[ad_1]

On the floor, the Netherlands looks like a no brainer for worldwide eCommerce. By GDP, they’re the Seventh-richest nation in Europe and seventeenth on the earth. They’re passionate on-line patrons—96% of the inhabitants is on-line and 52% of on-line patrons already store throughout borders—and the Dutch have the sixth-highest disposable revenue in Europe.

They’re extraordinarily proficient in English and are one of many world’s largest exporters—it’s a recipe for achievement. Nevertheless, there are after all challenges:

- Robust home competitors

- Particular shopping for and fee preferences

- Weak cell and social commerce infrastructure

- Enhanced GDPR guidelines & laws

None of those is insurmountable. There may be huge alternative for cross-border promoting to the 17 million residents of the Netherlands. Let’s take a better take a look at what firms ought to anticipate—and the way they will enhance their odds—when coming into the Dutch eCommerce market.

The state of eCommerce within the Netherlands

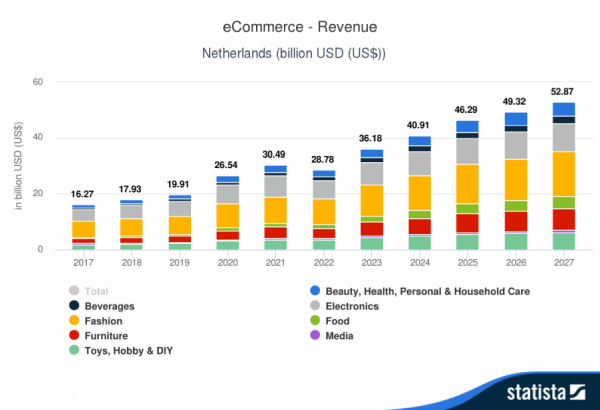

As a digital-focused nation with a really prosperous inhabitants, the Netherlands has an unsurprisingly robust and established eCommerce market. It’s predicted to overhaul its Covid-19 spike (over $30bn) later this 12 months. This factors to a powerful and secure eCommerce market that was boosted, however not artificially inflated, by the pandemic.

Style and electronics dominate market share of on-line purchases, whereas different teams—like private care and meals—grew considerably over the previous couple of years.

This stability is essential for companies seeking to appeal to Dutch shoppers. It reveals that there’s a robust future and that funding in Dutch eCommerce—in each money and time—is usually a dependable possibility. The Netherlands has lengthy had the infrastructure, robust retail market, and excessive stage of digitization wanted for heavy eCommerce adoption—the pandemic has merely accelerated the timeline.

With on-line orders capturing up practically 50% between 2019 and 2021, that is a particularly wholesome market.

eCommerce Development Alternatives within the Netherlands

Because the Seventh-ranked eCommerce market in Europe, overseas companies might be hesitant to stray into this very established $30bn market. Nevertheless, analysts forecast a rise in on-line shopping for throughout key retail classes, together with meals, furnishings, hobbies and DIY.

Electronics and trend retailers ought to be notably excited, as these are forecast to develop considerably as much as 2027.

Cellular commerce

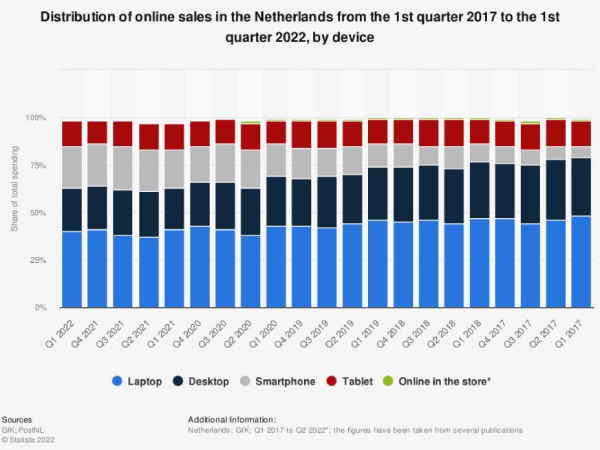

A sexy proposition for any massive eCommerce retailer is cell promoting. The Netherlands has large smartphone penetration (96.1%) however relating to cell purchasing, nonetheless lags the remainder of Europe by way of spend—solely 36.9% is attributable to smartphones and tablets.

So what makes cell eCommerce enticing? The speed of progress. The Netherlands may need the fastest-growing cell eCommerce market in Europe, with adoption rising from round 18% in 2017 to over 35% in Q1 2022. Cross-border retailers ought to enter the competitors with fully-optimized cell purchasing and checkout.

Hybrid experiences + quick supply

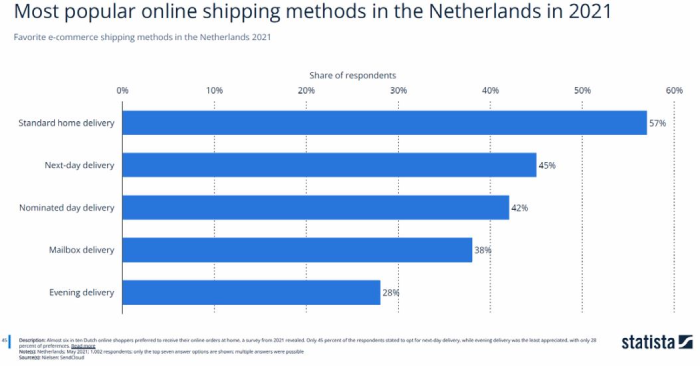

With widespread adoption of home retail marketplaces similar to bol.com and Coolblue, Dutch buyers have come to anticipate the identical fast order success supplied by giants like Amazon.

18% of Dutch buyers need same-day supply and over half, 58%, anticipate it as an possibility for orders positioned earlier than midday. Each next-day supply and click-and-collect providers have turn out to be extraordinarily widespread.

Cross-border sellers have to be ready to convey innovation to the Netherlands, the place adoption of ‘phygital’ methods shall be essential to compete with home manufacturers.

Social media and Advertising and marketing for Dutch Shoppers

The Dutch begin extra buying journeys on search engines like google and yahoo (54% to 48%) than different nations. They’re additionally much less inclined to analysis manufacturers or merchandise on social media—simply 20% in comparison with 75% globally. More practical methods are promotional emails and utilizing social media for model consciousness.

The Dutch B2B market is greater than B2C and continues to be rising impressively. Proper now, 48% of B2B orders are positioned on-line. Within the subsequent 3 years, it’s anticipated that eCommerce income will hit $54bn.

Main Cross-Border Markets within the Netherlands

Software program

Regardless of its small inhabitants, the Netherlands is the world’s tenth greatest software program market. There are alternatives for crossborder sellers of all sizes to promote successfully. Enterprise software program makes up a 3rd of software program income, estimated to hit $5bn by 2028. Nevertheless, the Netherlands additionally has a dominant productiveness software program phase in addition to success in system infrastructure software program and app improvement.

Subscriptions

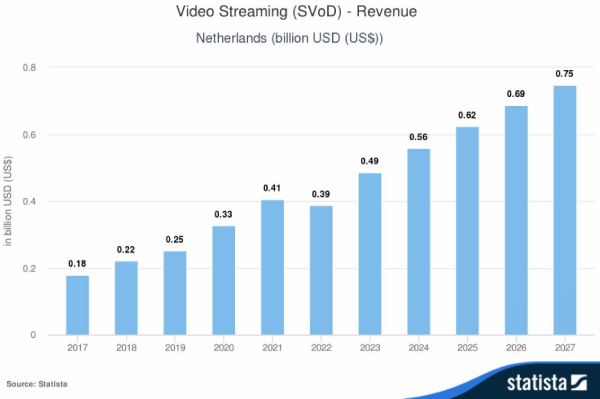

Regardless of a normal feeling of discontent with subscription surveys, the Dutch subscribe to 14 providers per thirty days and the phase is rising quickly at 7% YoY. Video streaming providers are rising at double that price (14% CAGR) and are anticipated to succeed in $750m in income by 2027.

The opposite massive gamers in subscriptions are meals (59% of the class), private care (10%) and drinks (6%).

50% of Dutch subscribers would worth extra transparency by way of billing and account administration, so this might be a aggressive benefit for brand new gamers out there.

On-line Dutch Fee Choices

On the subject of accepting on-line funds, there is just one phrase: iDEAL.

iDEAL is an inter-bank fee system that accounted for practically 70% of all on-line funds within the first half of 2021. The supplier owns 96% of the financial institution switch market and ought to be a distinguished possibility for each single transaction within the Netherlands.

This can be a stark distinction to Europe, the Center East and Asia, the place financial institution switch is considerably much less widespread than bank cards, debit playing cards and digital wallets. In fact that also leaves 30%. By providing a small number of different strategies, it ought to be attainable to seize the overwhelming majority of orders.

Rising Conversion Charges for Dutch Customers

The Dutch are extraordinarily proficient in English. In reality, it’s practically a 50:50 break up between buyers with their browser set to English versus Dutch, in accordance with 2Checkout platform information. Due to this fact localization to each languages is vital.

Different expectations to satisfy throughout checkout embody the vary of fee strategies detailed above, native forex, and social proof throughout checkout. For instance, the variety of models bought, evaluations for that product, and so on.

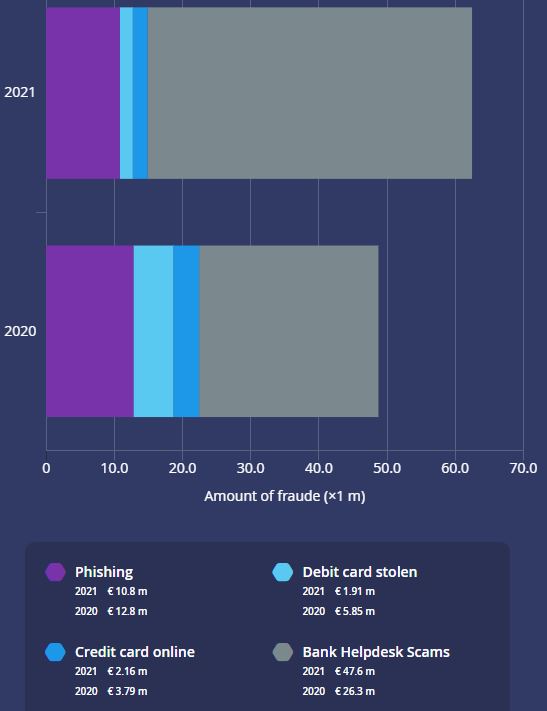

As a consequence of excessive ranges of digital fraud within the Netherlands—notably phishing and chargebacks—using 3D Safe and 3DS2 are important. These are utilized to 90% of transactions and have considerably decreased purchaser issues about fraud. As a crossborder vendor, these suspicions could also be increased in your merchandise than home manufacturers, so demonstrable safety is paramount.

As in each market, it’s important to check your checkout expertise and optimize for the very best conversions.

Information dealing with and safety

The Netherlands has taken steps to boost client privateness rights with the Dutch GDPR Implementation Act. This contains protections round extra organizations, notification necessities, and private information processing.

Any crossborder vendor have to be conscious and compliant with Dutch privateness legal guidelines, as these could not mirror your home guidelines.

To be taught extra concerning the eCommerce market within the Netherlands and strategy cross-border promoting with most confidence, learn our eBook: eCommerce within the Netherlands: A Service provider’s Cross-Border Information to On-line Gross sales.

[ad_2]