[ad_1]

Join every day information updates from CleanTechnica on e mail. Or comply with us on Google Information!

Following up on my detailed report on the highest electrical automobile fashions on the planet, let’s look now on the prime auto manufacturers and OEMs by way of EV gross sales.

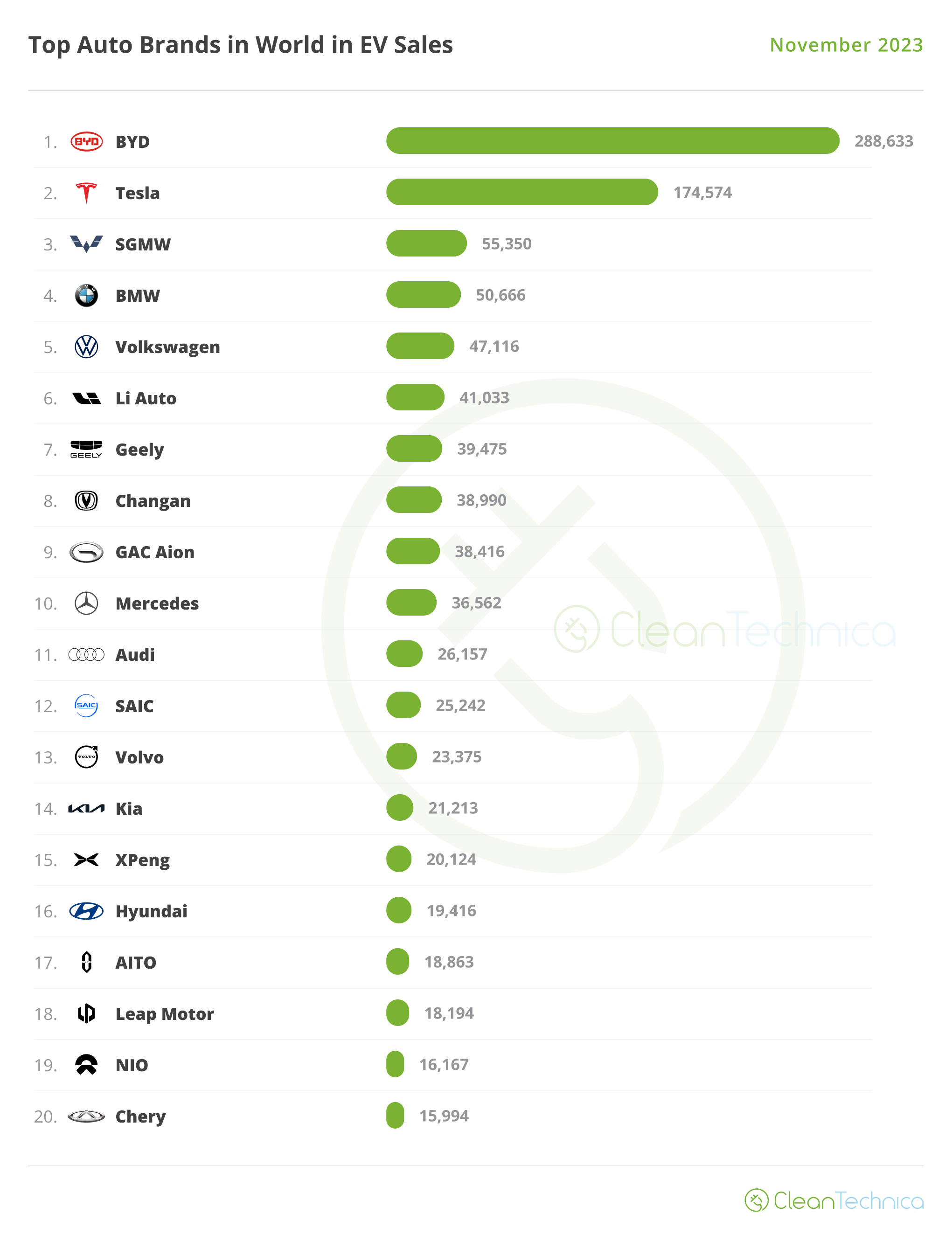

High Promoting Manufacturers

In November, BYD continued at report ranges, due to a 289,000-unit efficiency. Tesla went again to its regular self, delivering 174,000 models. That was 14% above the identical interval in 2022.

Under the highest two galactics, we’ve the SGMW JV ending the month in third, banking on the newfound success of its dynamic duo (Wuling Mini EV & Bingo) to finish forward of the competitors.

Each #4 BMW and #5 Volkswagen had 12 months greatest outcomes, with 50,666 models and 47,116 models, respectively, which might be an indicator of report ends in December for the 2 German makes.

#6 Li Auto continues to go from energy to energy, with one more report month, its eighth in a row. Li Auto had over 41,000 registrations due to report outcomes throughout the lineup. With the startup model nonetheless provide constrained, count on the high-end firm to proceed beating information often within the foreseeable future. Particularly when the midsized L6 SUV and L5 sedan land someday subsequent 12 months. Oh, and the cherry on prime of Li Auto’s cake is a sure bullet practice Mega MPV … with mega specs.

Slightly below it, #8 Changan once more hit a report month, round 39,000 models, a lot due to the success of the little cutesy Lumin and the Deepal S7 SUV. One other report performer was #7 Geely. Due to nice outcomes throughout the board, not the least the report rating of the Panda Mini, and in addition the 8,473 models of the Galaxy L7, Geely delivered over 39,000 models!

Nonetheless on Geely’s galaxy of manufacturers, Zeekr’s efficiency hasn’t gone unnoticed. Its report 13,124 registrations haven’t fairly allowed it to have a prime 20 presence, however as soon as the 007 undercover agent lands, that may change into only a matter of time.

Whereas the 007’s design is one thing of an acquired style, identical to vodka martini (shaken, not stirred…), its specs provide little doubt that they’ve a license to kill something within the mannequin’s section — Teslas included. (Okay, I promise to cease with the James Bond analogies now….) The bottom model has 688 km CLTC vary (606 km for the bottom Mannequin 3) and charging can add 500 km in quarter-hour, whereas the Lengthy Vary model has 870 km CLTC vary (713 km for the Mannequin 3 AWD). The bottom model begins out at RMB 209,000 (260,000 for the bottom Mannequin 3). Anticipate the brand new Zeekr mannequin to sit down firmly within the 2024 version of the highest 20, with a prime 10 presence to not be excluded from risk.

Volkswagen’s premium model, Audi, scored a year-best end result, 26,157 registrations. However within the non-public race between the Three Marys (BMW, Audi, & Mercedes), the four-ring model remains to be in final place, and much beneath chief BMW. BMW scored an additional 24,000 models in the identical interval. The explanation? Whereas Audi has solely three EV fashions, of which solely the This autumn e-tron and Q8 e-tron may be thought-about quantity fashions, BMW has twice as many quantity fashions on sale (iX1, iX3, i4, iX, and don’t overlook the Chinese language i3). Even when BMW doesn’t have a star participant just like the Audi This autumn, the mixture of these fashions is sufficient to simply outsell Audi. The upcoming Audi A6 e-tron and Q6 e-tron are badly wanted….

Two huge surprises had been #15 XPeng, which had its 2nd report lead to a row, 20,124 registrations. The corporate noticed its SUVs, the midsize G6 and fullsize G9, shine. Seemingly popping out of nowhere, AITO jumped into #17, due to a report 18,863 registrations, and whereas 81% of that end result got here from the M7 mannequin, with the XXL-SUV M9 beginning its profession quickly and a deep refresh introduced to the midsize M5 someday within the first half of 2024, count on this Huwaei-backed EV model to change into one thing huge. As the present 100,000 orders for the M7 mannequin show, the Chinese language tech firm has greater than sufficient muscle to make AITO primarily a second Li Auto. Anticipate this model to be one of many surprises of 2024….

One other OEM on the rise was Chery, one of many EV pioneers in China. Due to the nice results of its QQ Ice Cream mannequin, the model scored 15,994 registrations, its greatest lead to over a 12 months. That supplied it with a desk presence, after an extended absence within the prime 20. Notably, Chery was the twelfth Chinese language model on this prime 20.

However among the extra attention-grabbing tales on this rating lie slightly below Chery. Whereas #21 Ford misplaced a rating presence by simply 51 models, it was nonetheless the USA’s greatest promoting legacy model, ending forward of #2 … Buick. Yep, regardless of GM’s greatest efforts within the USA, from Chevrolet and Cadillac, it’s Buick, due to its Chinese language operations, that’s the solely related GM model globally. That’s due to the aforementioned Velite 6 compact wagon (a mannequin that contradicts EVERYTHING that GM stands for within the USA), a report end result, and the nice results of the latest Buick Electra E5 (5,915 registrations) in China. The Electra E5 is a mannequin that’s associated to the American-made Chevrolet Equinox EV. If Normal Motors could have any relevance in a future EV-based automotive market, it will likely be due to its Chinese language operations. Simply meals for thought….

Lastly, moreover Geely’s and Zeekr report outcomes, there may be one other model from the Chinese language OEM that deserves a point out. The singular Lynk & Co model additionally scored a report end result, 14,647 registrations, contributing to the present rise of Geely Group. However extra on that later….

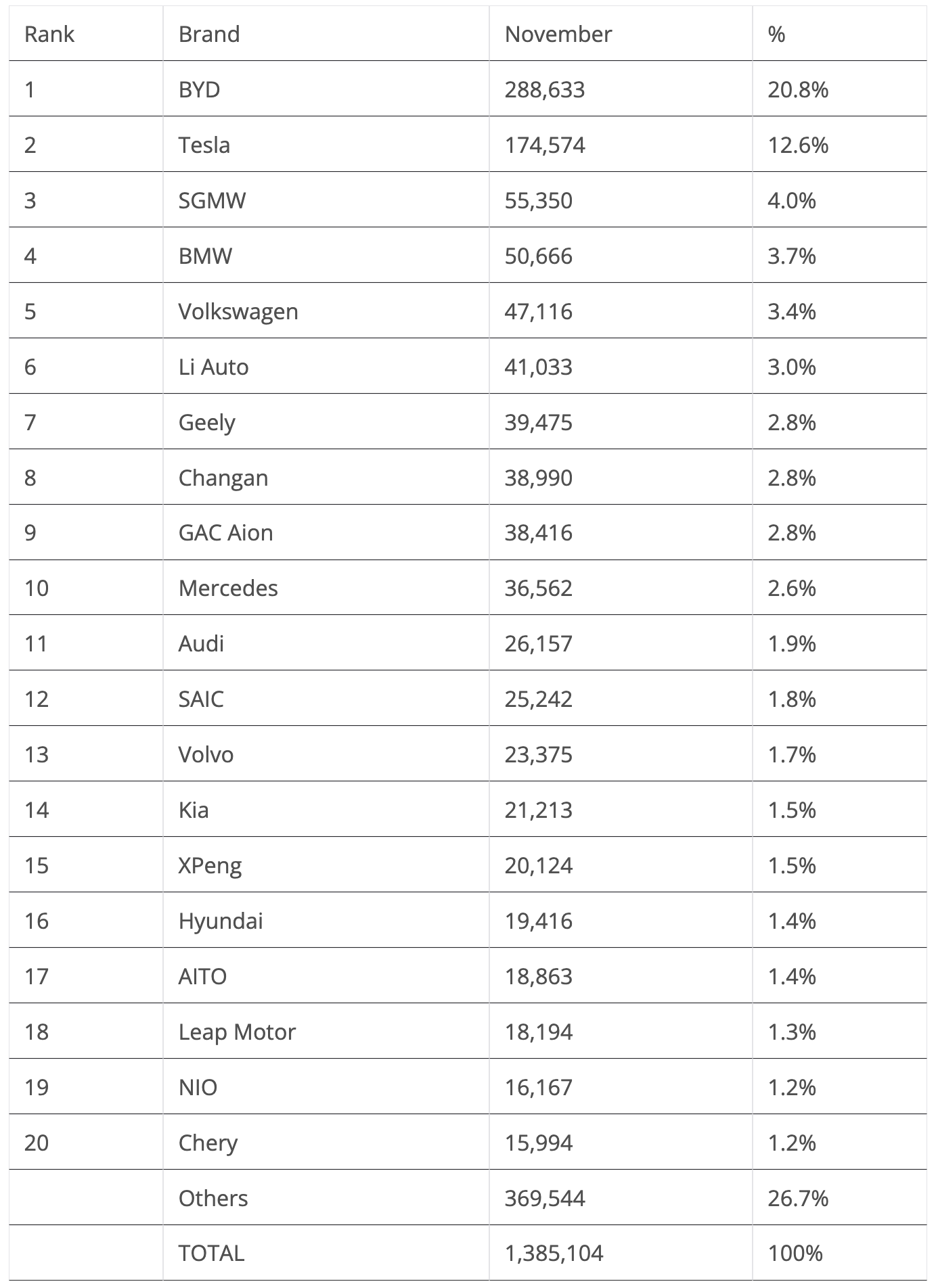

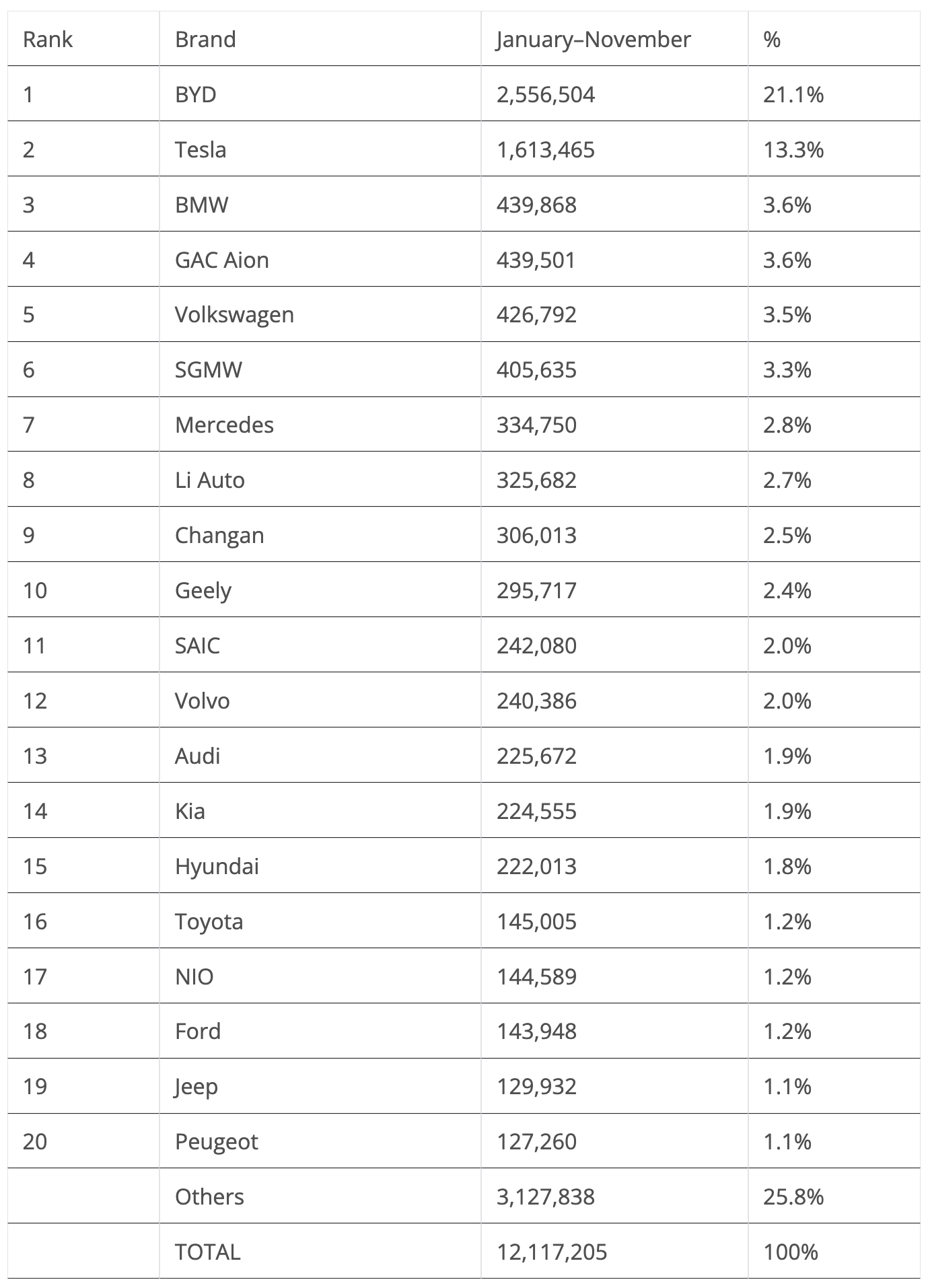

Within the YTD desk, there isn’t a lot to report concerning the highest two positions. BYD is effectively forward of Tesla, and each are in a galaxy of their very own. The 2 makes collectively are chargeable for multiple third of the worldwide plugin automobile market.

Far beneath these two, that are actually in a league of their very own, there was a place change within the NTNB (not Tesla, not BYD) management. Due to a year-best rating in November and in addition a below-expectations end result from GAC Aion, BMW returned to the third place and is now the favourite to take bronze within the 2023 version of the producer race. That may be the Bavarian’s second podium presence ever, after its 2016 bronze medal.

However with solely 300 models separating BMW from #4 GAC Aion, something can nonetheless occur and the Chinese language model can nonetheless have fun its first podium presence. It simply must beat the German make in December….

Coming again to November, the primary half of the desk doesn’t have loads to speak about, with the principle focal point being the #7 spot, the place Mercedes might be pressured in December by a rising Li Auto. The Chinese language startup is breaking information each single month, so it may find yourself surpassing the German make within the final days of the 12 months.

The remaining place change additionally got here from Germany, the place Audi surpassed each Koreans, Hyundai and Kia, to take the thirteenth spot. This additionally serves a kind of warning to Hyundai–Kia. Moreover having good EVs, it’s worthwhile to produce them at a big scale and with aggressive pricing, or else somebody will steal your cake.

Whereas there weren’t that many adjustments in November, the final month of the 12 months ought to have extra fluctuations, particularly down beneath, the place #17 NIO is near surpassing Toyota. The Japanese make will probably be surpassed by #18 Ford, too. The final two positions on the desk also needs to have adjustments, as each #19 Jeep and #20 Peugeot might be surpassed by a rising Leap Motor, presently in #21 with 127,245 models, which is simply 15 models behind the French model. Curiously, Leap Motor just lately partnered with Stellantis, Jeep’s and Peugeot’s Mothership. Fascinating coincidence, isn’t it?

We are able to’t additionally exclude #22 XPeng from becoming a member of the race. Regardless of being 5,000 models behind #20 Peugeot, it’s on the rise. The startup model may additionally create a last-minute shock.

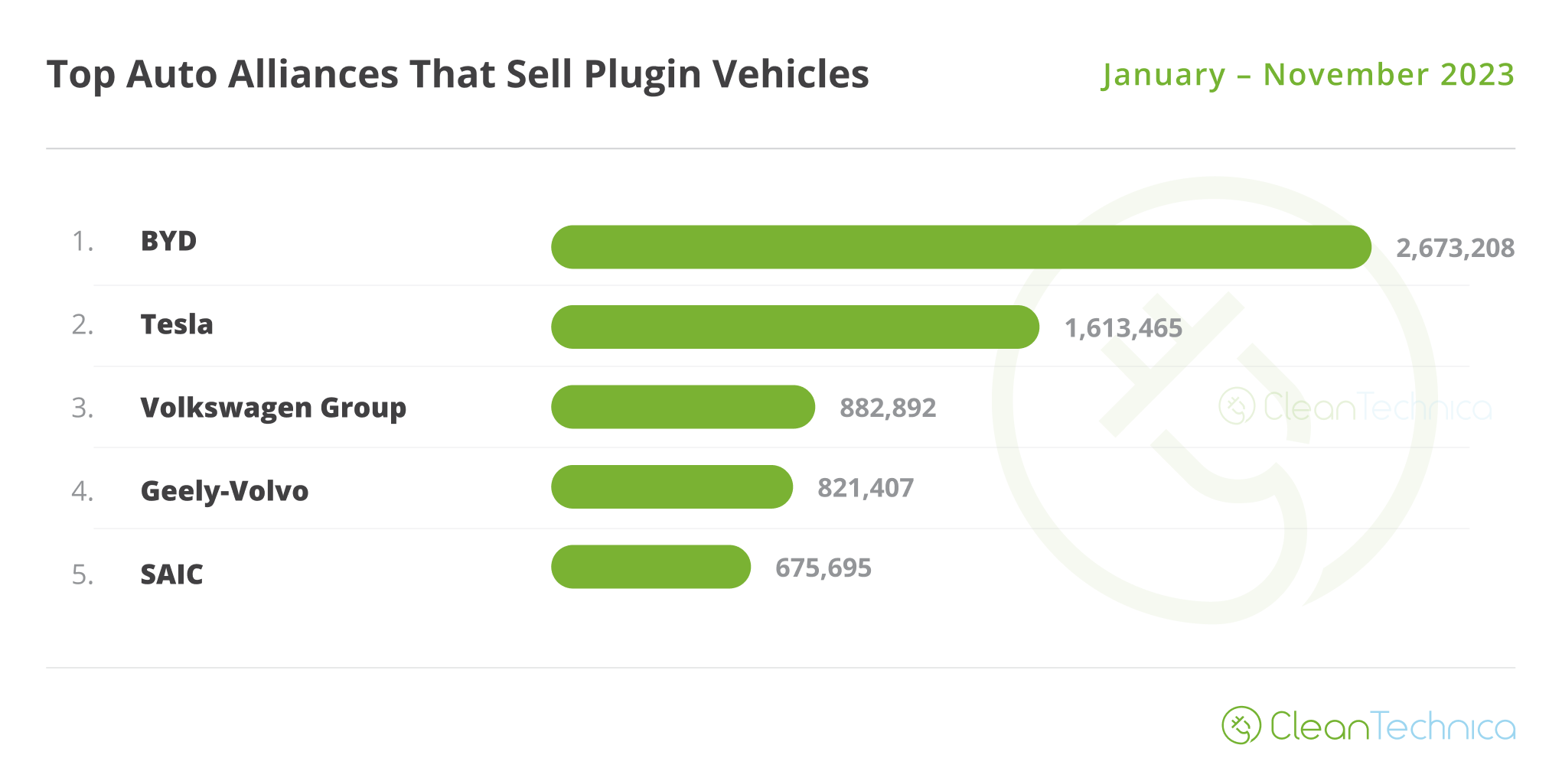

Taking a look at registrations by OEM, chief BYD was secure at 22.1% share, whereas Tesla was down by 0.q%, to 13.3% share.

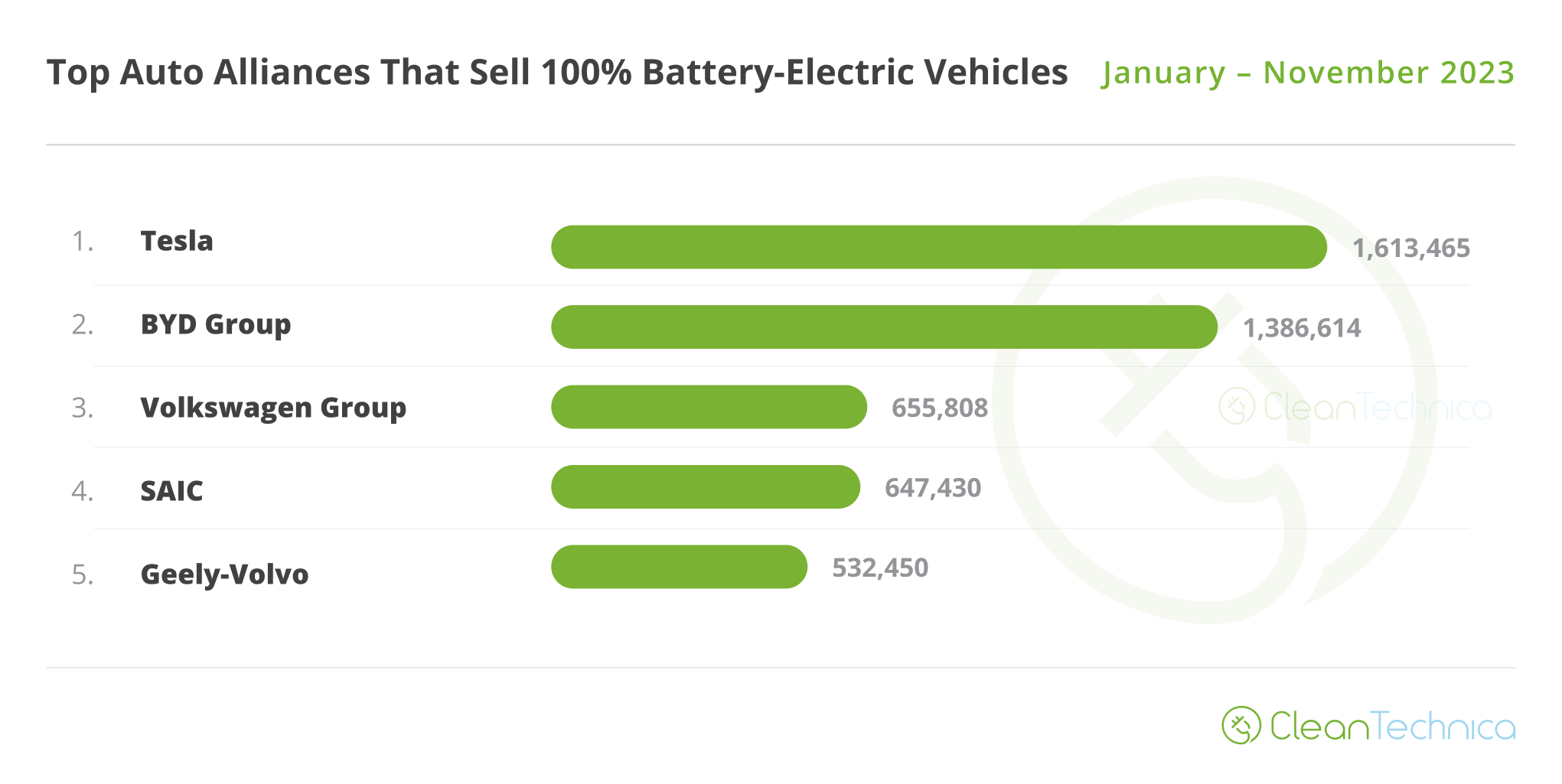

third place is within the palms of Volkswagen Group (7.3%), which is maintaining itself a long way forward of rising #4 Geely–Volvo (6.8%, up from 6.7%). The Chinese language OEM profited from nice performances with a number of of its manufacturers, beginning at Geely, passing by Lynk & Co, and ending at Zeekr.

Whereas we’re too near the tip of 2023 to see the Chinese language conglomerate strain #3 Volkswagen Group, the 2024 race ought to see an attention-grabbing duel between these two within the race for the NTNB title.

As for #5 SAIC (5.6%, up from 5.5% in October), the share drop stopped and appears to be reversing. That was not the case for Stellantis, which is secure in sixth place however noticed its share drop by 0.1% to 4.3%.

Under the multinational conglomerate, issues are extra attention-grabbing. #7 BMW Group (4.1% share) saved its place, and even gained floor over #8 GAC (3.9%, down 0.1%) and #9 Hyundai–Kia (3.8%, down from 3.9%).

Taking a look at the place the rating was a 12 months in the past, we will see that each of the highest two manufacturers gained share, 3.7% within the case of BYD and 0.3% within the case of Tesla. The opposite beneficiary was Geely–Volvo, which added 0.7% of share on the best way.

On the losers aspect, Volkswagen misplaced 0.7% share 12 months over 12 months (YoY), whereas SAIC dropped 1.8 factors in share, from 7.4% a 12 months in the past to its present 5.6%.

Evaluating the YTD share within the 2nd month of the present quarter (November), with the second month of the third quarter (August), the principle winner in these final three months was Geely, that gained 0.7% share, from 6.1% to the present 6.8%, whereas the largest loser was Tesla, that misplaced 1.1% share, from 14.4% in August, to the current 13.3%.

Trying simply at BEVs, Tesla remained within the lead with 19.2%, down from 19.3% in October. The US make nonetheless has a cushty lead over BYD (16.5%, up from 16.3%) due to the US automaker gaining a major lead within the first half of the 12 months.

Subsequent 12 months, nevertheless … it isn’t a lot a query of if, however extra of when. I don’t count on it to occur in Q1, because the Chinese language market could have new 12 months festivities that may certainly decelerate BYD’s gross sales, however Q2 ought to most likely sign the inflection level the place BYD surpasses Tesla within the BEV race. (Editor’s word: BYD handed Tesla in BEV gross sales within the 4th quarter, however only for the quarter. Tesla ended the 12 months at #1 throughout the 12-month interval. Jose’s feedback right here presumably concern management in a YTD rating.)

Within the final place on the rostrum, Volkswagen Group (7.8%) misplaced treasured floor to SAIC (7.7%, up from 7.6%). Anticipate an entertaining race between these two within the final stage of the race.

In fifth, Geely–Volvo consolidated its place, rising from 6.2% share to its present 6.3% share, all whereas #6 GAC misplaced share, from 5.6% in November to its present 5.4%.

Lastly, evaluating the present image with what occurred a 12 months in the past, Tesla’s rise is obvious (+1.1% share), however not as spectacular as BYD’s — the Chinese language EV large gained a related 3.8% market share. Geely–Volvo’s market share seize (+1.2%) can be spectacular, particularly because it began from a a lot smaller base.

What about 2024?

BYD and Tesla will proceed to develop, albeit reasonably:

- The Chinese language model is already reaching its pure limits in China, and it’s more durable so as to add important volumes in export markets than it’s to take action in a single’s home market. I suppose BYD’s predominant purpose for 2024 is to develop with out lowering margins, therefore the latest bets on high-end manufacturers.

- Tesla is proscribed by an ageing/maturing lineup, with out many development prospects. The one just lately launched mannequin, the Cybertruck, remains to be deep in Manufacturing Hell. Even when it provides some 100,000–200,000 models in 2024 to the OEM’s gross sales, that can be lower than 10% of the corporate’s complete gross sales quantity, so is hardly sufficient to maneuver the needle. Important development ought to solely are available 2025 as soon as the compact mannequin is claimed to land.

Volkswagen Group and SAIC will most likely stay shut to one another, however will doubtless be competing for 4th place, not third anymore. That’s as a result of, proper now, Geely–Volvo appears unstoppable. With development prospects from nearly each model they’ve (Geely’s increasing Galaxy sub-brand, Volvo’s EX30 and EX90, Zeekr’s 007, Lynk & Co’s upcoming BEV fashions, and Polestar’s 3 & 4, simply to call a couple of), count on it to change into one of many winners of 2024, putting it as a cushty bronze medalist within the BEV rating.

Have a tip for CleanTechnica? Need to promote? Need to recommend a visitor for our CleanTech Speak podcast? Contact us right here.

Our Newest EVObsession Video

https://www.youtube.com/watch?v=videoseries

I do not like paywalls. You do not like paywalls. Who likes paywalls? Right here at CleanTechnica, we applied a restricted paywall for some time, but it surely all the time felt fallacious — and it was all the time robust to determine what we should always put behind there. In concept, your most unique and greatest content material goes behind a paywall. However then fewer individuals learn it!! So, we have determined to fully nix paywalls right here at CleanTechnica. However…

Thanks!

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

[ad_2]