[ad_1]

Many seasoned traders are getting a bit involved about shares surging to five,100 for the S&P 500 (SPY). That is as a result of earnings progress is sort of non-existent and thus inventory costs are attending to elevated ranges. This might level to a nasty correction forward. That’s the reason you’ll want to tune into Steve Reitmeister’s hottest market commentary together with buying and selling plan and prime picks. Learn on beneath for the complete story.

Sure, the frenzy as much as 5,100 for the S&P 500 (SPY) was spectacular. However similar to final 12 months we see far an excessive amount of of the latest beneficial properties flowing in direction of the Magnificent 7 shares. A whole lot of that due to the “off the charts” earnings report from NVDA.

Sadly, the broader we glance…the tougher it’s to really feel uber bullish. Very true with Fed indicators pointing to June being the primary price lower (and once more…possibly even later than that).

This creates an attention-grabbing funding panorama the place shares are in any respect time highs and but earnings progress may be very low. Not a fantastic recipe for future inventory market advance.

Let’s dig in deeper on this very important subject on this week’s Reitmeister Complete Return commentary.

Market Commentary

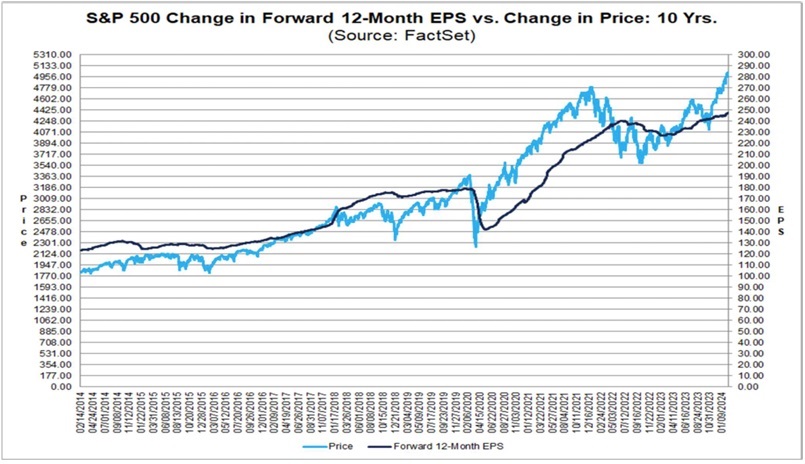

We have to begin the dialog with this provocative chart from FactSet evaluating the motion of the ahead S&P 500 EPS estimates versus the inventory index:

You’ll uncover that for a lot of the previous 10 years the darkish line for earnings is above the worth motion. That means the advance within the earnings outlook propelled shares increased. But every time we discover the inventory index climbing above the EPS outlook it comes again right down to measurement prefer it did in 2022.

So, it’s attention-grabbing to ponder that the latest inventory surge beginning in November was borne beneath the auspices that the Fed would quickly be decreasing charges. And but as time rolls on, we discover that isn’t true with the beginning date pushed out additional and additional.

Final week’s launch of the FOMC Minutes reaffirmed the hawkish intent of the Fed to not act too early to decrease the charges lest they danger inflation staying above pattern far too lengthy. This information, on prime of hotter than anticipated CPI inflation #s this previous month, has traders recalculating when the Fed will formally begin chopping charges.

Proper now, the percentages of the primary price lower taking place on the Might 1st assembly stands at solely 19% all the best way down from 88% probability a month in the past. This has sights despatched extra on June being the beginning line because the market units that chance at 63% which is nice, however not overhwelming conviction.

Again to the S&P 500 earnings chart above…I imagine that shares are working effectively forward of the basics. If the teachings of historical past maintain true, then it factors to 2 attainable outcomes.

First, could be a correction for inventory costs to be extra in step with the true state of the earnings outlook. One thing within the vary of 10% ought to do the trick with among the extra inflated shares enduring a stiffer 20%+ penalty.

Then again, shares might degree out for some time patiently ready for charges to be lowered. This act is a well-known catalyst for higher financial progress that ought to lastly push earnings increased getting issues again in equilibrium with the index value.

Sure, there’s a 3rd case the place shares simply hold rallying as a result of traders are usually not wholly rationale. Sadly, these durations of irrational exuberance led to rather more painful corrections additional down the street. So, let’s hope that won’t be the case right here.

Buying and selling Plan

I imagine the twond state of affairs above is the almost certainly. That’s the place the S&P 500 ranges out for some time. Maybe clinging in tight consolidation beneath the latest highs of 5,100. Or maybe a wider buying and selling vary right down to the earlier breakout degree of 4,800.

My best hope is that the latest rotation to small cap shares continues to unfold. For instance, over the previous three classes the S&P 500 has truly slipped slightly from the highs. All of the whereas the small caps within the Russell 2000 have generated a way more spectacular +2.2% achieve…and eventually again into optimistic territory on the 12 months.

The principle level is that we’re rightfully in a bull market. Simply generally the worth motion will get forward of the basics. So, this both creates a interval of pause…or correction. I sense the previous is the almost certainly state of affairs.

In that surroundings the general market would not transfer a lot, however overpriced shares are typically squeezed down, whereas worth shares are bid up.

We’ve got an amazing benefit to search out these finest worth shares due to the 31 worth components contained in the POWR Worth mannequin. You and I shouldn’t have sufficient hours within the day to judge these 31 components by hand for all 5,300 shares measured by the POWR Scores mannequin.

Gladly the computer systems do the heavy lifting for us every night time making it a lot simpler handy choose the shares that finish in our portfolio.

Which of them are in my portfolio now?

Learn on beneath for the reply…

What To Do Subsequent?

Uncover my present portfolio of 12 shares packed to the brim with the outperforming advantages present in our unique POWR Scores mannequin. (Almost 4X higher than the S&P 500 going again to 1999)

This contains 5 beneath the radar small caps just lately added with great upside potential.

Plus I’ve 1 particular ETF that’s extremely effectively positioned to outpace the market within the weeks and months forward.

That is all primarily based on my 43 years of investing expertise seeing bull markets…bear markets…and all the pieces between.

In case you are curious to be taught extra, and wish to see these fortunate 13 hand chosen trades, then please click on the hyperlink beneath to get began now.

Steve Reitmeister’s Buying and selling Plan & Prime Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares have been buying and selling at $506.93 per share on Tuesday afternoon, up $0.94 (+0.19%). Yr-to-date, SPY has gained 6.65%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Steve Reitmeister

Steve is healthier recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit Does This Chart Level to a Inventory Correction? appeared first on StockNews.com

[ad_2]