[ad_1]

NUBURU, Inc. has introduced it has obtained discover from the NYSE American LLC indicating that the Firm is just not in compliance with the continued itemizing requirements in Part 1003(f)(v) of the NYSE American Firm Information.

The high-power, high-brightness industrial blue laser expertise developer obtained the deficiency letter on December 28, 2023, which decided that shares of its widespread inventory have been promoting for a low worth per share for a considerable time frame. NUBURU’s continued itemizing is based on it demonstrating sustained worth enchancment by no later than June 28, 2024.

In line with a press launch, NUBURU says it intends to observe the worth of its Widespread Inventory and take into account choices, together with conducting a reverse inventory cut up. NUBURU says the discover doesn’t have an effect on the its enterprise, operations or reporting necessities with the Securities and Change Fee.

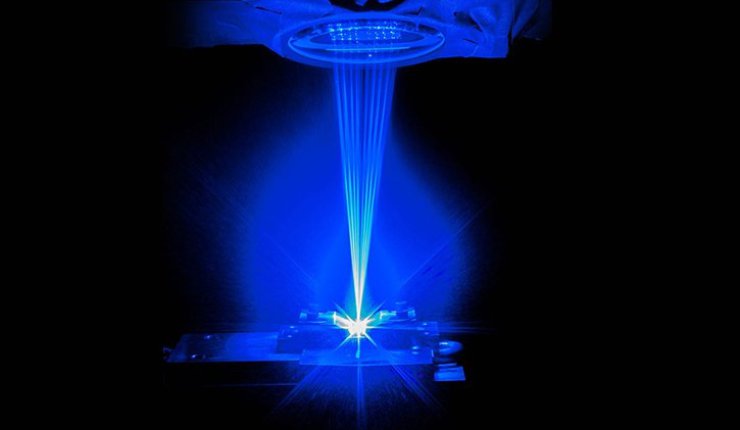

NUBURU’s blue laser expertise is alleged to allow quicker, larger high quality welds and components for laser welding and additive manufacturing processes utilizing demanding supplies resembling copper, gold, and aluminium. Final 12 months, the corporate delivered its first items to Excessive Velocity Extrusion 3D printing firm Essentium (acquired by Nexa3D in November) as a part of a beforehand introduced multi-year, multi-million-dollar settlement to develop and manufacture a blue laser-based 3D printing platform. The corporate additionally introduced the signing of a joint growth settlement with GE Additive to discover the advantages of blue laser-based steel 3D printing.

The information follows a comparable announcement from steel additive manufacturing firm Velo3D earlier this week, which noticed the corporate notified on December 28, 2023 by the New York Inventory Change (NYSE) of its noncompliance with Rule 802.01C of the NYSE’s Listed Firm Guide, referring to the minimal common closing worth of the corporate’s widespread inventory required over a consecutive 30 day interval. It comes after a collection of notices for different publicly traded 3D printing corporations together with Desktop Metallic, which obtained a non-compliance discover from the NYSE in November 2023, and Markforged, which obtained its first non-compliance discover in April, and second in November.

[ad_2]