[ad_1]

Jimbos Protocol, an Arbitrum-based DeFi undertaking, has suffered a flash mortgage assault that resulted within the lack of greater than of 4000 ETH tokens, at present valued at over $7,500,000.

The corporate disclosed the assault on Twitter yesterday, saying that regulation enforcement have been notified and it’s working with safety professionals to remediate the scenario.

The assault occurred solely three days after the platform launched its V2 protocol, at a second when many individuals had simply invested in its ‘jimbo’ token, and the perpetrator managed to steal 4,090 in ETH tokens.

The jimbo token has a semi-stable ground worth backed by belongings, whereas the platform has applied mechanisms like taxes and incentives to assist preserve a secure worth.

Following the hack, although, jimbo’s worth collapsed shortly, going from $0.238 to simply $0.0001 on the time of writing.

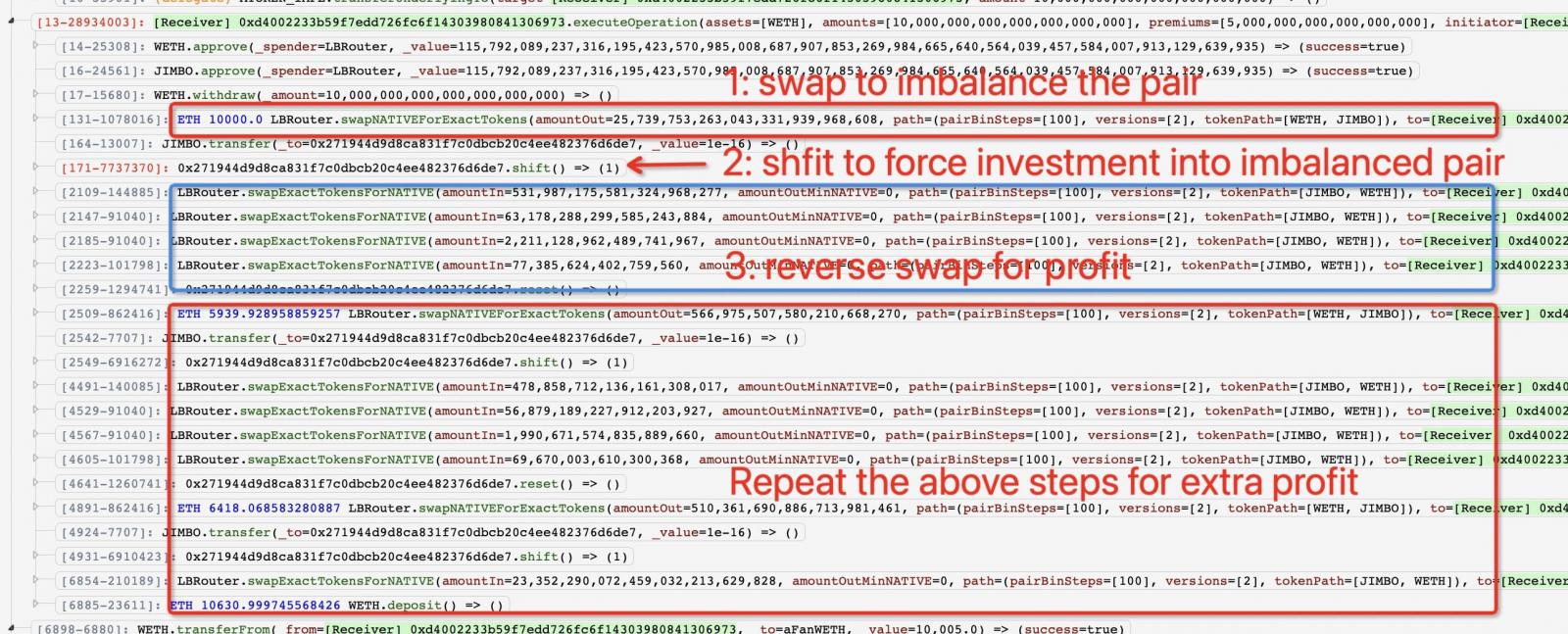

In keeping with blockchain safety consultants at PeckShield, Jimbos Protocol was the sufferer of a flash mortgage assault that leveraged the dearth of slippage management on the platform.

Flash loans are actions the place customers borrow a considerable amount of tokens and are anticipated to pay them again in the identical transaction (instantly).

If the attacker exploits a flaw within the DeFi platform or they manipulate the worth of the token throughout that very quick interval between receiving the quantity and paying it again, they will hold the distinction at the price of the lender.

We have now seen this unfold a number of occasions in theoretically well-secured and completely audited lending protocols. A notable latest instance is the flash mortgage assault that hit Euler Finance, leading to a large lack of $197 million.

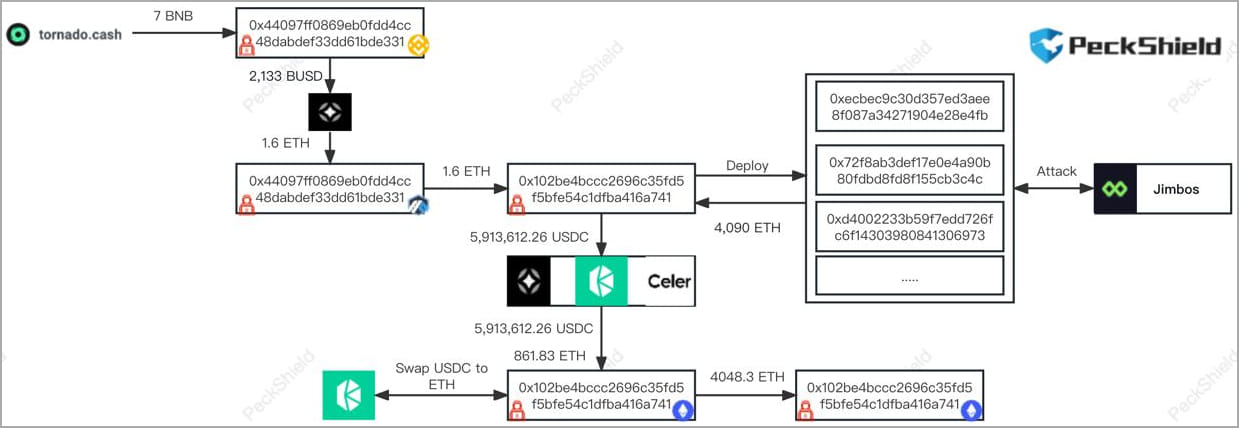

Within the case of Jimbos Protocol, the attacker took a $5.9 million flash mortgage, manipulated the market to skew the worth vary, traded again the tokens, and escaped with 4,090 ETH.

Slippage management is a measure that restricts token worth modifications to make sure that their fluctuation stays inside a suitable vary from the time of initiating a commerce to its completion, on this case, a flash mortgage.

Jimbo Protocol had warned buyers concerning the “experimental” nature of Jimbo V1, saying that “the contracts are unaudited and […] any sum of money you set into this protocol might be misplaced because of unexpected circumstances at any time.”

Nonetheless, Jimbo V2 was purportedly designed to rectify slippage and different apparent safety points. As such, it was projected as a extra reliable funding alternative, at the very least for a quick three-day interval.

The incident has positioned Jimbos Protocol in a predicament, and the platform has despatched an on-chain message to the perpetrators asking them to return 90% of the stolen funds in trade for the promise to not provoke authorized proceedings in opposition to them.

[ad_2]