[ad_1]

The world wants extra flexibility. Renewable electrical energy additions the world over are breaking data however balancing this new provide is turning into a significant headache for system operators. The intermittency of renewables is creating issues with sustaining the grid frequency – set at 56-605HTz in most Western international locations – and inertia. In the meantime constructing new grid infrastructure is nigh unattainable as a consequence of entry to land restrictions and provide chain bottlenecks. New load facilities, corresponding to electrical automobiles and warmth pumps, add additional stress to the grid.

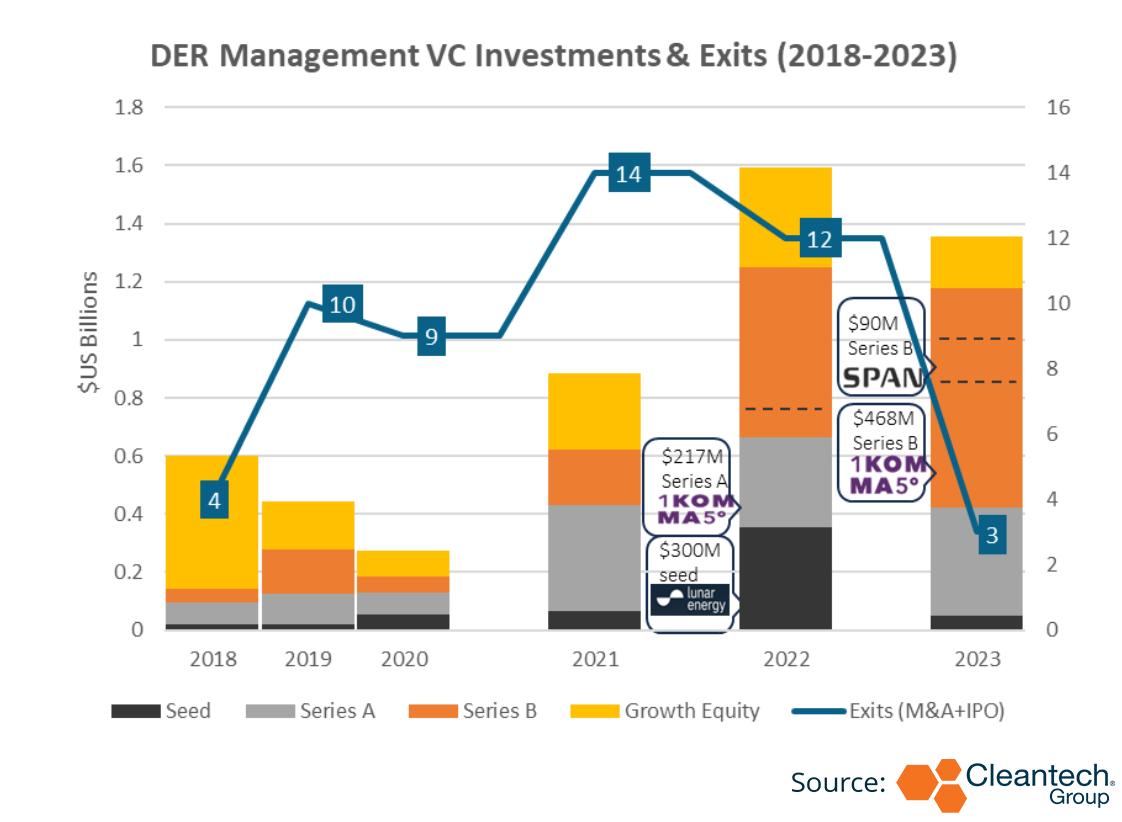

Regardless of an rising want for flexibility, innovation is stalling as software program suppliers have been in a position to leapfrog the regulation. Enterprise and progress funding numbers present that flexibility-related investments have plummeted in 2023, with simply $338M invested. The variety of exits and preliminary public choices (IPOs) have additionally plummeted, and exiting shouldn’t be as straightforward because it was – Shell has been in search of patrons for Sonnen, a sensible vitality storage and digital energy plant it bought solely in 2019, since September 2023. Numerous enterprise capital suppliers in main interviews with Cleantech Group have mentioned that they’re at present pulling again from the pliability area.

This can be a far cry from just some years in the past. Over 2021 and 2022, Cleantech Group tracked a report quantity of $1.48B of funding into distributed vitality administration options. These included provide and demand aggregation and extra. As rates of interest surged in 2022, digital applied sciences had been a low hanging fruit for enterprise capital, made enticing by low required CAPEX to scale know-how and subsequently decrease threat, “as-a-service” fashions locking clients in, in addition to simpler routes for exits. Corporations like demand response aggregator Voltus raised $31M in progress fairness, whereas VPP and DER aggregator AutoGrid raised $85M in progress fairness. Demand for asset gentle excessive return software program options was hovering.

There was a transparent pivot away from DER administration software program investments in direction of extra hardware-heavy built-in suppliers. Even established gamers, corresponding to native flexibility market Piclo and market Leap have raised comparatively small rounds in 2023. Leap raised $14M in two Sequence B rounds, whereas Piclo raised $10M in a Sequence B spherical.

Compared, clever dwelling {hardware} supplier Lunar Power got here out of stealth in 2023 and raised $300M in a Seed spherical. One-stop-shops, firms that combine each software program and {hardware} and promote a bundle of photo voltaic PV, storage, and vitality administration programs, like 1Komma5, Span and Lunar may also present flexibility however that’s not their important enterprise mannequin.

Having mentioned that, the necessity for extra flexibility continues to be very pertinent. The distribution system operators within the UK say they’re solely ever in a position to safe as much as 50% of the pliability they want in any explicit locality.

Software program Strikes Quick, Coverage Strikes Gradual

An excellent instance is the FERC 2222 mandate. Regardless of the FERC ruling for member states to facilitate extra DER in grid administration, only some states have made tangible progress. The image in Europe can be blended. UK transmission system operators and regulators have made nice efforts to combine DER into the vitality administration image together with contracting flexibility on the native degree. On mainland Europe, solely a handful of nations enable for DER participation in grid flexibility, largely as a result of the transmission system operators function beneath a CAPEX not TOTEX regime and so are largely centered on making capital investments to get returns.

In geographies the place flexibility is allowed, it’s already making a tangible distinction. In December 2023, the 2GW IFA energy line between France and the UK tripped and misplaced half of its output. In response, a UK utility, Octopus, was in a position to mobilise 400MW of batteries to offset a few of the outage. Over the winter interval in 2022, the UK was in a position to name on 4GW of versatile assets.

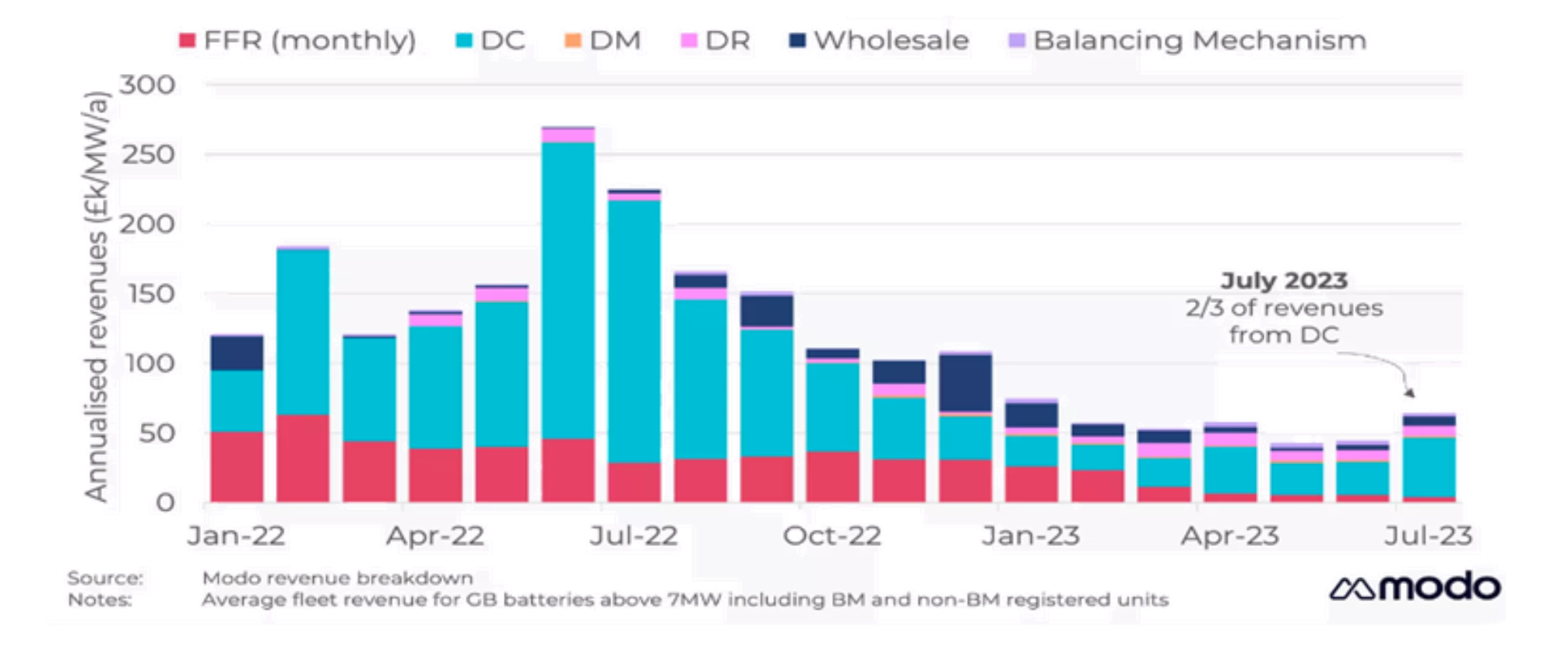

Distributed battery belongings have additionally been instrumental in sustaining grid stability in a lot of European international locations via to the frequency containment reserve (FCR) instrument that compensates belongings which might be in a position to ramp up in sub 30 seconds within the case of an outage. Nonetheless, in geographies with excessive battery proliferation, FCR costs are coming down.

Current innovators are already working with regulators to open up extra flexibility in new geographies, making it tougher for newcomers to enter the market. Leap labored with California ISO CAISO on the brand new Demand Aspect Grid Assist (DSGS) to incorporate extra battery asset grid providers. Piclo already co-operates with 4 out of six transmission system operators within the UK and is working with TSO’s of Lithuania, Portugal, Italy and Eire to open up new flexibility in these geographies. Estonian Fusebox is engaged on a pilot within the Danish market.

Software program options that do every part that’s required so as to add extra provide/demand facet flexibility to a transmission or distribution grid within the present framework exist already. This, coupled with the truth that innovators who’ve developed this software program are actively working with regulators to open up extra flexibility, makes it troublesome for brand spanking new suppliers to enter this very aggressive area.

Cleantech Group at present tallies 177 DER administration firms within the i3 database. Contemplating how a lot headway the incumbents on this area have made and the way few markets enable for DER participation in grid administration, it’s seemingly that we’ll see additional consolidation. Most of the innovators could have proprietary software program that can be enticing for utilities, however for brand spanking new pureplay DER administration firms the window of alternative is quickly closing.

[ad_2]