[ad_1]

Zoho Expense: Quick detailsBeginning worth for paid plan: $3/energetic consumer Key options:

|

Zoho Expense is a cloud-based, stand-alone enterprise expense monitoring app supplied by Zoho. Zoho Expense can also be accessible as a part of the Zoho One bundle plan.

That can assist you resolve if Zoho Expense is correct for your online business’s wants, we’ll do a deep dive into its pricing plans, options, professionals and cons on this thorough Zoho Expense evaluation.

Leap to:

Zoho Expense’s pricing

Free

This plan is free for as much as three customers. Options embody:

- 5 GB receipt storage.

- 20 receipt autoscans.

- Multi-currency bills.

- Mileage bills.

Customary

The Customary plan prices $3 per energetic consumer per thirty days billed yearly, or $5 per energetic consumer per thirty days billed month-to-month. It requires a minimal of three customers and helps limitless customers. A 14-day free trial is out there for this plan. Options embody:

- 20 receipt autoscans per consumer.

- Company card reconciliation.

- Money advances.

- Multi-level approval.

Premium

The Customary plan prices $5 per energetic consumer per thirty days billed yearly, or $8 per energetic consumer per thirty days billed month-to-month. It requires a minimal of three customers and helps limitless customers. A 14-day free trial is out there for this plan. Options embody:

- Journey requests.

- Buy request.

- Superior approval.

- Per Diem automation.

Enterprise

The Enterprise plan prices $8 per energetic consumer per thirty days billed yearly or $12 per energetic consumer per thirty days billed month-to-month. It requires a minimal of 200 customers and helps limitless customers. Options embody:

- TMC/OTA integration.

- ERP integration.

- Single Signal On (SAML).

- Devoted account supervisor.

In case you have greater than 500 customers, you have to contact Zoho Expense for a customized quote. You too can go for the Zoho One plan, which bundles all of Zoho’s software program merchandise — greater than 40 instruments in all, together with Zoho Expense — right into a single reasonably priced worth plan that prices $37 per thirty days per worker, billed yearly.

Zoho Expense’s key options

Receipt administration

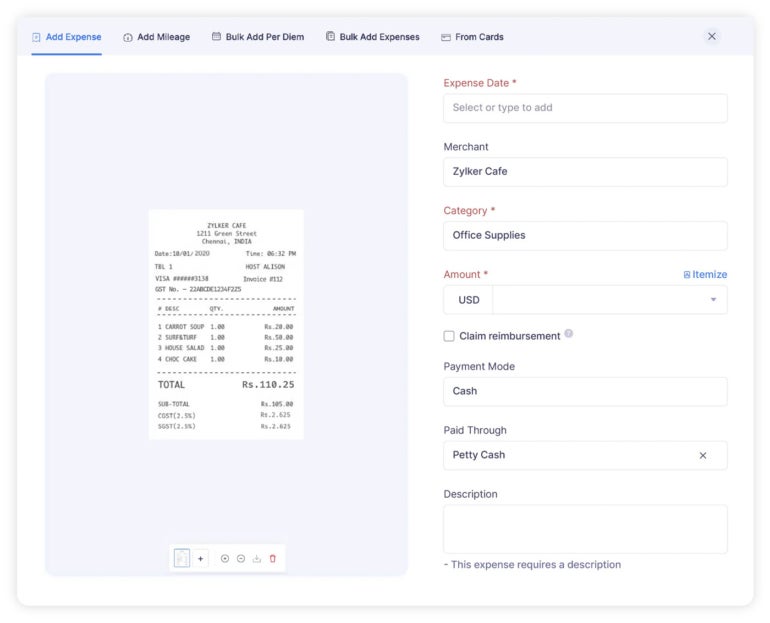

Determine A

Workers can add receipts to Zoho Expense in a number of methods (Determine A): take a photograph utilizing the cellular app, drag-and-drop an current picture out of your desktop, ahead an e-mail affirmation for a reservation or import receipts from different cloud functions. The app’s superior autoscan function reads receipts in 14 languages and creates expense information for them. Bulk importing of receipts is out there on all plans, together with the free model.

Expense administration

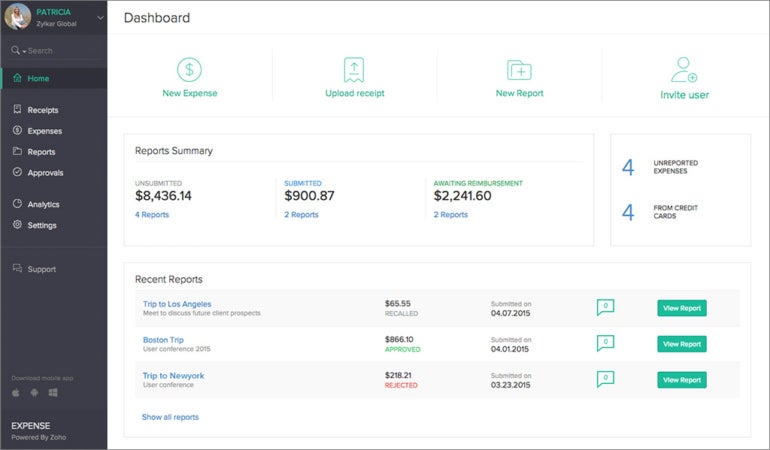

Determine B

As soon as receipts are within the instruments, the dashboard offers you a high-level view of their standing (Determine B). You may itemize bills so they’re tax exempted appropriately and break up shared bills by quantity, day or customized class. Admins can management what staff see, eliminating pointless fields to keep away from confusion. They’ll additionally set a per diem fee for workers primarily based on location.

Mileage monitoring

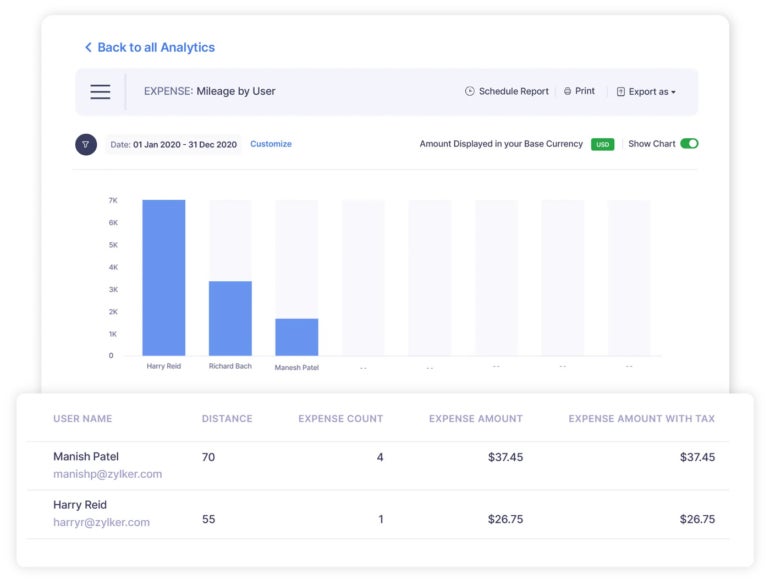

Determine C

Miles will be tracked in 4 methods on Zoho Expense (Determine C): through GPS, distance lined, point-to-point map places and odometer readings. Admins can set customized mileage charges for various autos, insurance policies, departments or value facilities. Run mileage reviews for every consumer to see how a lot they’ve tracked for a customized time period.

Card administration

You may join company, pay as you go or private bank cards to Zoho Expense, so purchases will mechanically be logged within the system, making it straightforward to reconcile enterprise bills. With Direct Feed Integration (DFI), company card feeds will likely be fetched instantly from Visa, Mastercard and Amex (American Specific), eliminating the necessity for a intermediary and enhancing safety.

Expense management and approvals

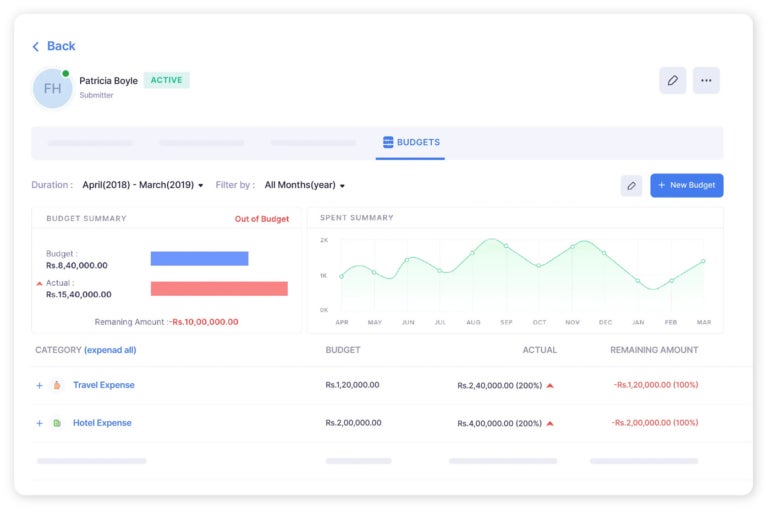

Determine D

Admins can arrange expense guidelines primarily based on mounted quantities, mileage limits and extra; these limits will be each day, weekly, month-to-month or a customized period. They’ll additionally institute expense insurance policies for various manufacturers, departments or value facilities, which can then set off a notification if a coverage is violated. Total funds limits (Determine D) can be created for sure expense classes or sorts, and the system will warn or block staff when their buy request is about to exceed the funds. Easy, custom-made approval workflows get rid of repetitive work and preserve bills in examine.

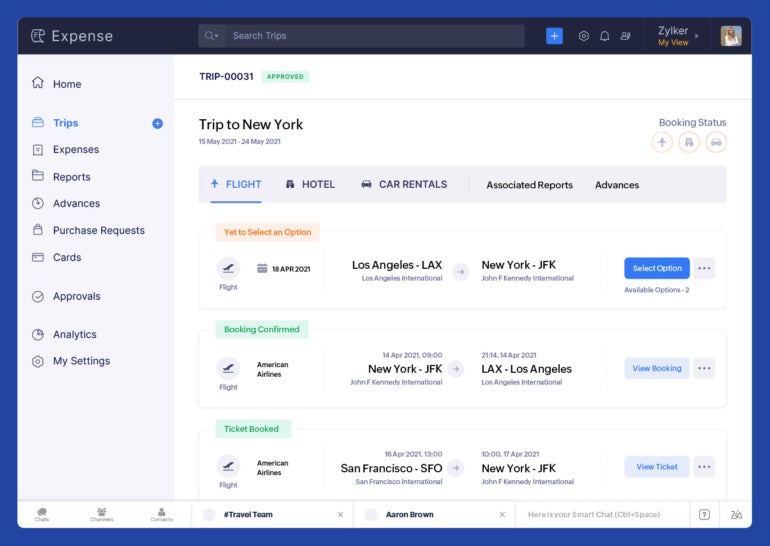

Journey expense administration

Determine E

Zoho Expense does provide journey expense administration options (Determine E), although these are restricted to the Premium and Enterprise plans. The self-booking software helps staff e book their very own journey whereas following firm spending insurance policies. The system will freeze a fare whereas awaiting approval to keep away from worth surges and notify staff of worth alerts to allow them to re-book at a decrease fare. The system additionally automates visa requests and journey coverage compliance.

Expense reviews

Determine F

Workers can simply create and submit expense reviews for approval with Zoho Expense (Determine F), which can mechanically generate distinctive numbers for you. You may group associated bills like air journey, lodging and meals to simplify the report. Workers may apply money advances to the report back to offset reimbursement quantities and guarantee appropriate calculations.

Zoho Expense professionals

- Reasonably priced, clear pricing plans that may work for a lot of small companies.

- Eternally free plan accessible.

- Integrates with widespread accounting software program, together with QuickBooks.

- Integrates seamlessly with different Zoho Merchandise.

- Visually interesting and colourful interface.

- Many customizable automation choices.

Zoho Expense cons

- Steeper studying curve, particularly for individuals who haven’t used a Zoho product earlier than.

- Free plan’s storage is restricted.

- Onboarding and setup processes will be prolonged.

- Should improve to the Premium plan for journey expense administration.

- Accountants are much less prone to be acquainted with Zoho vs. QuickBooks.

- Buyer assist may very well be improved.

Zoho Expense integrations

Zoho Expense integrates with different Zoho merchandise in addition to many widespread third-party providers, like these:

- Follow accounting and bookkeeping with Zoho Books, QuickBooks, Sage Accounting and Xero Accounting.

- Create and ship custom-made invoices with Zoho Bill.

- Handle journey bills with Get There and Routespring.

- Ship reimbursement funds with CSG Forte, ICICI Financial institution and HSBC.

- Submit rideshares for expense reimbursement with Uber, Lyft and Bolt.

- Reclaim VATs after worldwide journey by way of Taxback Worldwide and WAY2VAT.

- Handle paperwork with Dropbox, Google Drive and Microsoft OneDrive.

- Message coworkers with Slack.

Who’s Zoho Expense greatest for?

Zoho Expense is a no brainer for any firm that already makes use of Zoho merchandise, particularly different finance instruments like Zoho Books and Zoho Invoices. Since Zoho makes use of the identical login for all its merchandise, it’s straightforward so as to add one other to your software program stack, and so they all combine seamlessly with one another.

Zoho Expense can also be a fantastic alternative for small companies on the lookout for an reasonably priced standalone expense administration software. Many alternate options, similar to QuickBooks, bundle the expense administration operate along with accounting, stock administration and different options. This will increase the worth of competitor’s plans and should saddle SMBs with additional performance they don’t want or need.

That being mentioned, if you happen to do want extra finance-related options past simply expense administration, you’ll have to look into different Zoho instruments for that. Fortuitously, most different Zoho merchandise, together with Zoho Books accounting, provide a free tier of service in addition to reasonably priced paid plans. Relying on what degree of performance you want, it’d truly be cheaper to mix a number of of Zoho’s merchandise as an alternative of springing for a dearer all-in-one different like QuickBooks.

If Zoho Expense isn’t very best for you, take a look at these alternate options

For all its benefits, Zoho Expense isn’t the best alternative for each enterprise. Some firms want extra performance than only a standalone expense administration app. Whereas Zoho does provide Zoho Books and Zoho Bill, these instruments aren’t almost as widespread amongst accountants as QuickBooks, which might additionally complicate issues come tax season. Listed here are some Zoho expense alternate options to think about.

FreshBooks

FreshBooks is a extra reasonably priced different to QuickBooks that features limitless expense monitoring on its base plan, which begins at $17 a month. FreshBooks additionally contains different accounting and invoicing options for an all-in-one platform. FreshBooks is a superb alternative for companies which might be on the lookout for an accounting software program that features expense monitoring however don’t wish to spend as a lot cash as QuickBooks requires.

QuickBooks

QuickBook is the trade normal in accounting software program, and it gives receipt seize and expense administration for all pricing tiers, which begin at $30 a month. Its recognition implies that each accountant will likely be acquainted with it, whereas the identical can’t be mentioned for Zoho Expense. QuickBooks additionally incorporates every part into one platform, whereas Zoho breaks out capabilities into separate merchandise like Zoho Expense, Zoho Books and Zoho Bill.

Expensify

Expensify is a well-liked stand-alone expense administration software that may be very akin to Zoho Expense, together with its free plan. Along with normal expense administration options like receipt seize, the corporate gives its personal Expensify card, which makes capturing bills a breeze. You may nonetheless use the app with your individual bank cards.

Evaluation methodology

To evaluation Zoho Expense, we signed up for a free trial of the Premium plan. We additionally watched demo movies, consulted consumer critiques and checked out product documentation. We thought-about options similar to receipt administration, mileage, monitoring, expense controls and journey expense administration. We additionally weighed different elements such because the consumer interface design, studying curve and buyer assist.

[ad_2]