[ad_1]

Plan A, a carbon accounting and ESG (environmental, social, and governance) reporting platform for firms, has raised $27 million in a Collection A spherical of funding led by U.S. VC large Lightspeed Enterprise companions.

Technically the funding is an extension of a $10 million Collection A spherical it introduced almost two years in the past, which means for all intents and functions that is the closing of a $37 million Collection A spherical, taking its whole raised to $42 million throughout its six yr historical past. However maybe extra notably, its newest spherical additionally consists of participation from some main names from the company world, together with Visa, Deutsche Financial institution, and BNP Paribas’ VC arm Opera Tech Ventures, amongst quite a few different angel buyers.

“The urgency of the local weather disaster, mixed with the complexity of navigating net-zero journeys for companies, made it crucial for us to deliver onboard top-tier buyers now,” Lubomila Jordanova, Plan A founder and CEO, defined to TechCrunch.

Scoping out

Based out of Berlin in 2017, Plan A (a reference to the ‘no plan B’ local weather motion mantra) is one in all quite a few VC-backed startups to emerge out of Europe with the specific purpose of serving to firms measure (and minimize) their carbon footprint. The perennial downside, it appears, is that even with the most effective will on the planet, reducing carbon emissions will be troublesome until an organization makes an actual effort to find precisely what their emissions are, and the place they’re within the provide chain.

A survey final yr from Boston Consulting Group (BCG) discovered that 90% of organizations didn’t measure their greenhouse gasoline emissions “comprehensively.” As typical, so-called “scope 3 emissions” have been recognized as a serious stumbling block, whereby an organization fails to deal with emissions down by its provide chain involving associate companies. Whereas it’s true that scope 3s are tougher to measure in comparison with scope 1 (which refers to emissions immediately underneath an organization’s management), there’s rising strain for organizations to deal with emissions all through their community.

That is essential for plenty of causes, however primarily as a result of many companies’ carbon footprint is basically made up of scope 3 emissions. For instance, a Coca-Cola bottling associate — Coca-Cola European Companions (CCEP) — has beforehand estimated that 93% of its emissions have been scope 3.

Furthermore, reasonably than coming down, world energy-related Co2 emissions are nonetheless on the rise, rising 0.9 % in 2022.

“Because the local weather disaster is outlined largely by the expansion of emissions, probably the most pressing challenges, and the one economically viable alternative, is to quickly cut back the emissions curve, particularly for firms,” Jordanova mentioned.

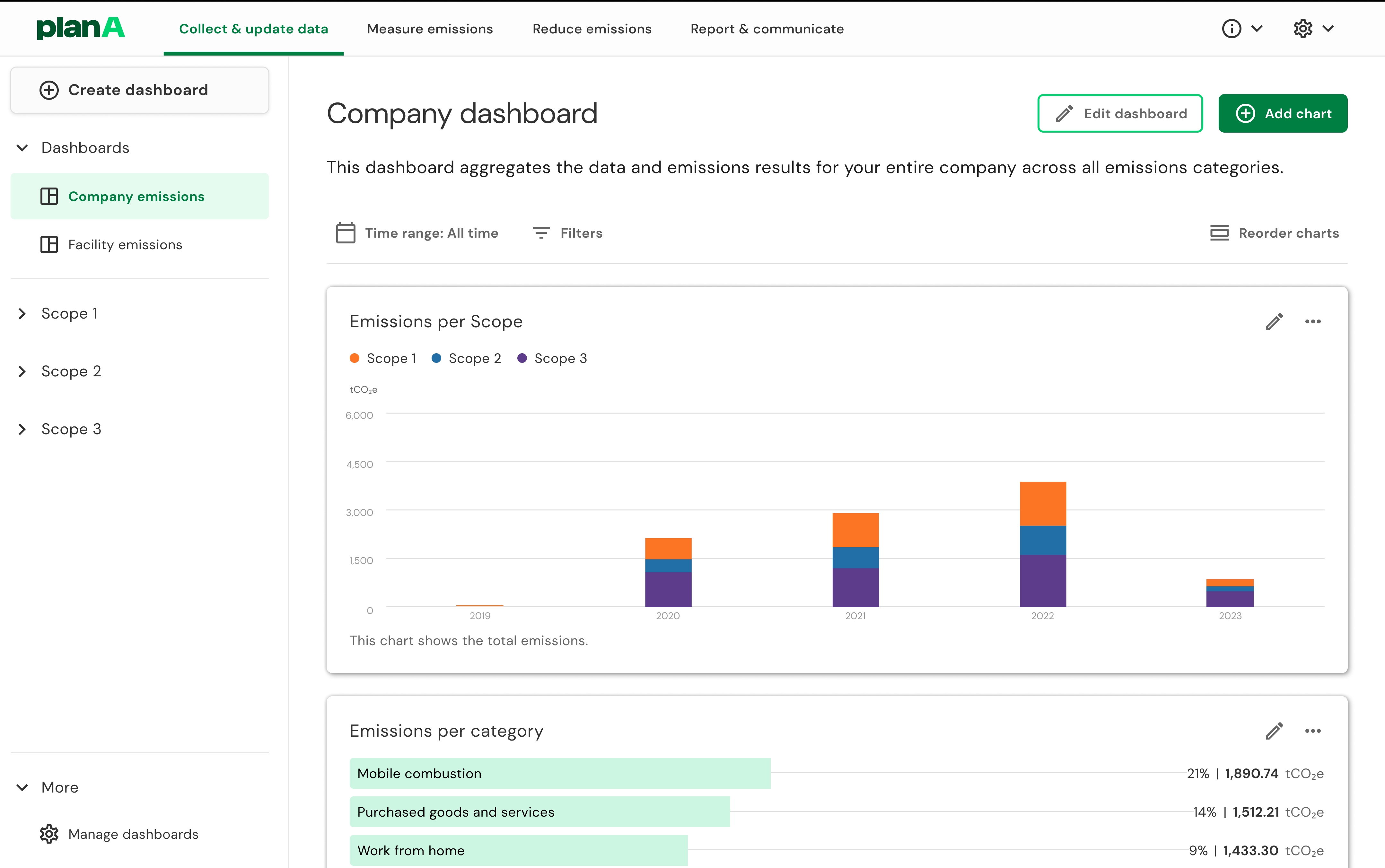

Thus, Plan A has developed a SaaS-based sustainability platform that allows firms to self-manage their net-zero efforts — this consists of amassing information, calculating emissions, setting targets, and decarbonization planning. Crucially, it consists of mapping emissions information throughout all scope 1, 2, and three, and aligning them with world scientific requirements and methodologies, together with the Greenhouse Fuel Protocol and the Science Based mostly Targets Initiative (SBTi).

Whereas the core Plan A product is an online app, clients — which embody BMW, Deutsche Financial institution, KFC, and Visa — may also plug immediately into Plan A through API, which is beneficial for integrating enterprise and emissions information from throughout myriad purposes comparable to enterprise journey software program and enterprise intelligence (BI) instruments.

Plan A: Sustainability Platform Emissions dashboard Picture Credit score: Plan A

At present, Plan A counts 120 workers throughout Berlin, Paris, and London, and with its contemporary money injection Jordanova mentioned that it plans to “double down” on that with a slew of latest hires.

“The funding now heralds our subsequent progress section,” she mentioned. “With the contemporary capital, we’ll double our headcount to develop our market penetration in Europe with a powerful give attention to France, the U.Ok., and Scandinavia, in addition to deepen our platform capabilities.”

Local weather emergency

Whereas the funding panorama is considerably arid today past a swath of seed stage rounds, climate-tech startups appear to have fared comparatively properly, although general funding within the area remains to be down on final yr. The info suggests that is largely as a result of a decline in later-stage funding from Collection B onwards, with early-stage developments trying slightly higher.

Nonetheless, ESG information startups particularly appear to be in demand. Local weather information startup Persefoni final month introduced $50 million in contemporary funding, which follows two different European rivals Sweep and Greenly which raised $73 million and $23 million respectively, albeit final yr. Elsewhere, ESG information administration startup Novisto secured $20 million in Collection B funding a few months again.

Whereas funding throughout the startup sphere is down, it nonetheless appears that buyers nonetheless view local weather tech extra favorably in comparison with many different sectors, with the general share of VC {dollars} rising from 10% to 13% up to now yr, in line with Dealroom information. And this, in line with Jordanova, is all the way down to a number of elements. Whereas different industries have suffered as a result of macroeconomic elements and shifting investor preferences, local weather tech is prospering (comparatively) due largely to the severity of the accelerating local weather emergency which is resulting in extra regulation and strain being heaped on enterprises to alter course earlier than it’s too late.

“European governments have applied insurance policies and rules favouring clear tech, providing incentives and subsidies to draw buyers,” Jordanova mentioned. “Giant firms are additionally making sustainability commitments, driving investments in startups that align with their objectives.”

Lightspeed’s London associate Julie Kainz mentioned that local weather will “seemingly be probably the most enticing funding themes” within the coming a long time. “Fixing the local weather problem has firmly moved on the strategic agenda of governments, firms and most of the people; and we strongly consider that the strain from shoppers will solely proceed to rise,” Kainz advised TechCrunch by electronic mail.

[ad_2]