[ad_1]

Mental property (IP) safety is usually a very important a part of an organization’s journey from younger upstart to billion-dollar behemoth, safeguarding all its technologists’ laborious work whereas including to the corporate’s worth for buyers or would-be acquirers.

However as we’ve seen numerous instances by the years, IP may also be weaponized.

Patent wars have been a mainstay of the trendy expertise period, with among the world’s largest firms embroiled in high-profile tête-à-têtes, from Apple vs. Samsung, Qualcomm and Nokia, to Google vs. Sonos, Twitter vs. IBM and many extra. Whereas a few of this patent palaver would possibly effectively stem from real IP infringements, there are a lot of examples of patents being misused purely for monetary achieve.

That is one concern that’s rising within the aftermath of OpenText’s $6 billion acquisition of Micro Focus, a deal that closed six months in the past. We go into the complete particulars of that story right here. However the lengthy and quick is that OpenText picked up 1000’s of granted and pending patents by the acquisition; Micro Focus is now giving up its membership of the anti-patent troll membership group LOT Community; and lots of are left questioning what occurs subsequent. OpenText is not any stranger to patent assertion, and it has already been accused of behaving like a patent troll within the wake of its 2019 acquisition of information safety agency Carbonite — a deal that has led to ongoing patent litigation proceedings in opposition to CrowdStrike, Kaspersky, Sophos, and Pattern Micro.

This all results in one query: what does a patent litigation goal seem like in 2023? And is there something particularly that may make one firm extra vulnerable to lawsuits than one other?

NPE risk

The price that non-practicing entities (NPEs), or “patent trolls,” have on innovation is sizeable, significantly impacting startups and scale-ups manoeuvring by the world of R&D, though long-established billion-dollar firms are removed from immune, too.

A report revealed earlier this 12 months by LOT Community, performed by IP consultancy Hightech Options (HTS), delved into precisely this. The NPE risk: patent sources and litigation goal charactertistics explored litigation exercise round NPEs from 2017 to 2022, utilizing knowledge offered by Unified Patents associated to greater than 6,000 defendants sued by NPEs over the interval.

As you would possibly count on, the likes of Google, Amazon, Samsung, and Apple characteristic extremely within the record of defendants most ceaselessly focused in patent litigation. Nevertheless, a part of the report’s remit was to find to what extent NPEs pose a risk to smaller firms — these on the cusp of getting large that will have rather a lot on the road. These companies won’t all the time have sizeable authorized assets at their disposal, both.

The information means that whereas “legit” patent litigation by working firms has declined just a little lately, these instigated by NPEs has “elevated steadily,” due principally to the variety of patent property “on the market on the open market and availability of litigation funding.”

“It’s fairly frequent for NPEs, relatively than to fund or finance themselves, [to connect] with a litigation financing entity that basically pays for the litigation after which will get a minimize on the assertion,” IP legal professional Patrick McBride, who most lately headed up IP applications at Crimson Hat, defined to TechCrunch. “And as you may think, that adjustments the sport fairly a bit, as a result of the NPE has vital monetary assets backing them and what they’re attempting to do.”

Roughly 60% of all patent litigation final 12 months stemmed from NPEs. However the traits that make an organization “roughly doubtless” to be focused by a frivolous patent lawsuit, as recognized within the report, makes for fascinating studying.

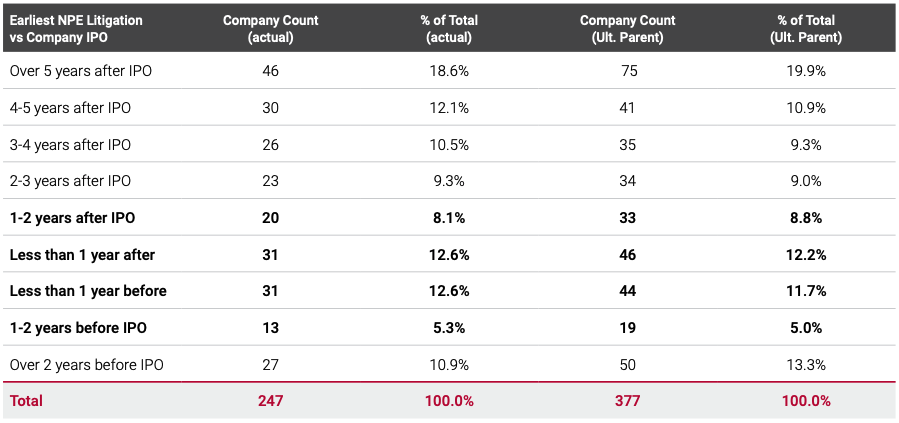

The report begins with a hypotheses that NPEs could possibly be motivated by timings associated to an organization’s IPO. For instance, startups approaching a public itemizing shall be eager to settle rapidly, whereas those who have simply accomplished an IPO could have further capital at their disposal.

Of the 247 firms it recognized from NPE litigation targets that went public from 2012 to 2022, 30 p.c of the earliest litigation befell 4 years or extra after the date of the IPO. However in contrast, 39 p.c of the NPE litigation befell within the two years earlier than and after an IPO.

The report famous:

This discovering provides assist to the speculation we had been exploring, and signifies that the interval earlier than and after an IPO is a time of elevated threat {that a} agency will develop into the goal of a number of NPE lawsuits.

Choose NPE Litigation (2017 – 2021) and Monetary Information (IPOs from 2012 – 2022) Picture Credit: HTS / LOT Community

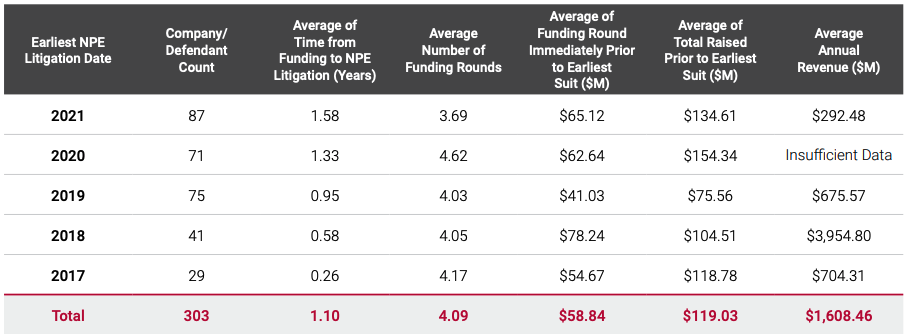

The report additionally prompt that NPEs would possibly consider funding raised by its targets, with the typical variety of rounds raised sitting at almost 4 — which means that someplace round Sequence C to D stage is engaging to NPEs, with the typical funding quantity raised previous to the earliest litigation sitting at $65 million.

The report added:

This all is sensible, in that, in enterprise, it’s all the time extra engaging to sue a goal that has deep pockets, than one recognized to be scarce of monetary assets.

Abstract of NPE Lawsuits Towards Personal Corporations By Earliest NPE Litigation Date (Funding Rounds

Introduced 2017 – 2022) Picture Credit: HTS / LOT Community

This knowledge won’t inform the complete story, after all. Not all litigation threats makes it into the general public sphere; some would possibly get settled on the earliest attainable stage earlier than attracting any consideration. However it nonetheless helps the notion that patent trolls undertake a reasonably focused strategy to their litigation endeavors.

“NPEs are drawn to cash they usually need straightforward cash,” McBride stated. “They’re drawn to entities with merchandise within the market that they’ll analyse and at the least make a colorable declare that they’re coated by their patents. The extra your merchandise are within the market, seen to customers and such like, the extra doubtless you’re to be the goal of an assertion.”

Tears of a cloud

There are some real-world examples that assist for example a few of these knowledge factors. This consists of Cloudflare, which is presently within the midst of combating a second spherical of patent litigation that kicked off in 2021 — roughly two years after the corporate went public.

Nevertheless, the net infrastructure big was initially focused by a special patent troll in 2017, precisely two years earlier than going public. Relatively than acquiescing, Cloudflare went on the offensive and launched a crowdsourced marketing campaign known as Venture Jengo. This was in response to Blackbird Applied sciences, a regulation agency that had managed to accumulate dozens of patents earlier than submitting lawsuits in opposition to a number of firms, together with Cloudflare.

Venture Jengo was (and nonetheless is) pitched as a “contest,” with Cloudflare providing monetary rewards to individuals who assist conduct analysis round prior artwork to assist combat its case. Cloudflare emerged victorious in 2019 simply earlier than itemizing on the New York Inventory Trade (NYSE), however two years later it was focused by one more patent troll. And though some 90% of these assertions made in opposition to it had been thrown out earlier this 12 months, Cloudflare should face a few of these claims in court docket later this 12 months.

Cloudflare common counsel Doug Kramer acknowledged that pre-IPO startups would possibly appear to be a extra alluring goal for NPEs, but it surely’s possibly not fairly as clear-cut as that.

“I’m unsure we’ve seen a transparent technique or concentrating on within the flood of threatening letters and threatened lawsuits pursued by patent trolls,” Kramer defined to TechCrunch. “As soon as an NPE will get maintain of a patent, it would typically ship letters to everybody who may plausibly be sued for infringement below that patent — together with very early-stage firms, or perhaps a firm that purchases a retail product off the shelf made by an organization that the NPE could allege is infringing. They forged a large web and see what they’ll reel in.”

The choice to combating again, in accordance with Kramer, would doubtless have been to accept a “low six-figure” sum. Nevertheless, the larger concern right here was about setting a precedent, encouraging extra frivolous claims additional down the street.

“We actually noticed the principle threat was that we’d be shovelling extra coal into the engine of this roaring locomotive,” Kramer stated. “We didn’t wish to perpetuate that system, and thought there was a manner that we may pay extra within the quick time period and attempt to arrange ourselves, and the trade usually, in a greater place for the long run.”

The truth that Cloudflare is dealing with a second spherical of patent litigation would possibly counsel that the corporate’s combative techniques didn’t work as a deterrent. However Kramer argues that it’s extra about lowering relatively than fully eradicating the possibilities of being focused.

“We undoubtedly assume Venture Jengo can deter future trolls, each in opposition to Cloudflare particularly and in opposition to firms usually,” he stated. “Deterrents are profitable in the event that they diminish the stream of instances, even when not eliminating them totally. And we’re undoubtedly conscious of some claims or threats of claims that had been withdrawn when trolls turned conscious of our practices.”

Susceptible

Autonomous automobile startup Oxa (previously Oxbotica) is one startup that’s approaching a stage that patent trolls would possibly begin listening to it, having lately closed a $140 million Sequence C spherical of funding. The corporate has filed for round 8 patents itself, with one granted on the time of writing.

Alex Tame, head of licensing and IP administration at Oxa, says that though he’s not anticipating patent litigation within the instant future, issues may change as its profile grows.

“As a small firm within the U.Ok., we’re most likely not likely on the radar for lots of the ‘drawback’ firms on the market,” Tame stated. “As we begin to develop and our model begins to get a bit extra kudos, we’re going to be on somebody’s radar someplace.”

AI firms, together with startups much like Oxa which might be working on autonomous automobiles, have been ripe for acquisition these previous few years. A part of this has been pushed by the necessity for high technical expertise, however IP has additionally been a central element. When Amazon, for instance, doled out a reported $1.2 billion for self-driving car startup Zoox again in 2020, it scooped up greater than 150 patents, spanning cruise management, signalling, and driver help applied sciences, in accordance with Forbes on the time.

Whereas there hasn’t been an excessive amount of IP litigation within the AI realm usually, we’re nonetheless within the comparatively nascent section of a fast-growing AI revolution, and issues can change rapidly as extra gamers look to assert their authority (and IP) over rivals. ChatGPT developer OpenAI is at present within the course of of trademarking “GPT” with the US Patent and Trademark Workplace (USPTO), a harbinger maybe of what’s to come back down the street for startups, scaleups, and enterprise behemoths attempting to get their slice of the trillion-dollar AI pie.

This doesn’t essentially imply that we’re about to see a maelstrom of lawsuits and counter lawsuits, however with the AI hype prepare gaining steam, firms will at the least begin to get defensive with their IP measures in order that they’ve some foundation for shielding themselves. This isn’t restricted to patents, however logos, copyright, and all the remaining.

That is partly why considered one of Tame’s first duties when he joined Oxa in 2019 was to set the corporate up with membership in LOT Community, the nonprofit coalition that protects member firms by robotically cross-licensing their patents in the event that they fall into the arms of a patent assertion entity (PAE — the same idea to an NPE, which LOT defines as an entity that derives greater than half of its earnings from patent enforcement). LOT counts 1000’s of members, together with a few of Oxa’s deeper-pocketed rivals.

“We aren’t in an trade that — in the mean time — goes to be litigious,” Tame stated. “We’re not an trade that’s going to start out choosing fights with one another, although that will come later. You have a look at who the members are of the LOT Community, and most of our rivals are within the community. So it was a little bit of a no brainer — if we joined the LOT Community, we get some safety from [the likes of] Google and Uber and Aurora.” (Although this safety solely extends to eventualities the place LOT members’ patents fall into the arms of a NPE/PAE).

Whereas there won’t all the time be a cogent or constant technique within the patent troll playbook, it seems that there’s something of a candy spot by way of what an excellent litigation or licensing goal seems like. Certain, Google or Intel may be juicy targets, however they’re additionally well-resourced and well-versed in addressing litigation.

“The factor to know about NPEs is they don’t seem to be concerning the deserves of their invention, they’re about negotiating leverage to maximise the cash they get — that’s the sport they’re taking part in,” McBride stated. “And so when you’re a pre-IPO firm, or you’re a small firm wishing to be privately acquired, you’re in a susceptible state.”

The concept is that any pre-IPO firm that may be topic to due diligence, both forward of a public-listing, funding spherical, or potential acquisition, will need that inspection to go as easily as attainable. Any lingering litigation, spurious or not, is a significant red-flag within the due diligence course of. Thus patent trolls could possibly be drawn to such eventualities, for the reason that startup may be just a little extra keen to settle the case.

“I’ve executed due diligence on firms that had been hoping to be acquired, they had been topic to an NPE assertion or litigation and that killed the deal,” McBride stated. “The NPEs know this, and particularly time their assaults for simply such an occasion.”

[ad_2]