[ad_1]

Within the dynamic panorama of the digital financial system, B2B funds play a pivotal position in shaping enterprise interactions. These transactions, occurring between companies moderately than shoppers, facilitate the trade of products, providers, and funds.

As we step into 2024, the importance of B2B funds intensifies, pushed by technological developments, altering client habits, and international market shifts. Fiscal 12 months 2023 witnessed an unprecedented surge in B2B funds, reflecting the rising reliance on seamless monetary processes.

From provide chain administration to cross-border commerce, B2B funds are the lifeblood of commerce, impacting effectivity, liquidity, and competitiveness. Let’s delve into the tendencies and challenges that outline this essential area within the coming 12 months.

Development 1: Digital Pockets Adoption

Digital wallets have been witnessing an unstoppable development and adoption inside the B2B cost panorama, reshaping the way in which companies conduct transactions. The surge in cellular cost adoption, pushed by widespread smartphone utilization, has prompted conventional banks to adapt by providing tailor-made on-line banking options for companies.

The B2B digital cost market measurement is projected to develop considerably, from USD 4.2 billion in 2023 to USD 8.2 billion by 2028. This development is attributed to the regular enhance within the adoption of strategies corresponding to e-wallets and digital playing cards.

Fintech sector’s development has launched modern cost options, corresponding to digital wallets, additional driving the shift within the B2B funds panorama. Though digital adoption is comparatively new within the B2B funds, it’s a Fintech sector with a big market alternative.

The B2B cost panorama is quickly evolving, with digital wallets taking part in a pivotal position on this transformation. Companies are embracing this development, leveraging the comfort, pace, and safety provided by digital wallets to optimize their monetary operations.

Problem: Whereas digital pockets adoption is predicted to surge within the B2B cost panorama of 2024, challenges corresponding to safety considerations, interoperability points, and resistance to vary from conventional cost strategies can pose important hurdles.

Development 2: Blockchain and Sensible Contracts

Blockchain’s basis is distributed ledger know-how (DLT), the place transactions are distributed and verified by a community of computer systems, guaranteeing transparency and safety. With its decentralized method, blockchain eliminates the necessity for intermediaries like banks, facilitating quicker and cheaper funds.

Cryptocurrencies, constructed on blockchain know-how, have gotten a sexy choice for B2B funds. They provide benefits corresponding to quick cross-border transactions, decreased transaction charges, and elevated privateness.

Blockchain additionally facilitates programmable funds by way of sensible contracts, which automate cost processes primarily based on predefined circumstances. For example, JPMorgan is leveraging blockchain to make company transactions extra versatile and automatic.

Within the retail sector, blockchain and cryptocurrencies are making on-line funds safer and simpler, negating the necessity for purchasers to pay further expenses.

Furthermore, blockchain is revolutionizing cross-border funds by offering environment friendly and safe options, overcoming the challenges of conventional banking methods.

Cryptocurrency and blockchain know-how are reworking the B2B funds panorama by providing safe, clear, and environment friendly options. Their affect is predicted to develop considerably within the coming years.

Problem: Regardless of the potential of blockchain and sensible contracts to revolutionize B2B funds, their adoption faces obstacles like regulatory uncertainty, lack of technical understanding, and scalability points.

Development 3: Actual-Time Funds

Actual-time funds (RTP) have change into a big development within the monetary world. Because the title suggests, RTP are funds which can be processed immediately, constantly, and around the clock. With RTP, transactions between financial institution accounts are initiated, cleared, and settled inside seconds, whatever the time of day.

Actual-time transactions have been recognized as one of many key tendencies to form the way forward for B2B funds. RTP networks, such because the one offered by The Clearing Home, allow shoppers and companies to conveniently ship funds immediately from their accounts.

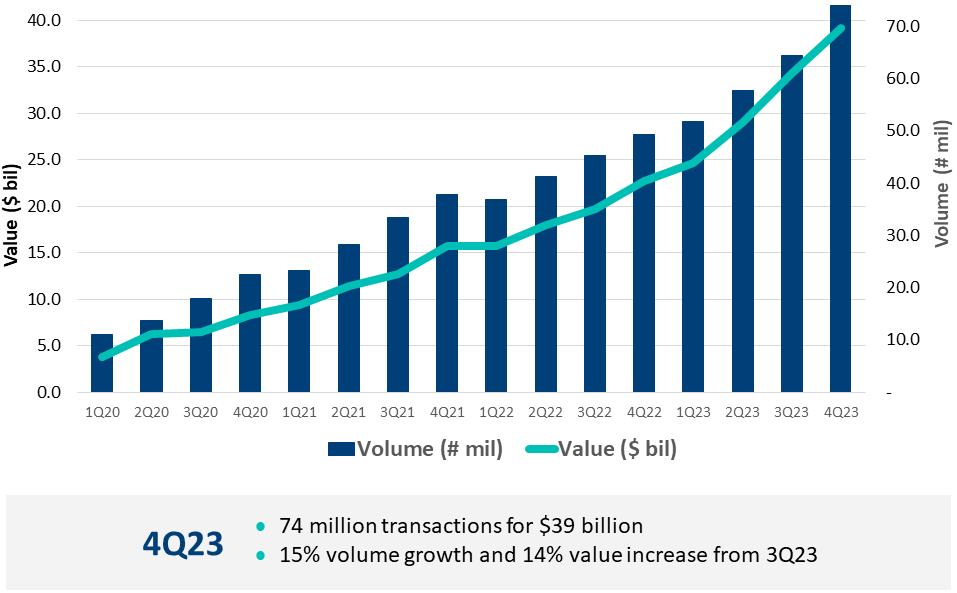

Supply: The Clearing Home

The macro atmosphere at the moment calls for effectivity beneficial properties, additional automation, and value reductions. Actual-time funds, providing speedy funds availability, align with these calls for, enhancing operational effectivity, and bettering money stream administration for companies.

Furthermore, the real-time stability characteristic of RTP provides a affirmation of funds. As soon as a cost is allowed, the payer’s account displays the deduction of funds instantly. This characteristic provides one other layer of safety and belief within the cost course of.

Importantly, RTP function on a 24/7/365 mannequin, permitting customers to ship and obtain funds at any time. This continuous operation is very helpful for international companies that take care of completely different time zones.

The rise of real-time funds is ready to remodel the way in which companies deal with transactions in 2024, providing safe, environment friendly, and instantaneous options.

Problem: Actual-time funds promise prompt, 24/7 transactions for companies. Nonetheless, integration complexities, information safety points, and the necessity for international standardization can impede their widespread adoption.

Development 4: Embedded Finance and APIs

Embedded finance, powered by APIs, is predicted to change into a big development within the B2B cost panorama of 2024. This modern method permits companies to combine monetary providers immediately into their present product choices.

In B2B , embedded finance can streamline the cost course of, scale back handbook duties, and reduce potential errors. The mixing of APIs allows seamless connection to third-party monetary providers, making these advantages accessible inside present enterprise platforms. For example, e-commerce websites providing loans, social media platforms introducing cost functionalities, and cost facilitators are all examples of how embedded finance is being leveraged.

The market measurement for embedded finance within the B2B sector is predicted to broaden considerably. Anticipated to develop to $6.5 trillion by 2025 (from $2.5 trillion in 2021), the potential for B2B purposes is huge.

Embedded finance and APIs are set to reshape the B2B funds panorama in 2024, providing extra environment friendly, built-in, and customer-friendly cost options.

Problem: Remember that embedded finance and APIs are set to reshape the B2B funds panorama, however challenges like guaranteeing information privateness, managing third-party dangers, and dealing with regulatory compliance can come up.

Development 5: Cross-Border Fee Improvements

Cross-border funds have been revolutionizing the B2B panorama, witnessing constant development and paving the way in which for a transformative 2024. This sector, at the moment the fastest-growing section within the cross-border area, is primed to reshape international commerce.

The expansion of cross-border funds within the B2B realm might be attributed to some key elements. Firstly, digitalization has performed a big position, offering companies with the instruments and platforms obligatory to simply facilitate worldwide transactions. Secondly, the growth of worldwide commerce has pushed demand for environment friendly, dependable cross-border cost options.

Regardless of making up lower than 20% of the entire market by 2030, B2B cross-border funds are a pressure that can’t be ignored. The market witnessed a gradual enhance of $14 trillion with a development charge of 10%, from $137 trillion. This determine is predicted to rise 53% to $290.2tn in 2030.

In 2024, the cross-border funds section is anticipated to develop on the highest CAGR of 11.63% within the B2B funds market. This development is fueled by the growing significance of cross-border transactions in supporting the expansion of business-to-business commerce and commerce.

The surge in cross-border funds is ready to considerably impression B2B transactions within the following 12 months and past. As companies proceed to globalize, the demand for environment friendly, safe, and quick cross-border cost options will solely enhance.

Problem: Improvements in cross-border funds are shaping B2B transactions, but they will face hurdles corresponding to excessive transaction prices, regulatory complexities, and points associated to overseas trade volatility.

Conclusion

Because the market continues to develop and evolve, companies should adapt to new applied sciences, buyer preferences, and regulatory necessities. The tendencies we’ve got mentioned on this weblog publish present alternatives for corporations to innovate and improve the shopper expertise.

Staying forward on this dynamic atmosphere requires an knowledgeable and proactive method. It’s essential to grasp not simply the alternatives these tendencies current, but additionally the potential hurdles that may come up. By doing so, companies can strategically navigate the altering panorama and harness the facility of those tendencies to drive development and effectivity.

Seeking to perceive extra about rising and increasing tendencies? Watch our session with Sam Hänni, CEO of SwissMadeMarketing, to get a primer on how AI is altering the taking part in subject in advertising.

[ad_2]