plan opens the door to havoc, even within the uncommon instances when the metrics are completely outlined. Ambiguity practically at all times favors the bigger and better-funded occasion (on this case, the investor), since they will fund and stand up to a dispute for longer. Hiring a extremely certified enterprise lawyer will enable you to keep away from this final result.

Keep in mind the Human Issue

I’ve targeted on how your cap desk and monetary mannequin will help you grasp sure key phrases in an effort to perceive the true value of what you’re providing and ensure you obtain adequate consideration in return. The negotiations themselves, nonetheless, are a profoundly human train.

Figuring out the profile and viewpoint of the traders will enable you to infer how a lot relative worth they’ll place on sure phrases. Buyers who’re newer to VC, similar to household workplaces and traders with extra conventional non-public fairness backgrounds in rising ecosystems, will typically focus extra on draw back safety, whereas Silicon Valley traders steadily pay extra consideration to upside optionality. Company enterprise capital could also be extra concerned about strategic phrases than financial ones. Understanding their priorities will enable you to tailor your strategy.

Lastly, keep in mind that simply because the phrases you settle for will set a precedent for future rounds, the negotiation is barely the start of your relationship with a specific investor. Your habits throughout negotiations will inform the investor what sort of associate you’ll be—and vice versa. The second you signal the ultimate settlement, you’ll all be on the identical crew, and shortly sufficient you’ll be getting ready collectively for the following spherical.

[ad_2]