[ad_1]

Cryptocurrency-based crime has metastasized into many types. Due to the convenience with which cryptocurrency ignores borders and permits multinational crime rings to rapidly get hold of and launder funds, and due to widespread confusion about how cryptocurrency capabilities, a variety of confidence scams have targeted on convincing victims to transform their private financial savings to crypto—after which separate them from it.

Amongst these types of organized legal actions, none appear as pervasive as “pig butchering” (from the Mandarin time period, sha zhu pan, coined to explain the exercise). Most of those scams use courting purposes or different social media to lure victims into what they assume is a budding romantic or platonic relationship, after which introduce a fraudulent scheme to earn money collectively. In some latest circumstances we discovered the scammers utilizing generative AI to write down messages to their targets to make them extra convincing.

We first started investigating pig butchering scams in 2020 in reference to faux cryptocurrency-trading cellular apps that gadget customers had downloaded on the course of somebody the consumer had been contacted by most of the time by a courting app or web site. We dubbed these “CryptoRom” apps, and have continued to analysis the rip-off rings, and the way they evade platform safety on cellular gadgets. One methodology that has change into prevalent over the previous 12 months is to leverage the weaknesses of professional cryptocurrency purposes by their means to be linked to net purposes.

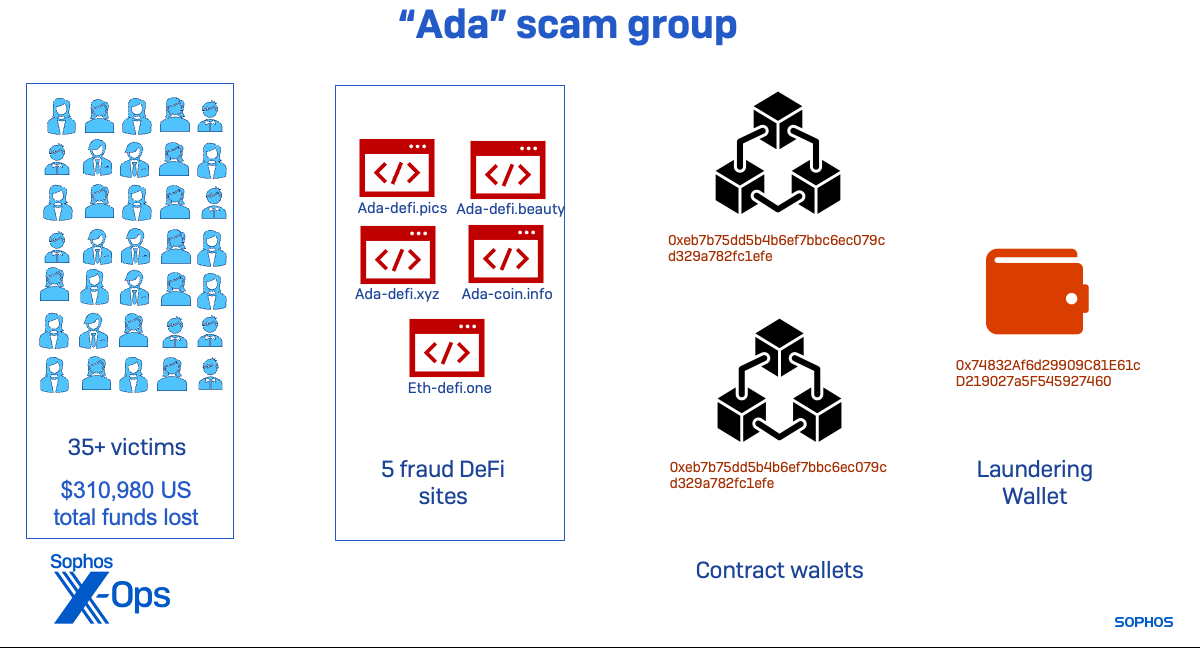

Not too long ago, I shared the particulars of a rip-off case wherein a person sufferer (whom we known as “Frank”) misplaced over $20,000 USD in a faux “mining pool.” Primarily based on the small print Frank offered, we have been capable of uncover a a lot bigger set of scams utilizing over a dozen totally different domains. The infrastructure of those domains was constructed on 5 totally different controlling “contract wallets” that directed cryptocurrency from victims’ wallets to different wallets for laundering. This set of scams seems to have interacted with over 90 victims. Now we have excessive confidence that the rip-off was run by three units of associates linked to a multinational Chinese language-language crime group.

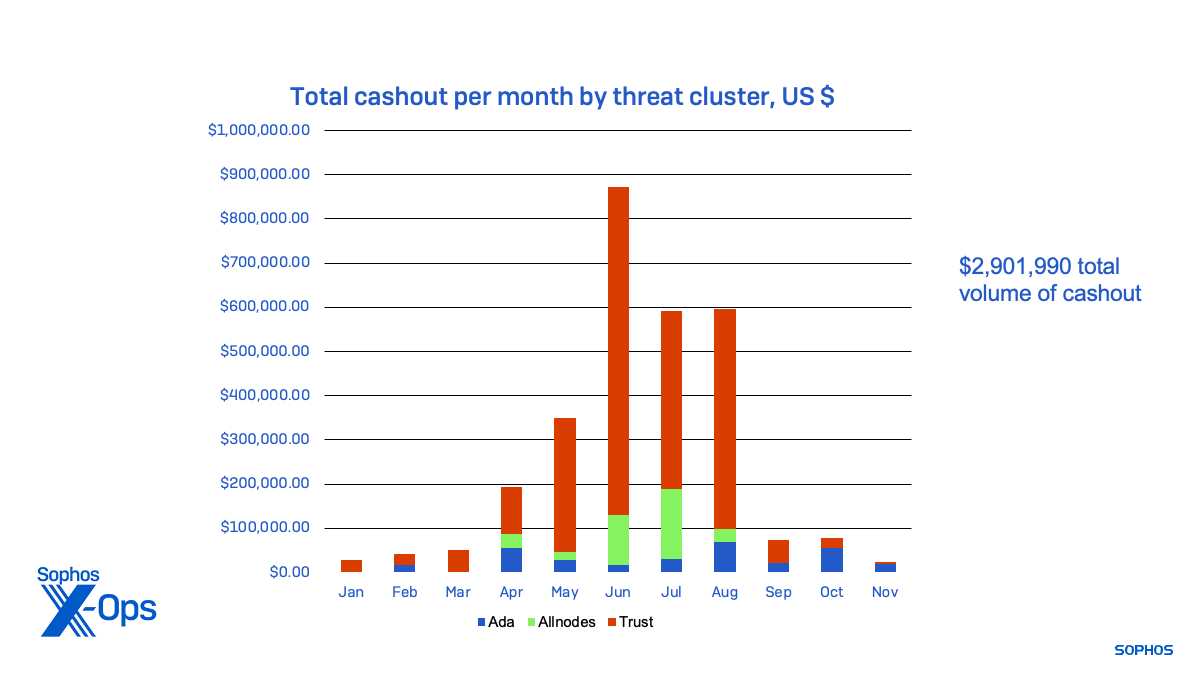

Trying again to the start of 2023, I discovered these contract wallets had moved $1.22 million price of Tether (USDT) cryptocurrency from focused wallets to locations laundering the stolen crypto between January 1 and November 20. They seem to have been run by three separate menace exercise teams utilizing equivalent fraudulent decentralized finance (“DeFi”) app websites, suggesting that they’re a part of or affiliated with a single organized crime ring.

The ring is probably a lot bigger. I discovered traces of two different domains that matched our fingerprint for the positioning that had been deactivated earlier than I might accumulate contract information. Analyzing the wallets that acquired the funds for laundering, I discovered extra contract wallets that have been shifting scammed funds from different victims—some pointing to extra laundering wallets. I proceed to research the info to determine additional rip-off operations.

In whole, the wallets concerned within the scheme moved practically $2.9 million price of cryptocurrency this 12 months as of November 15, coming from the scams we tracked and different criminal activity.

Following the cash

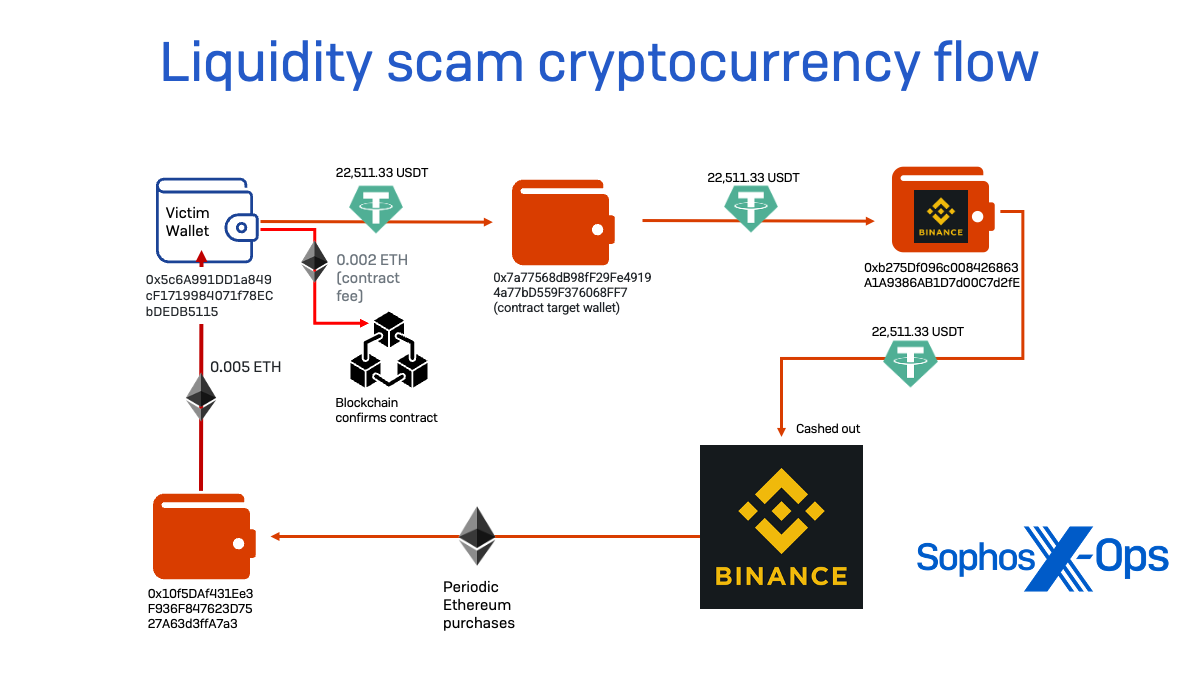

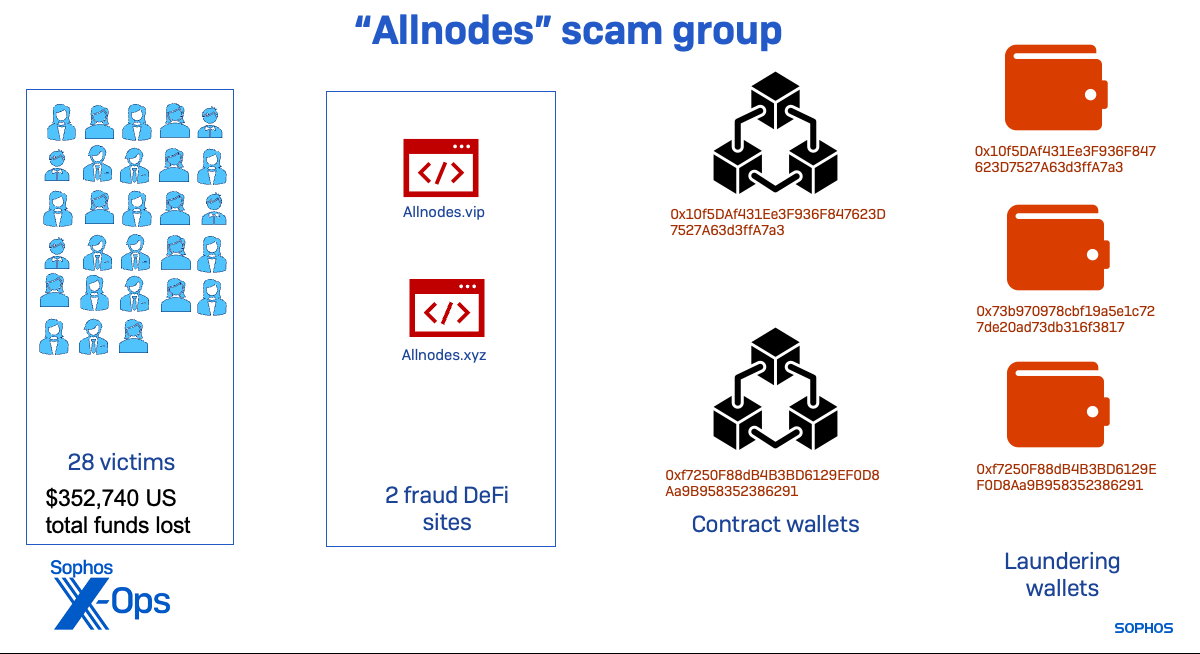

Throughout our investigation of the rip-off concentrating on “Frank,” I tracked the movement of cryptocurrency from his pockets. The scammer’s lure was a faux decentralized finance app hosted on the area allnodes[.]vip—a web site registered by and hosted by Alibaba.

The app created a sensible contract—paid for in Ethereum offered by the scammer in Frank’s case, and certain in all different scams run by this ring—that gave one other pockets tackle a just about limitless “allowance,” permitting its proprietor to see the stability of the pockets being linked and to switch Tether tokens deposited within the linked pockets. This distant tackle—the contract pockets—by no means moved cryptocurrency to itself however as a substitute transferred balances to different wallets beneath management of the scammers utilizing the sensible contract authority by authorizing transactions on the blockchain.

transactions for the management node, I used to be capable of decide that our sufferer was not the primary focused by this explicit rip-off configuration. The management node was first energetic on April 5, making what might have been a check switch of $55 price of Tether to verify the faux DeFi app’s configuration; the primary sufferer seems to have had funds transferred the subsequent day, being hit over the next two weeks for a complete of $15,400 price of cryptocurrency. In whole earlier than the node went quiet in early August, no less than 7 targets could be fleeced by the scammers for quantities starting from $2,000 to over $50,000—totaling $177,560.

Utilizing traits of this rip-off, I went looking for extra websites that have been comparable. And it rapidly turned clear that this was linked to a a lot bigger operation.

Trying to find extra domains and contract wallets

By analyzing area registry information, I discovered one other area utilizing the identical branding (allnodes[.]xyz) additionally registered and hosted by Alibaba at a distinct IP tackle. The websites have been equivalent in look and in underlying HTML and JavaScript code. The websites shared not simply the identical look, however the identical script file names and used the identical JavaScript-based in-site chat service (tawk[.]to). Nonetheless, the app on the .xyz area used a distinct contract pockets for its sensible contract payload.

I expanded my search by analyzing the net requests from every of those websites and trying to find websites with the identical JavaScript and filenames. Primarily based on these fingerprints, I discovered 11 extra domains internet hosting the identical actual code, some sharing the identical contract wallets of their configurations.

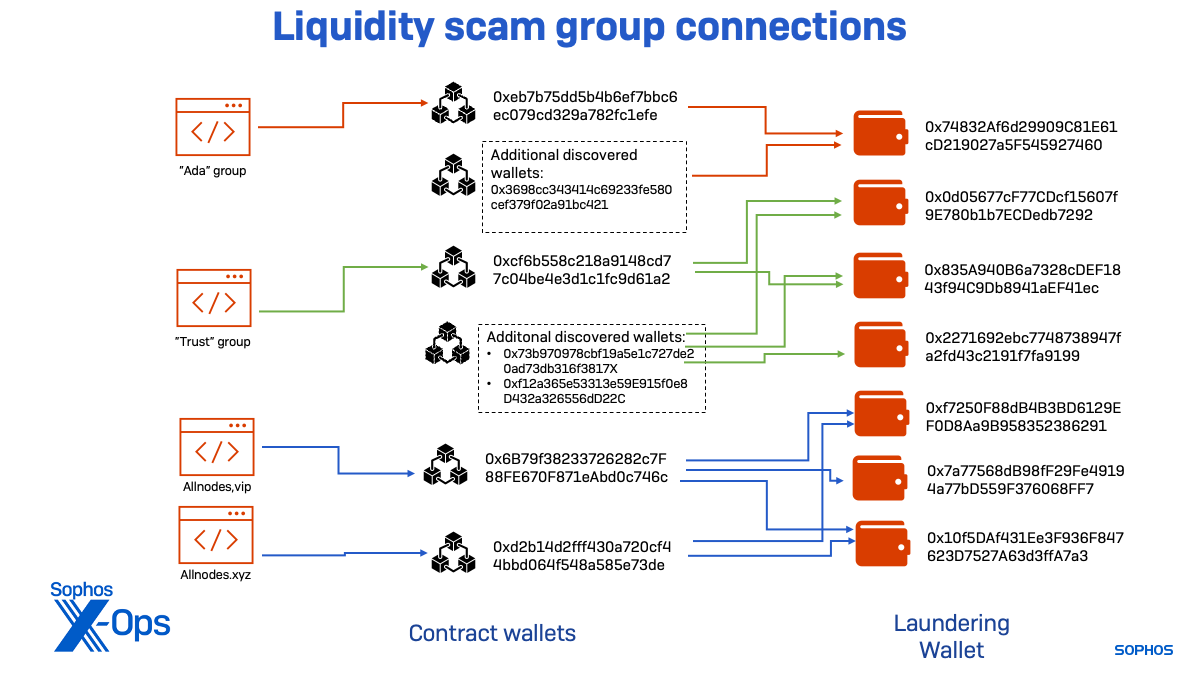

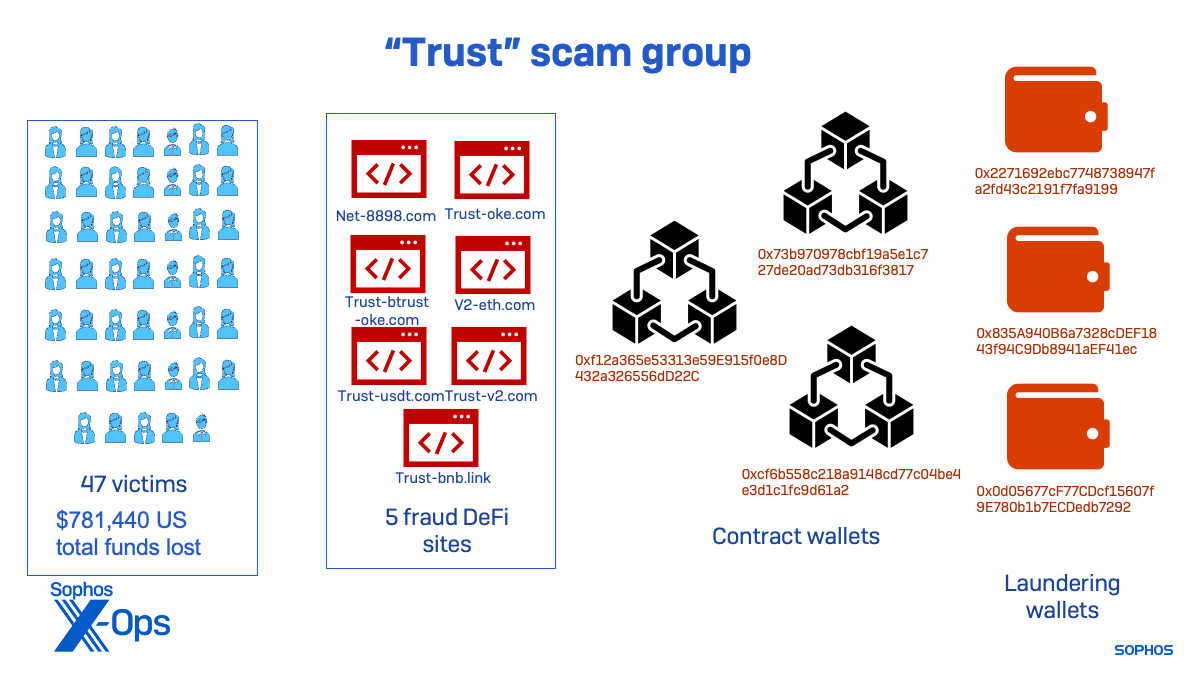

In whole, I discovered 4 addresses performing as management nodes throughout 14 domains. I additionally discovered two domains that had ceased operation however matched all traits in historic telemetry and third-party information. Analyzing the websites, I found distinct groupings of domains utilizing comparable naming conventions, area registrars and hosts, suggesting totally different sub-groups have been working equivalent rip-off kits concurrently. That is just like what we discovered when investigating pig butchering faux change websites, the place dozens of web sites have been utilizing the identical code however with totally different related pockets addresses.

| Group | Area | Contract wallets | Internet hosting | Registrar | Complete Crypto quantity of transactions

(US $) |

|

|---|---|---|---|---|---|---|

| Allnodes | allnodes.vip | 0x6B79f38233726282c7F88FE670F871eAbd0c746c | Alibaba Singapore | Alibaba Cloud | 177,596.00 | |

| allnodes.xyx | 0xd2b14d2fff430a720cf44bbd064f548a585e73de | Alibaba Cloud | Alibaba Cloud | 174,934.00 | ||

| Belief | trust-oke[.}com | 0xcf6b558c218a9148cd77c04be4e3d1c1fc9d61a2 | Amazon | Amazon | 676,869.00 | |

| trust-btrust-oke[.}com | ||||||

| trust-usdt[.]com | ||||||

| trust-v2[.]com | ||||||

| trust-bnb[.]hyperlink | ||||||

| v2-eth[.]com | ||||||

| net-8897[.]com | ||||||

| Ada | ada-defi[.]pics | 0xeb7b75dd5b4b6ef7bbc6ec079cd329a782fc1efe | Cloudflare protected | Dynadot | 62,660.00 | |

| ada-defi[.]magnificence | ||||||

| ada-defi[.]xyz | ||||||

| ada-coin[.]data | ||||||

| eth-defi[.]one | ||||||

| Unknown | trust-eth[.]com | Google, then Cloudflare | Gname.com | |||

| eth-mining[.]xyz | Google, then Cloudflare | Dynadot |

As proven within the desk above, two teams of domains had shared contract pockets addresses. And thru analyzing transaction information, I discovered that each “allnodes” domains, regardless of having separate contract wallets, routed cryptocurrency to the identical locations.

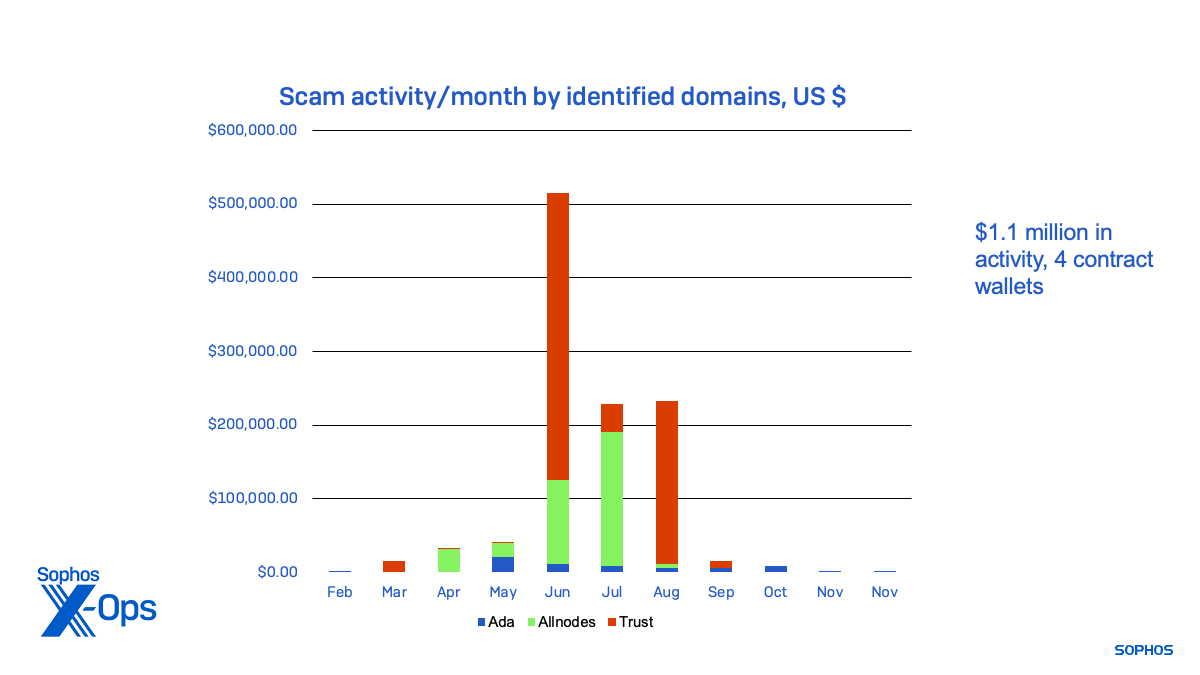

Exercise for the rip-off websites and their contract wallets, a few of which gave the impression to be testing the scripts related to contract wallets, dated again to February. A lot of the precise rip-off exercise related to the websites occurred in the summertime months, as proven under by the quantity of cryptocurrency moved by every of the first contract wallets:

Additional analyzing the transaction information for the wallets receiving fraudulent withdrawals, I found extra contract wallets sending crypto following the identical sample. They have been utilizing the identical vacation spot wallets as two of the above teams:

- 0x73b970978cbf19a5e1c727de20ad73db316f3817 and 0xf12a365e53313e59E915f0e8D432a326556dD22C, linked to “Belief” vacation spot pockets;

- 0x3698cc343414c69233fe580cef379f02a91bc421 , linked to an “Ada” group vacation spot pockets.

The “Ada” subgroup used a single pockets to launder funds from each its related contract wallets. This group of web sites was energetic starting in March, however the wallets confirmed indicators of rip-off exercise as early as February, suggesting one other area was a part of the group.

The “Belief” menace exercise cluster seems to have been energetic the longest. One in every of its contract wallets was extremely energetic in January, indicating that one other rip-off web site was energetic in 2022. That pockets’s exercise fell off utterly in March, with different wallets linked to newer websites changing into extra energetic. As of November, the “Belief” cluster was nonetheless energetic, however far lower than throughout the peak of the rip-off websites I recognized.

The “Allnodes” cluster was the one related to the “Frank” case. It began later than the others and shut down exercise tied to the infrastructure we recognized shortly after we have been contacted by the sufferer and started alerting pockets builders and exchanges of its presence. No additional money out exercise was seen on the wallets related to this menace group after August.

Regardless of being comparatively short-lived, the Allnodes group managed to herald over $352,000 earlier than its lifecycle was ended—most of which was cashed out by Hong Kong financial institution accounts.

Determine 8: The funds cashed out by every of the menace exercise clusters, from January 2023 to November 2023

Determine 8: The funds cashed out by every of the menace exercise clusters, from January 2023 to November 2023

In whole, the teams utilizing the liquidity mining rip-off equipment introduced in over $2.9 million over the course of the 12 months. It’s possible that they proceed to run different, comparable scams with new infrastructure. And there are lots of different rip-off operations utilizing comparable ways, instruments and practices—as I discovered investigating suggestions I acquired from different rip-off victims throughout the course of this analysis.

Extra kits, extra scams

Following the identical strategies—looking for domains that used DeFi and cryptocurrency names or borrowed branding from professional cryptocurrency-related manufacturers—we discovered a number of extra scams. One, I recognized, fronted by the area eth-defi[.]xyz, yielded one other contract pockets tackle: 0x2e7e4df940a2c999bf5b5cdcd15a738b8bb462d5.

Between August 18 and November 28, that contract pockets had pulled $115,820 price of Tether cryptocurrency from victims. Nearly all of these funds have been cashed out by Binance.

![Figure 9: The fake liquidity mining site eth-defi[.]xyz](https://news.sophos.com/wp-content/uploads/2023/12/eth-defi-xyz.png)

Utilizing the artifacts of this web site, I discovered one other 60 rip-off websites utilizing the identical equipment. I’ve not but carried out evaluation on these websites past confirming they’re working the identical rip-off interface.

As I investigated these rings, I noticed a shift in instruments and ways by different rip-off operations—which partly seems to be pushed by the response of exchanges and pockets builders to share menace information, enabling them to dam scams on the app stage. Rip-off instrument builders are taking measures to dam harvesting of contract node information, controlling which wallets might be used for the rip-off, and taking larger care to evade geolocation and evaluation. These extra cautious rip-off deployments spanned tons of of domains.

One instance of this variation in rip-off web site tooling—associated to a rip-off hosted at phpsqo[.]prime—got here from a sufferer. The goal, a pupil in Poland, was approached by WhatsApp by somebody claiming to be a Chinese language girl dwelling in Germany. The interplay led to the goal connecting her cellular pockets to a contract pockets by that area: 0x63809823AD21B6314624621172bAf4532c5B8b72

The goal put $1,177.79 price of USDT within the pockets and noticed day by day deposits till your entire stability was pulled a few week later.

This contract pockets was extraordinarily energetic, with over 950 transactions between March 26 and November 15, so handbook evaluation of the overall variety of victims and cryptocurrency transferred continues to be in progress. However drawing from a random sampling of the transactions, I estimate the contract pockets transferred no less than $200,000 price of cryptocurrency over that interval.

Getting that information would have been tough with out the sufferer offering her pockets tackle, as the positioning makes use of JavaScript to detect the net agent connecting and disallows desktop browsers along with checking for cryptocurrency pockets connections.:

![Figure 10: a screenshot of phpsqo[.]top showing how it appears in a desktop browser](https://news.sophos.com/wp-content/uploads/2023/12/phpsqo-top.png)

Looking on parts utilized by the positioning, I discovered 350 websites utilizing the very same equipment, most registered within the “.prime” top-level area, and all with internet hosting hid by Cloudflare. With out the flexibility to passively harvest information on contract wallets related to these websites with out utilizing the kind of pockets consumer permitted by the websites, it was not attainable to get an concept of the scope of the scams linked to them.

I additionally recognized by DNS searching one other set of about 100 websites utilizing one more mining rip-off equipment. This one permits somebody to connect with the positioning with a browser-based pockets however checks the pockets stability earlier than permitting a connection to the contract pockets. Nonetheless others use an API from WalletConnect to obscure the contract pockets tackle and maintain out guests with no particular set of cellular wallets appropriate with that service.

![Figure 11: USDmining[.]shop, another liquidity mining scam site, requires a balance in a connected wallet before the contract can be accessed](https://news.sophos.com/wp-content/uploads/2023/12/USDmining-shop.png)

Caveat Investor

When in comparison with final 12 months’s investigations, it’s clear that liquidity mining rip-off operations have matured of their methods, instruments, and practices, and that rip-off decentralized finance app “kits” have made these operations less complicated to scale up—whereas being extra accessible to much less technically-capable cybercriminals. The shifting ways in newer kits recommend important technical efforts are being made by instrument builders within the make use of of the Chinese language organized crime operations that again these rip-off rings.

As a result of these scams use professional purposes which have been enabled to connect with decentralized finance purposes, the perfect protection in opposition to these ever-maturing scams stays public consciousness of the scams and wholesome skepticism towards on-line interactions. As a result of victims of pig butchering-style scams comparable to these are sometimes remoted and focused by emotional appeals, broad public outreach is the one strategy to forestall or cut back loss.

We proceed to do what we are able to by reporting websites, blocking them by unfavorable status scores, and collaborating with internet hosting suppliers, legislation enforcement and cryptocurrency exchanges to get websites and change accounts tied to them shut down.

In the event you consider you’re a sufferer of one in all these scams, it’s best to:

- Instantly withdraw all funds from the pockets that you simply linked to the rip-off web site.

- Doc all the things you possibly can, together with messages between you and the attainable scammer, your cryptocurrency pockets tackle, and the area you have been instructed to connect with.

- Contact legislation enforcement. Even when your case shouldn’t be massive sufficient by itself to warrant a federal case, contact the suitable legislation enforcement company in your locality and nation (). Your information could also be useful in creating a bigger case in opposition to rings.

- Contact the Cybercrime Assist Community. They’ll present sources to help you in reporting crime and coping with the aftermath.

An inventory of probably the most not too long ago energetic domains found to be related to these scams and different indicators of the rip-off operations researched right here might be discovered on our GitHub. Further domains will likely be added as we course of them.

[ad_2]